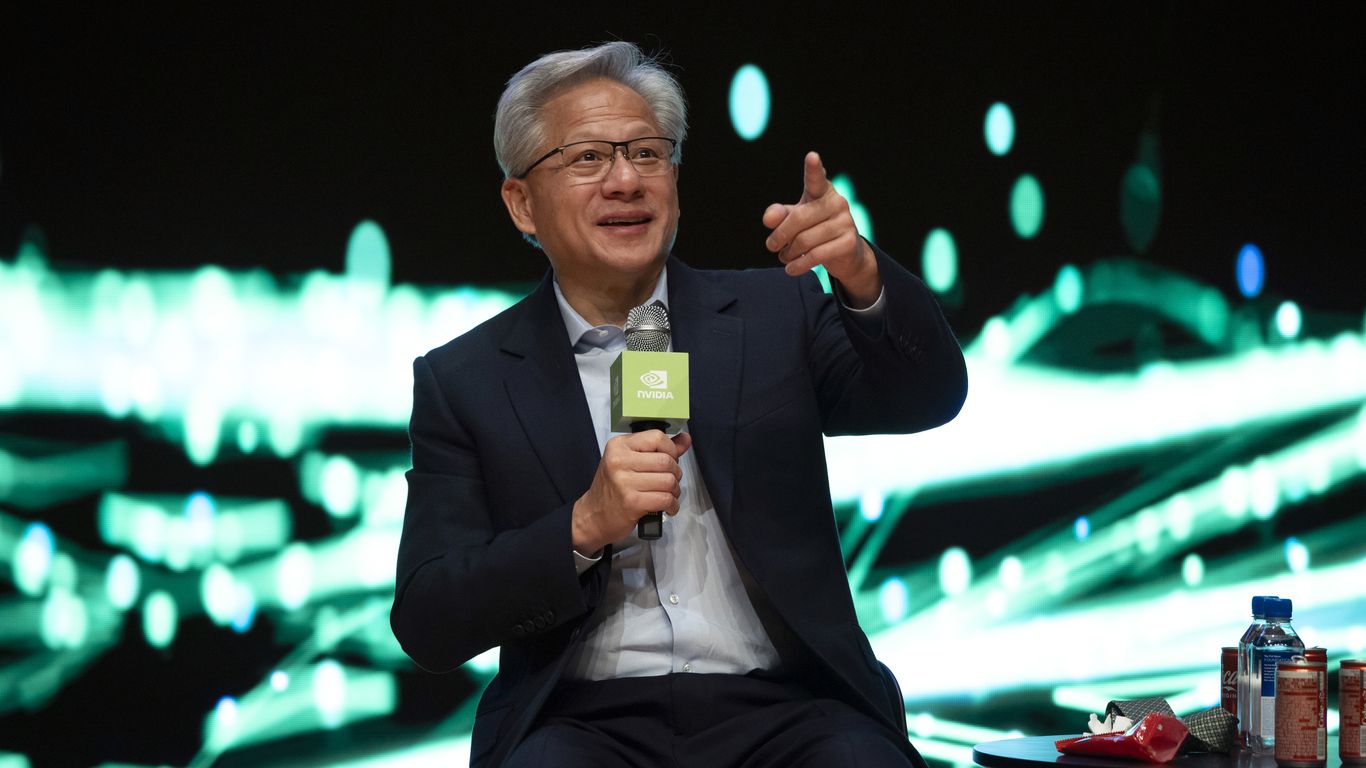

"Look at the large tech companies in the world today. Most of them have a business in advertising or social media or, you know, content distribution...Nvidia is the only company in the world that's large whose only business is technology, Huang said. We only build, we don't advertise. The only way that we make money is to create amazing technology and sell it. Between the lines: Companies like Meta and Google are referred to as tech companies, but much of their revenue comes from advertising. Technology fuels their advertising businesses, however, with AI features creating a windfall of ad-revenue at Meta, for example. As Wall Street has worried about the return on investment in AI, some investors tell Axios that the revenue for tech will still come from advertising in an AI-world."

"Another challenge for Nvidia is the competition between itself and its customers, as the major hyperscalers build out their own chip while still buying from Nvidia. Amazon is continuing to develop its own chips with multiple new offerings announced this week, which could be a more affordable alternative to Nvidia. Zoom out: Nvidia is the darling of the AI trade that's currently dominating the stock market. The company alone makes up 1% of the global stock market and 8% of the U.S. market. Its chips, the most powerful available, are benefiting from a surge in demand from Big Tech companies investing about $500 billion in AI infrastructure this year alone."

Nvidia focuses exclusively on creating and selling technology products and generates revenue by building and selling chips rather than by advertising. Many large tech companies derive substantial revenue from advertising and content distribution, and AI features have boosted ad revenue at firms like Meta. Some investors expect advertising to remain a primary revenue source in an AI-driven world despite concerns about AI return on investment. Nvidia faces competitive risks as hyperscalers develop in-house chips and companies like Amazon roll out potentially cheaper alternatives. Nvidia’s market dominance and powerful chips drive strong demand amid massive AI infrastructure investment.

Read at Axios

Unable to calculate read time

Collection

[

|

...

]