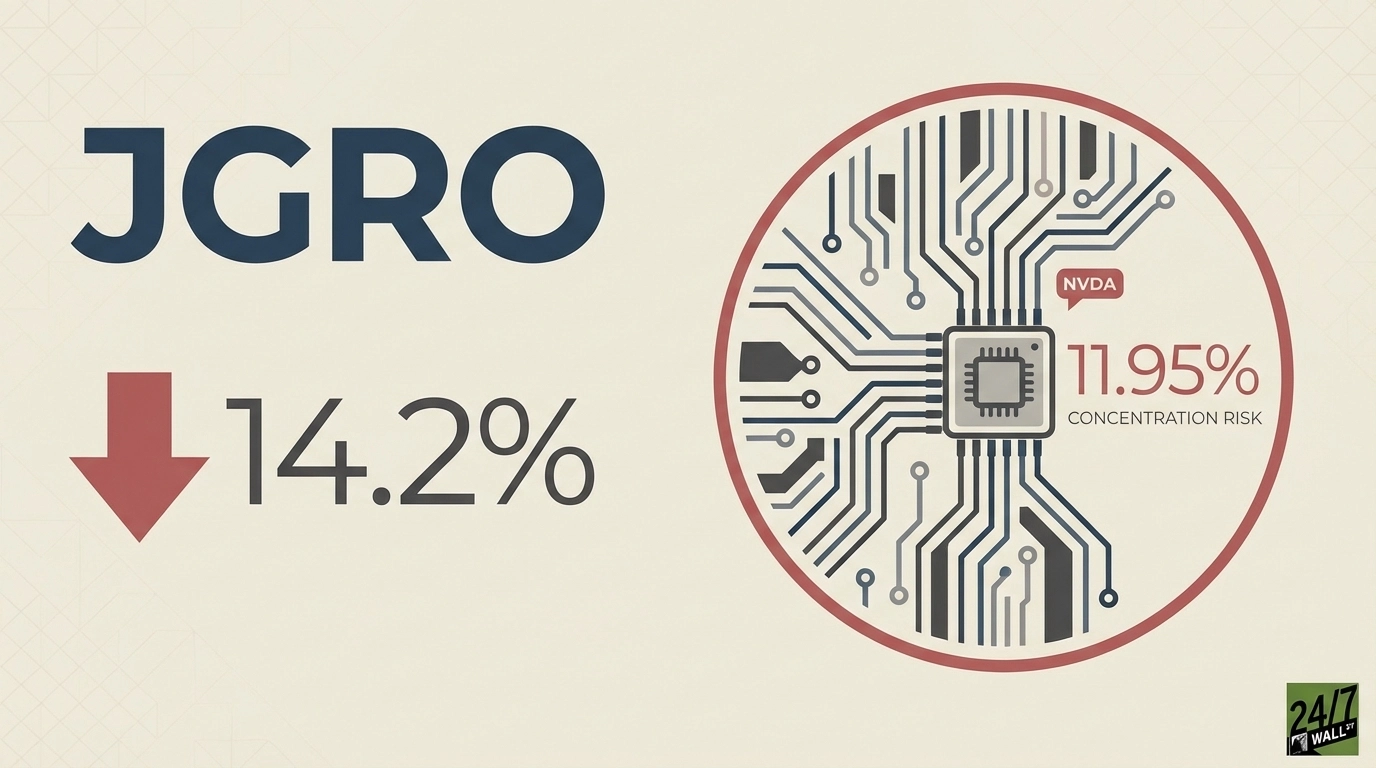

"The JPMorgan Active Growth ETF ( NYSEARCA:JGRO) delivered a 14.2% return over the past year, trailing the S&P 500's 17.9% gain by nearly 4 percentage points. For investors paying a 0.44% expense ratio for active management, underperformance raises a key question: what should you watch to understand whether this fund can close the gap? JGRO's $8.5 billion portfolio reveals a critical vulnerability through its concentration strategy. The fund's top three positions control over a quarter of assets, creating exposure to mega-cap technology headwinds."

"When Apple ( NASDAQ:AAPL) declined 4% year-to-date, it exemplified how this concentrated approach amplifies individual stock movements. Microsoft ( NASDAQ:MSFT) ranks among these top holdings, demonstrating how the fund's returns depend heavily on a handful of mega-cap technology names. The biggest macro factor for JGRO investors to monitor is Federal Reserve policy. After cutting rates three times in 2025, the Fed now faces conflicting signals. Wall Street banks are sharply divided on what comes next."

"Information technology represents 43% of JGRO's portfolio, making the fund highly sensitive to how the market values growth stocks. When rates stay elevated, these premium valuations face pressure as future cash flows get discounted more heavily. The fund's valuation tells a cautionary story. Trading at 22 times forward earnings, JGRO approaches multiples last seen at major market peaks. This elevated valuation leaves little room for multiple expansion if economic conditions deteriorate, creating downside risk for investors who entered at current levels."

JGRO returned 14.2% over the past year, trailing the S&P 500's 17.9% by nearly four percentage points while charging a 0.44% expense ratio for active management. The $8.5 billion portfolio concentrates over a quarter of assets in its top three positions, creating outsized exposure to mega-cap technology moves such as Apple and Microsoft. Information technology comprises 43% of the fund, making performance highly sensitive to Fed rate expectations. Divergent Wall Street forecasts and uncertainty about future rate cuts or hikes can materially affect growth stock valuations. Trading near 22 times forward earnings, the fund faces limited valuation upside and notable downside risk.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]