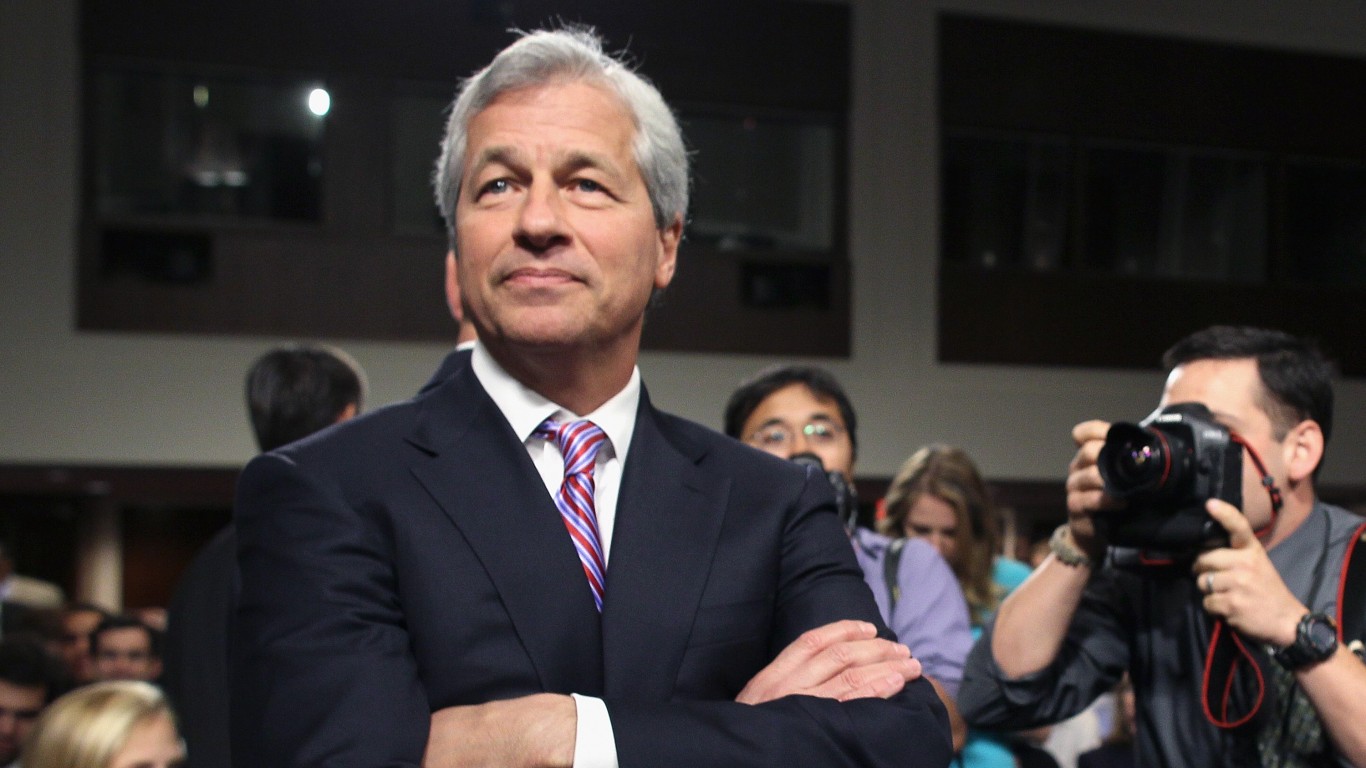

"The JPMorgan CEO called the three-year bull market run unmistakable, while warning that asset prices currently sit high and credit spreads are unusually tight, a rough combination that signals overconfidence. Like others issuing warnings, Mr. Dimon puts a big 6-month to 2-year window for a market correction, which he thinks could be as big as 30%, citing profligate government spending, geopolitical issues, and rising global militarization."

"One item we have been examining is the market-cap-to-GDP ratio, a stock market indicator favored by Warren Buffett. Currently, the U.S. market capitalization-to-GDP ratio, commonly referred to as the Buffett Indicator, has reached an all-time high, surpassing 217% as of early October 2025. This indicates significant market overvaluation according to historical interpretations of the metric. The ratio, which compares the total value of the stock market to the country's economic output, has not been this high in history."

The three-year bull market run is characterized as unmistakable; asset prices are high and credit spreads are unusually tight, a combination signaling overconfidence. A 6-month to 2-year window for a market correction is cited, with a potential decline up to 30% tied to profligate government spending, geopolitical tensions, and rising global militarization. The U.S. market capitalization-to-GDP ratio, or Buffett Indicator, has surpassed 217% as of early October 2025, reaching an all-time high and indicating significant market overvaluation by historical measures. JPMorgan is recommended for its leadership and strong research capabilities. AT&T distributes through company-owned stores, agents, and third-party retailers and provides residential broadband fiber and legacy telephony services.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]