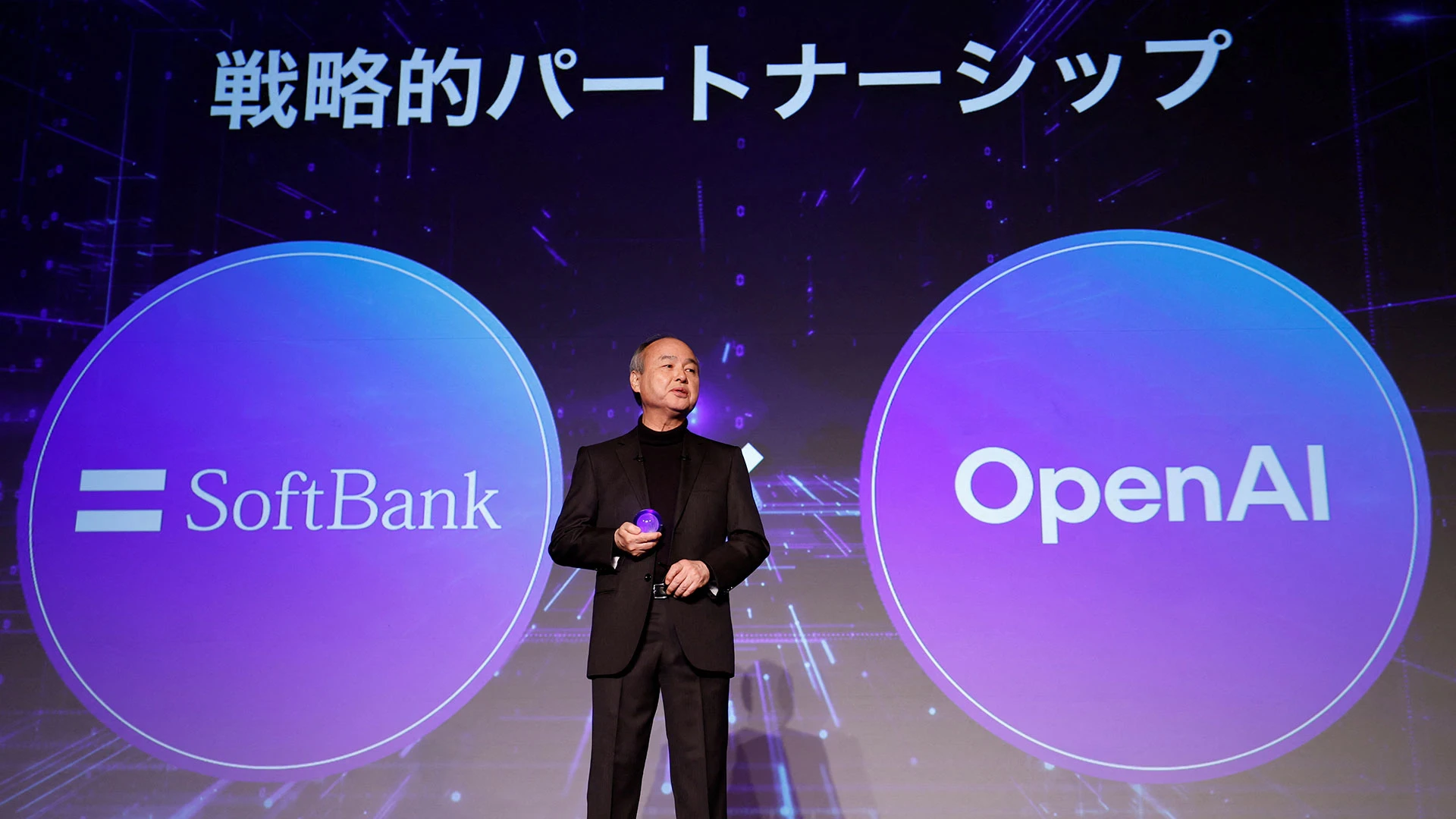

"SoftBank Group is racing to close a $22.5 billion funding commitment to OpenAI by year-end through an array of cash-raising schemes, including a sale of some investments, and could tap its undrawn margin loans borrowed against its valuable ownership in chip firm Arm Holdings, sources said. The "all-in" bet on OpenAI is among the biggest yet by SoftBank CEO Masayoshi Son, as the Japanese billionaire seeks to improve his firm's position in the race for artificial intelligence."

"Son's firm is working to take public its payments app operator, PayPay. The initial public offering, originally expected this month, was pushed back due to the 43-day-long U.S. government shutdown, which ended in November. PayPay's market debut, likely to raise more than $20 billion, is now expected in the first quarter of next year, according to one direct source and another person familiar with the efforts."

"The Japanese conglomerate is also looking to cash out some of its holdings in Didi Global, the operator of China's dominant ride-hailing platform, which is looking to list its shares in Hong Kong after a regulatory crackdown forced it to delist in the U.S. in 2021, a source with direct knowledge said. Investment managers at SoftBank's Vision Fund are being directed toward the OpenAI deal, two of the above sources said."

SoftBank Group is racing to secure $22.5 billion for OpenAI by year-end using cash-raising schemes, including selling investments and tapping undrawn margin loans against its Arm Holdings stake. Masayoshi Son sold SoftBank's $5.8 billion Nvidia stake, offloaded $4.8 billion of T-Mobile US shares, and cut staff. Deal approval at the Vision Fund has been centralized, with most transactions paused and any deal above $50 million requiring Son's sign-off. SoftBank is preparing an IPO for payments operator PayPay, expected to raise over $20 billion early next year. The group is also considering sales of Didi Global holdings while directing Vision Fund managers toward the OpenAI investment, reflecting pressure to finance large AI data-center projects.

Read at Fast Company

Unable to calculate read time

Collection

[

|

...

]