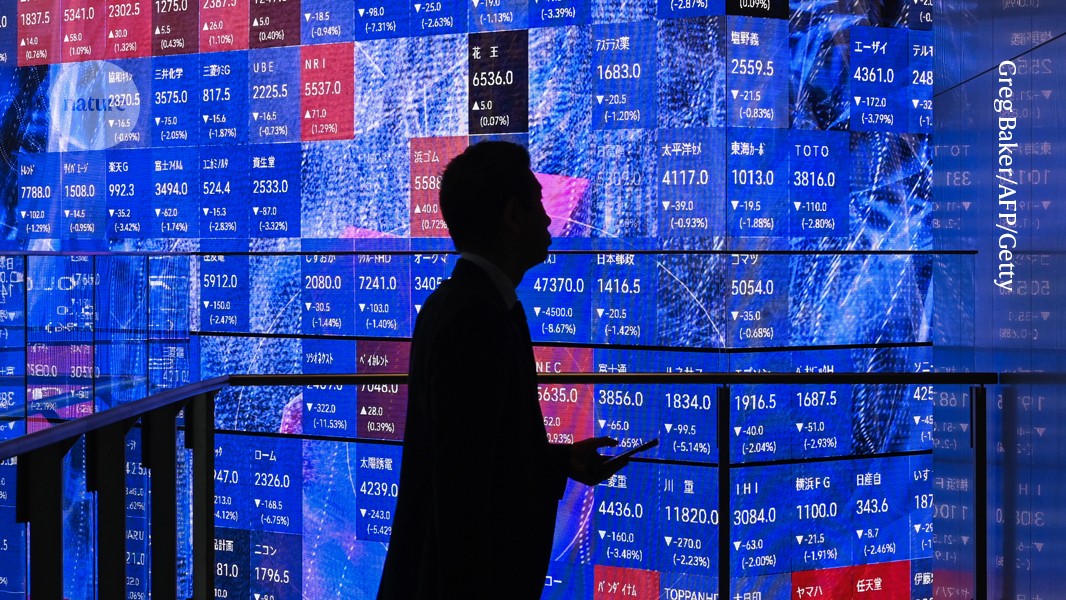

"A huge data set has confirmed a long-theorized relationship between the size of stock trades and the impact on prices. Buying large numbers of shares in a company would be expected to drive the price up for other investors, because such purchases imply a commodity in demand. Researchers have now gained their best handle so far on how much."

"Buying large numbers of shares in a company would be expected to drive the price up for other investors, because such purchases imply a commodity in demand."

A huge data set confirmed a long-theorized relationship between the size of stock trades and the impact on prices. Large purchases of shares tend to push prices higher for other investors because such purchases signal that the asset is in demand. The magnitude of price response scales with trade size and is now better quantified than before. Empirical evidence from the massive data set provides the most reliable estimate so far of how trade size translates into price movement. The findings refine understanding of market dynamics and liquidity effects.

Read at Nature

Unable to calculate read time

Collection

[

|

...

]