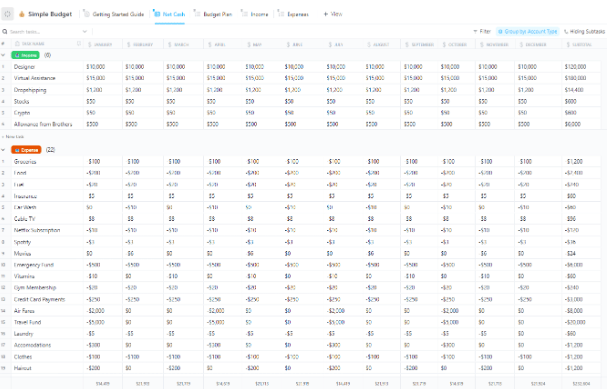

"But what if managing your money didn't require a finance degree, 10 spreadsheets, and a minor existential crisis? Enter: the magical 50/30/20 budget rule. It's as simple as pie: 50% for needs, 30% for wants, and 20% for savings. To make things even easier, we've got 50/30/20 budget templates that offer a structure to help you organize finances and build a long-term financial plan."

"A 50/30/20 budget template helps shape that behavior by offering a simple method to manage your income. It divides your net income into three parts: 50% for needs like health insurance and bills 30% for wants like entertainment 20% for savings and debt repayment Instead of tracking every penny, you categorize your monthly expenses based on priorities. These templates act as ready-to-use frameworks to organize finances, making it easier to start budgeting, monitor actual spending, and reach financial goals without overcomplicating the process."

The 50/30/20 budgeting method divides net income into three clear categories: 50% for essential needs, 30% for discretionary wants, and 20% for savings and debt repayment. Ready-made 50/30/20 templates provide a simple framework to categorize monthly expenses, track actual spending, and adjust allocations over time. These templates reduce complexity by focusing on priorities rather than tracking every penny and can adapt to income from salaries, loans, or side hustles. A strong template clearly breaks down monthly income, shows allocation sections at a glance, and supports ongoing adjustments to meet real-life expenses and financial goals.

Read at ClickUp

Unable to calculate read time

Collection

[

|

...

]