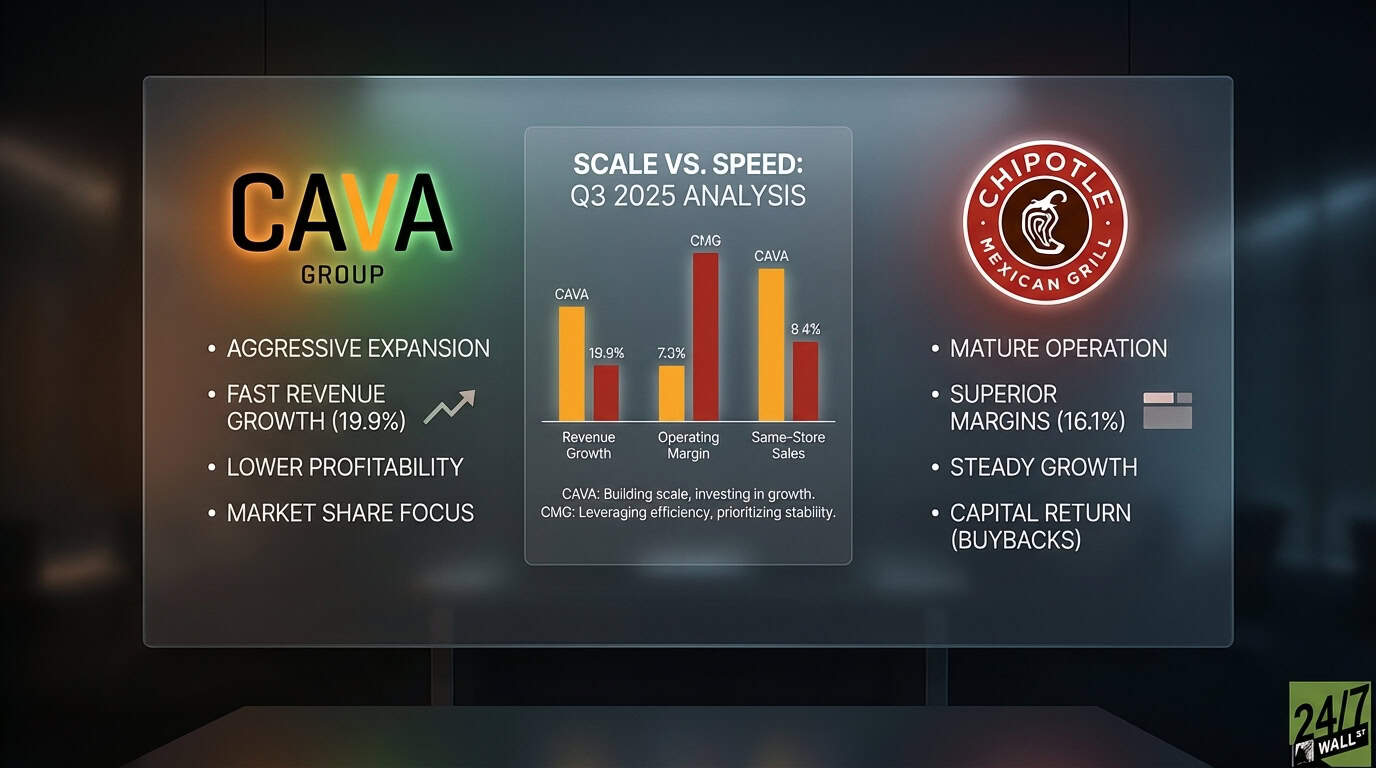

"CAVA posted 19.9% revenue growth but missed EPS estimates by 7.7%, while Chipotle grew revenue 7.5% and met expectations despite margin pressure."

"CAVA delivered $292.24 million in revenue, narrowly beating estimates, with same-store sales up 1.9%. The company opened 17 new restaurants and maintained a 37.6% digital mix. Restaurant-level margin compressed to 24.6% from 25.6% a year earlier, driven by higher food, beverage, packaging, and labor costs. Net income fell 17.9% year-over-year to $14.75 million. CEO Brett Schulman emphasized "market share growth" and reinforcing the brand's "value proposition.""

"Chipotle generated $3.0 billion in revenue, slightly missing estimates, with comp sales up 0.3%. The company opened 84 locations, 64 with Chipotlane drive-through formats. Operating margin declined to 15.9% from 16.9%, pressured by labor costs. Net income slipped 1.4% to $382.1 million. CEO Scott Boatwright acknowledged "persistent macroeconomic pressures" but highlighted the brand's "extraordinary value proposition." Chipotle's operating margin remains 2.6 times higher at 16.1% versus 6.3%."

CAVA reported 19.9% revenue growth to $292.24 million with same-store sales up 1.9% and opened 17 restaurants while keeping a 37.6% digital mix. Restaurant-level margin fell to 24.6% from 25.6% due to higher food, beverage, packaging, and labor costs, and net income declined 17.9% to $14.75 million. CAVA targets 1,000 locations by 2032 and trades at elevated multiples reflecting expected growth. Chipotle generated $3.0 billion in revenue with comp sales up 0.3%, opened 84 locations (64 Chipotlanes), experienced margin pressure from labor, and saw net income slip 1.4% to $382.1 million.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]