"In modern fraud detection systems, a critical challenge emerges: how do you achieve both lightning-fast response times and unwavering reliability? Most architectures force you to choose between speed and consistency, but there's a sophisticated solution that delivers both. Traditional event-driven systems excel at immediate processing but struggle with sparse activity patterns and external query requirements. When events don't arrive, these systems can leave aggregations incomplete and state stale - a significant liability in financial services where every millisecond and every calculation matters."

"The Core Challenge: When Event-Driven Systems Fall Short Event-driven architectures have transformed real-time processing, but they reveal critical limitations in fraud detection scenarios. Understanding these constraints is essential for building robust financial systems. Problem 1: The Inactivity Gap Consider a fraud detection system that processes user behavior patterns. When legitimate users have sparse transaction activity, purely event-driven systems encounter a fundamental issue."

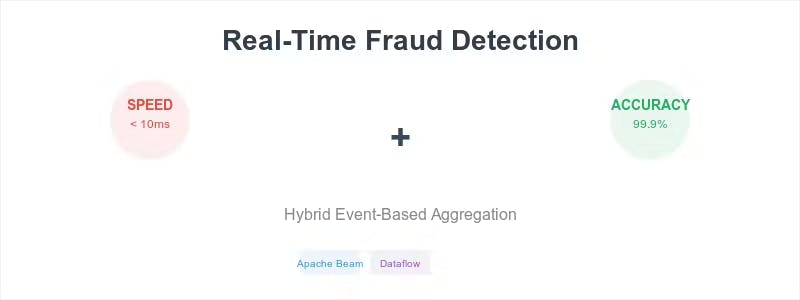

Hybrid event-based aggregation addresses the tradeoff between speed and consistency by combining immediate event processing with timer-driven completion to ensure completeness. Pure event-driven systems face inactivity gaps when sparse user activity leaves aggregations incomplete and state stale. External queries can receive outdated results when no recent events have occurred. The hybrid pattern triggers immediate aggregations on incoming events and uses timers or scheduled checks to finalize or refresh aggregations during inactivity. Implementations must handle timer management, idempotency, state persistence, and scalability to meet millisecond latency and reliable completeness.

Read at Hackernoon

Unable to calculate read time

Collection

[

|

...

]