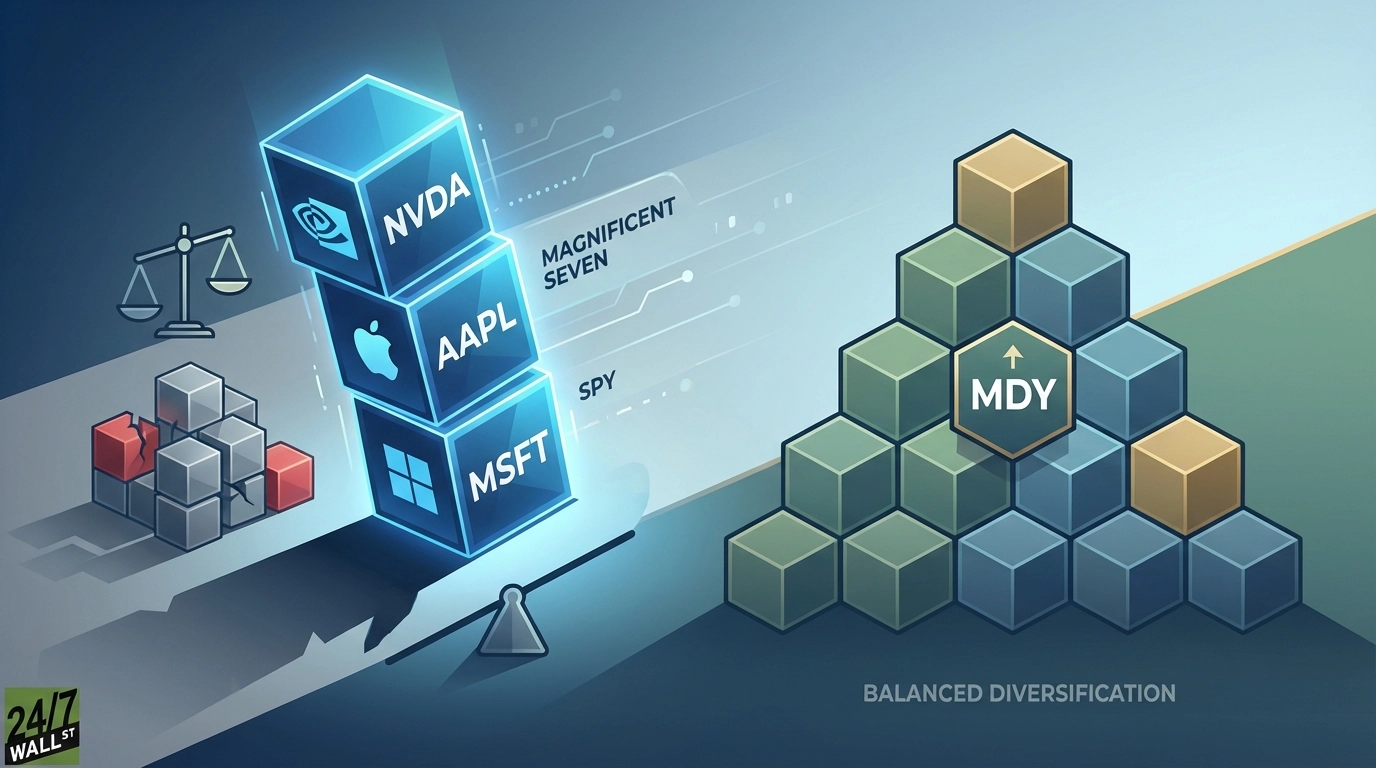

"The Magnificent Seven's dominance reshaped the S&P 500 in 2025, driving these tech giants to comprise roughly a third of the index's market cap. This concentration created hidden portfolio risk-when these seven stocks surged, they delivered returns that significantly outpaced the broader index, making investors increasingly dependent on a handful of companies to drive their portfolio performance. The result is a market where diversification has given way to concentration, and where a stumble by any of these mega-caps can ripple through millions of portfolios."

"For investors concerned about this mega-cap dominance, the SPDR S&P MidCap 400 ETF Trust ( NYSEARCA:MDY) offers a compelling alternative. MDY's structure prevents any single company from dominating returns. The largest holding represents just 1.08% of the portfolio, ensuring that no individual stock failure can derail performance. This balanced approach stands in stark contrast to SPY, where the top 10 holdings command over 20% of the index and create concentrated risk."

"The SPDR S&P 500 ETF Trust ( NYSEARCA:SPY) tells a story of increasing concentration. The S&P 500 has become a technology-dominated index, with information technology representing over a third of its weight. This concentration intensifies at the top, where just three mega-cap tech companies control more than a fifth of the entire index's value-creating a portfolio structure that rises and falls with the fortunes of NVIDIA ( NASDAQ:NVDA), Apple ( NASDAQ:AAPL), and Microsoft ( NASDAQ:MSFT)."

The S&P 500 has shifted toward heavy technology concentration, with information technology exceeding one-third of index weight and the top three mega-cap techs accounting for over a fifth of market value. The Magnificent Seven's dominance in 2025 amplified dependence on a few stocks, producing hidden concentration risk as their outsized returns outpaced the broader index. A single stumble among mega-caps can ripple through diversified portfolios. The SPDR S&P MidCap 400 ETF (MDY) provides an alternative with its largest holding at 1.08%, broader sector balance led by industrials and financials, and reduced single-stock and tech concentration.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]