"Built for the Green Energy Transition CTEX targets companies developing clean energy technologies including solar, wind, energy storage, and grid infrastructure. The fund holds 30 equally weighted positions dominated by industrials (63%) and semiconductors (23%), with top holdings including T1 Energy, Energy Vault, GE Vernova, and Array Technologies. Unlike utility-heavy competitors, CTEX emphasizes equipment manufacturers and technology providers building the infrastructure."

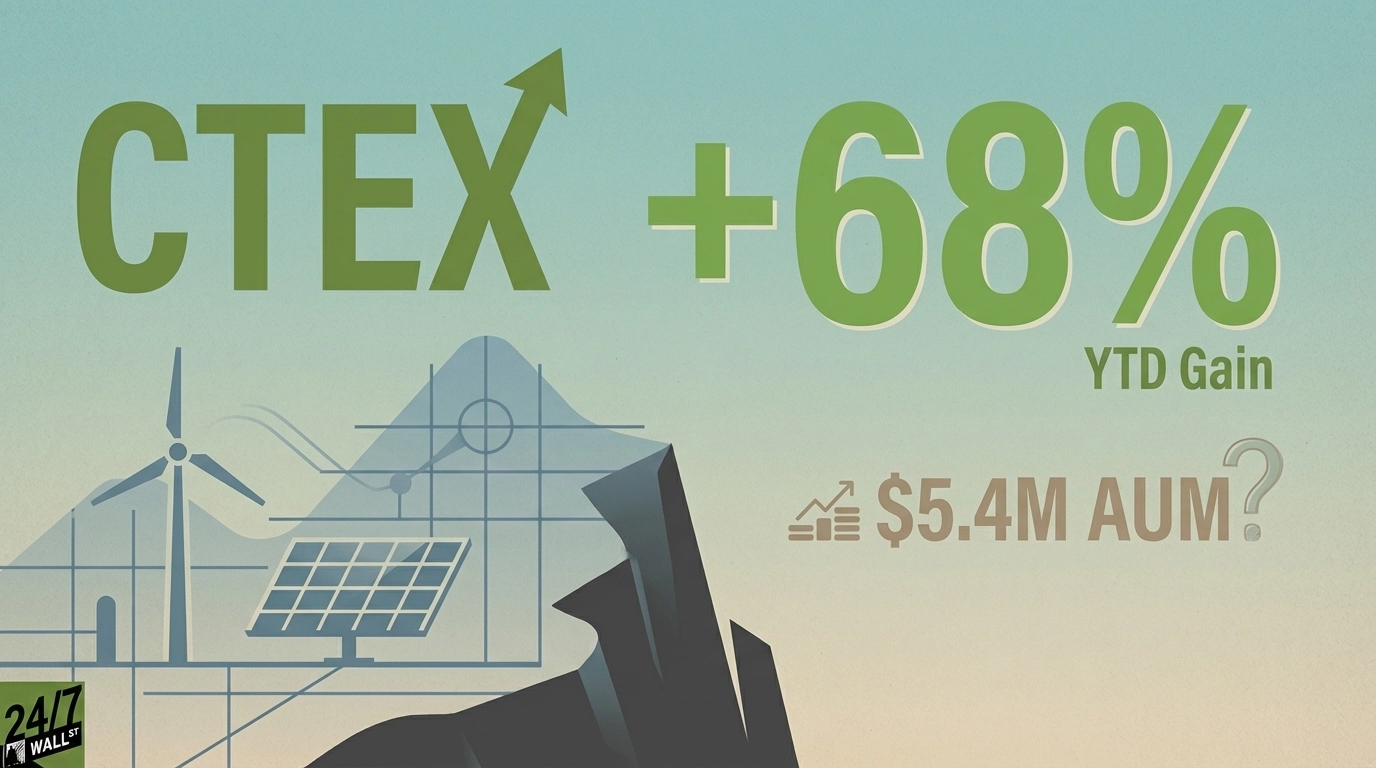

"The return engine is pure capital appreciation tied to cleantech adoption cycles. With a 30-day SEC yield of 0.02%, this ETF generates no meaningful income. Investors are betting on growth driven by decarbonization mandates, corporate net-zero commitments, and renewable energy buildouts. Performance Validated, But Timing Matters CTEX delivered a 68% year-to-date return through December 31, 2025. The fund's RSI cooled from overbought levels above 80 in October to a neutral 47 by year-end, suggesting momentum has normalized after the explosive rally."

"The fund's RSI cooled from overbought levels above 80 in October to a neutral 47 by year-end, suggesting momentum has normalized after the explosive rally. However, the fund's $5.4 million in assets raises serious liquidity concerns. Small ETF assets can lead to wider bid-ask spreads, difficulty exiting positions, and closure risk if flows don't materialize. The 0.58% expense ratio is reasonable for a thematic fund, but investors need conviction that AUM will grow to justify the concentration and liquidity tradeoffs."

CTEX targets companies building clean energy technologies across solar, wind, energy storage, and grid infrastructure with 30 equally weighted positions concentrated in industrials and semiconductors. The ETF delivered a 68% year-to-date return through December 31, 2025, with an RSI cooling from overbought levels to neutral by year-end. The fund generates no meaningful income with a 30-day SEC yield of 0.02% and carries a 0.58% expense ratio. The ETF's $5.4 million in assets raises liquidity and closure risks from wide spreads and difficult exits. A June 30, 2026 deadline on many clean-energy tax credits creates a policy cliff that could amplify volatility.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]