"I would be quite happy to invest abroad- in developed country equities, broadly in emerging markets- just to try and rebalance a portfolio,"

"one of these numbers is not like the others,"

"The thing that stands out is how expensive the U.S. is."

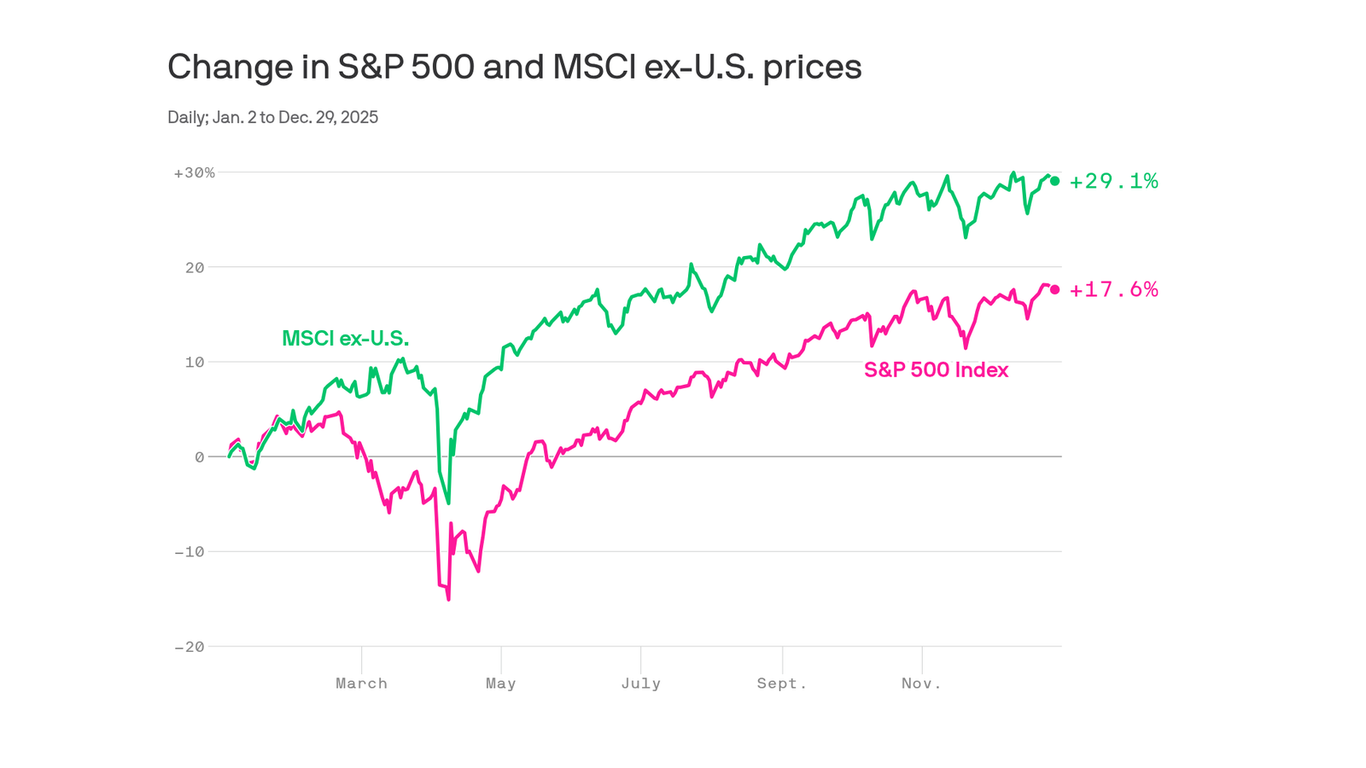

U.S. equities, especially tech, trade at elevated valuations with the S&P 500 near 23 times forward earnings versus a historical average of 18. The MSCI ex-US index is up 29% year-to-date and emerging markets nearly 30%, helped by a weaker dollar. Before 2025 the U.S. outperformed international stocks for more than a decade, but that trend is shifting due to rich U.S. valuations, lingering trade uncertainty from prior tariff actions, and concentrated gains in Magnificent Seven AI leaders that comprise more than a third of the S&P 500. Asia, including MSCI China and Hong Kong, is showing strong performance and rising AI competition.

Read at Axios

Unable to calculate read time

Collection

[

|

...

]