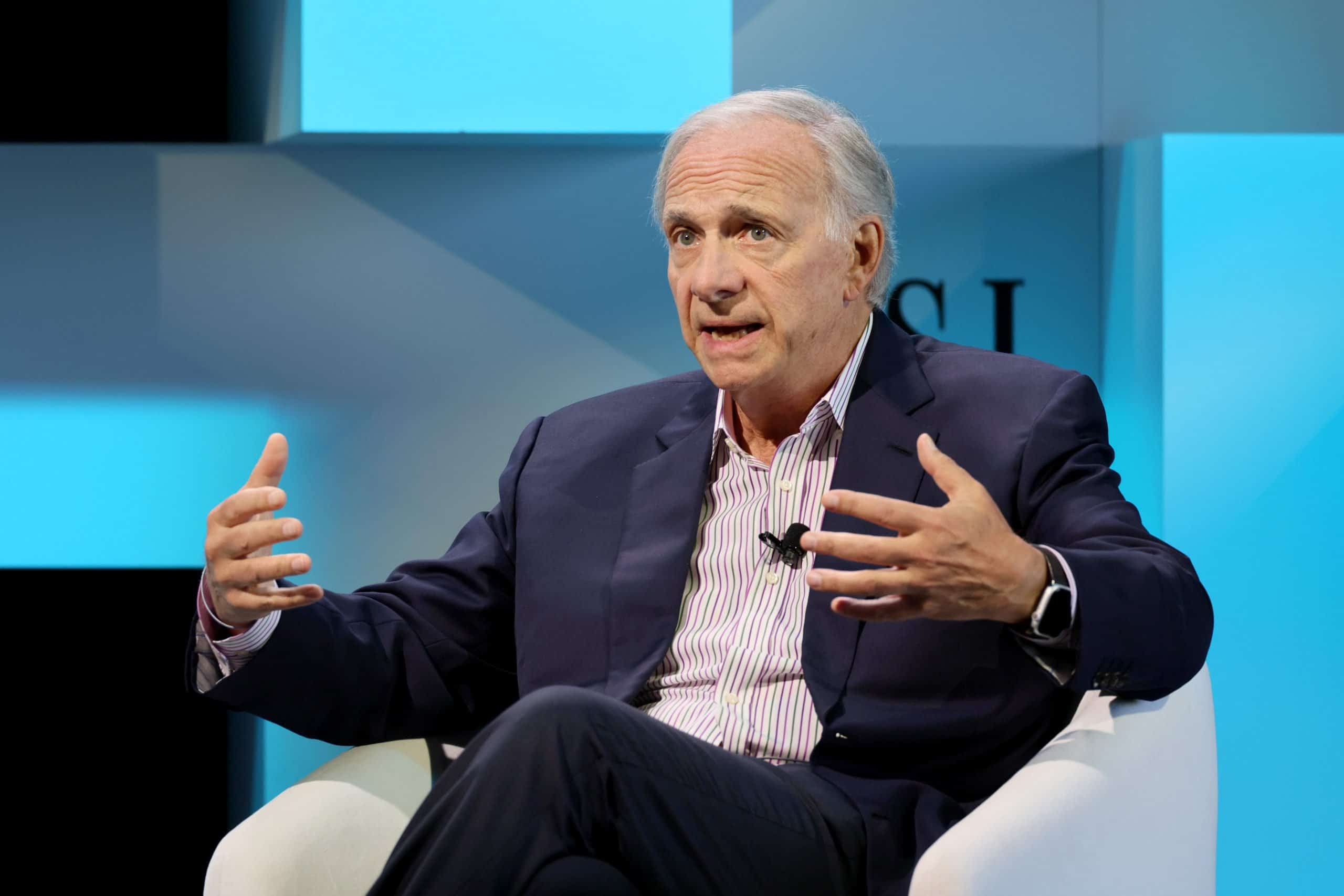

"When billionaire Ray Dalio talks, investors listen. Founder of the hedge fund Bridgewater Associates, Dalio has made moves that have generated impressive returns over the years. An experienced professional, Dalio stepped away from the firm he founded and has handed off the reins to a new generation. Bridgewater continues to remain the world's largest hedge fund with $136.5 billion in assets under management."

"His firm has seen double-digit returns in 2025 so far. It might not always be a good idea to follow a billionaire's moves, but there are times when they make smart choices, leading to impressive returns. Billionaire investors have access to research and bring decades of experience, making it worthwhile to consider their moves. In the second quarter this year, Bridgewater Associates made a complete exit from Chinese equities and moved to U.S. tech companies, reflecting its continued interest in innovation and structural growth."

"Ray Dalio already held a position in Uber Technologies at the beginning of the year. He added additional shares worth $258.66 million, increasing his stake in the company by 531.1%. He began investing in the company in 2022 and hasn't looked back. Exchanging hands for $92, Uber stock is up 47% this year and is on a rally. A global leader in mobility and delivery, Uber is always looking for alternative revenue sources to increase revenue. At the end of the second quarter, the company had 180 million monthly active users, up from 156 million a year ago. It has a presence across 15,000 cities worldwide, and there's still scope for growth. Its monthly active users are up 48%, and Uber holds 75% market share in the ride-hailing industry."

Ray Dalio is the founder of Bridgewater Associates, which manages $136.5 billion in assets. Bridgewater posted double-digit returns in 2025 and completed an exit from Chinese equities in the second quarter. The firm shifted allocations toward U.S. technology companies, emphasizing innovation and structural growth. Ray Dalio increased his position in Uber Technologies, adding $258.66 million and boosting his stake by 531.1%. Uber shares have risen strongly this year and the company reported growth in monthly active users, global presence across 15,000 cities, and leadership in ride-hailing market share.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]