"Bridgewater Associates has the highest allocation in the iShares Core S&P 500 ETF ( NYSEARCA:IVV), comprising 10.62% of the portfolio. The hedge fund increased its position by 4.83% in the third quarter. Bridgewater owns more than 1 million shares of the ETF and started investing in IVV in 2010. IVV has $733 billion in assets under management. The ETF provides exposure to large-cap companies in the U.S. and tracks the performance of the S&P 500 index."

"The fund has a yield of 1.04% and pays quarterly dividends. Its highest allocation lies in the technology sector at 34.36%, followed by financials (13.38%) and consumer discretionary (10.56%). IVV has a low expense ratio of 0.03% and has generated a cumulative 3-year return of 94.83% and a 5-year return of 114.12%. IVV has gained 17.09% in 2025 and is exchanging hands for $687.83."

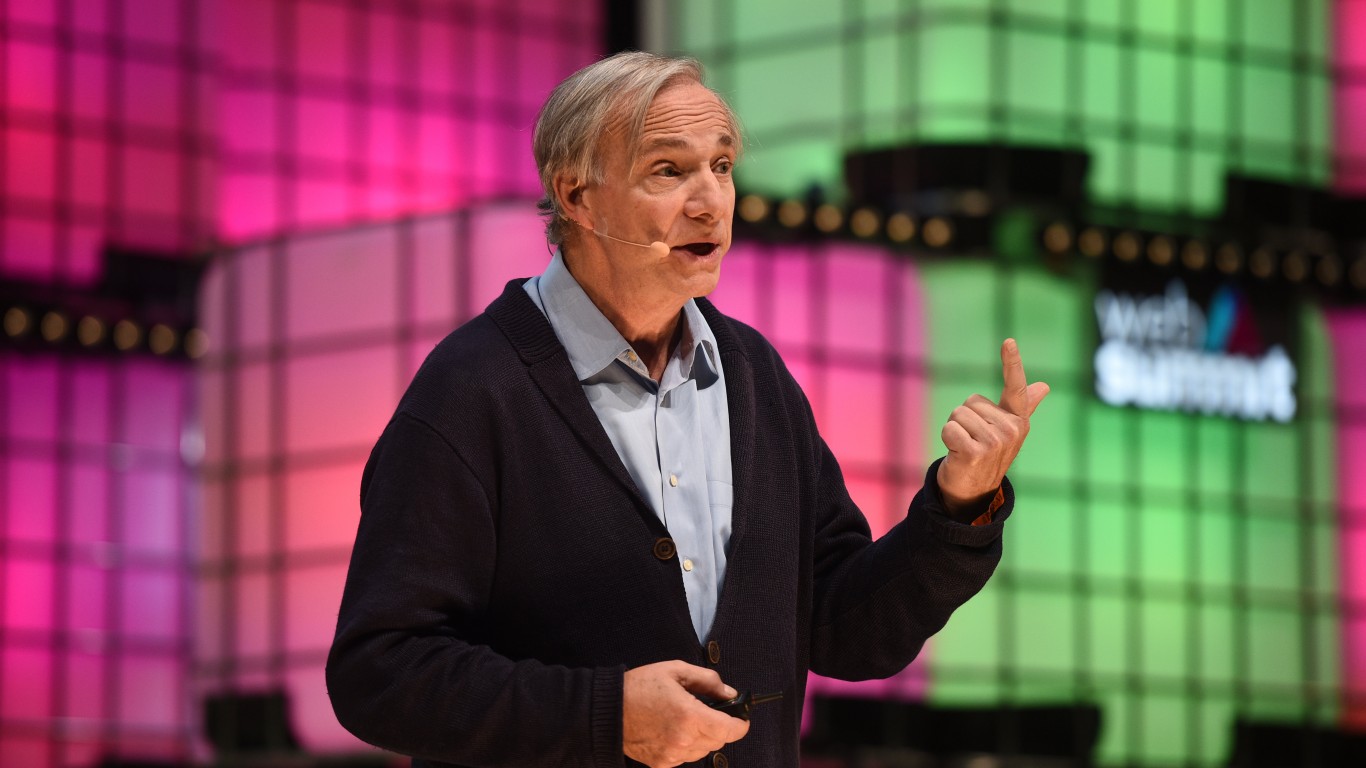

"Ray Dalio's Bridgewater Associates is one of the top hedge funds today. It has over $100 billion in assets, and the fund has made solid moves despite market uncertainties. Bridgewater Associates has made several transactions in the third quarter, and it is reflected in the 13F reports. However, the billionaire has played safe with his investments. His top holdings include two tech titans and two ETFs."

Bridgewater Associates manages over $100 billion and has made measured portfolio adjustments in the third quarter, as reflected in 13F filings. The firm maintains a sizable allocation to S&P 500 ETFs, with iShares Core S&P 500 ETF (IVV) at 10.62% and SPDR S&P 500 ETF Trust (SPY) at 6.69%. IVV provides broad large-cap U.S. exposure, heavy technology weighting, a 0.03% expense ratio, and strong multi-year returns. Bridgewater increased its IVV stake and holds more than one million shares. The fund’s approach emphasizes low-cost, diversified equity exposure while exercising investment caution. Due diligence remains essential.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]