""The credits have been important since Tesla's beginning. In the early years, it's really what kept them out of bankruptcy," says David Sperling, founding director of the Institute for Transportation Studies at UC Davis."

""Without the revenue from selling credits, Tesla would have posted a $186 million loss," highlighting the financial importance of regulatory credits to the company's bottom line."

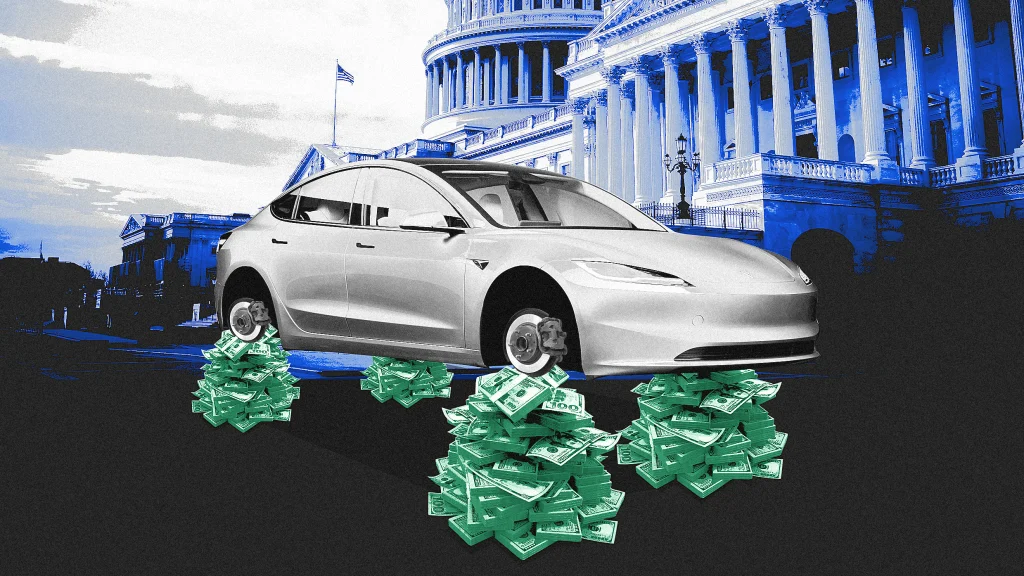

Tesla's latest earnings report revealed a significant reliance on regulatory credits, earning $595 million from selling these credits to other automakers to maintain profitability. The company suffered a 71% decline in sales for Q1 2025 compared to the previous year, largely due to external political influences. The ongoing efforts by government officials to dismantle credit systems could impact Tesla's revenue. As an early crucial factor for Tesla's survival, regulatory credits have historically played a vital role in its financial stability, especially during periods of struggle.

Read at Fast Company

Unable to calculate read time

Collection

[

|

...

]