"Between November 2023 and November 2024, U.S. active housing inventory for sale rose +26.1%. Between November 2024 and November 2025, U.S. active housing inventory for sale rose +12.6%. Some of that percentage deceleration is a denominator effect (i.e., as U.S. active inventory rises, it takes an even larger increase to generate the same year-over-year percentage gain). That said, the deceleration is not only due to a denominator effect."

"Why has U.S. active inventory growth slowed? Some of it is due to days on market not rising as quickly/stabilizing in some markets. Part of the slowdown reflects an increase in delistings in softer markets, as some sellers have thrown in the towel and pulled their listings. And, to a lesser degree, a handful of markets have seen a mild pickup in absorption, as existing-home sales have edged up slightly from their multiyear troughs."

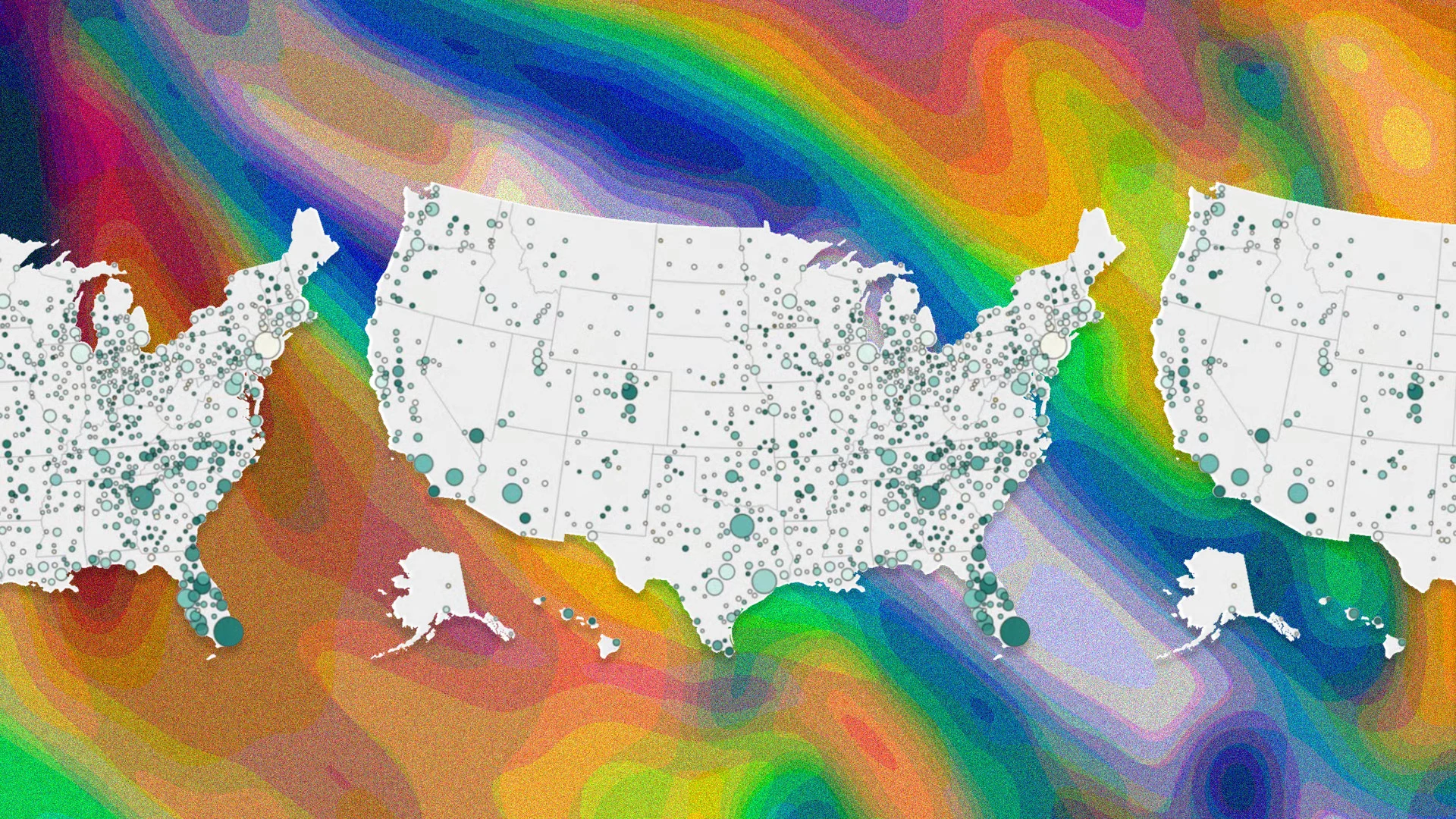

"While national active inventory for sale is still rising year-over-year, the pace of growth has slowed in recent months-something we've been closely documenting for several months for our ResiClub members. The side-by-side maps below help you to see that decelerated rate of inventory growth: Left map: Year-over-year change in metro level active inventory between November 2023 and November 2024 Right map: Year-over-year change in metro level active inventory between November 2024 and November 2025"

National active housing inventory continues to rise year‑over‑year, but the pace of growth has slowed in recent months. Between November 2023 and November 2024 active inventory rose +26.1%; between November 2024 and November 2025 it rose +12.6%. In unit terms there were +196,885 more homes for sale in Nov 2024 versus Nov 2023, and +120,003 more in Nov 2025 versus Nov 2024. Some deceleration stems from a denominator effect as inventory levels grow, but other factors include stabilizing days on market, increased delistings in softer markets, and a modest pickup in absorption as existing‑home sales edge up.

Read at Fast Company

Unable to calculate read time

Collection

[

|

...

]