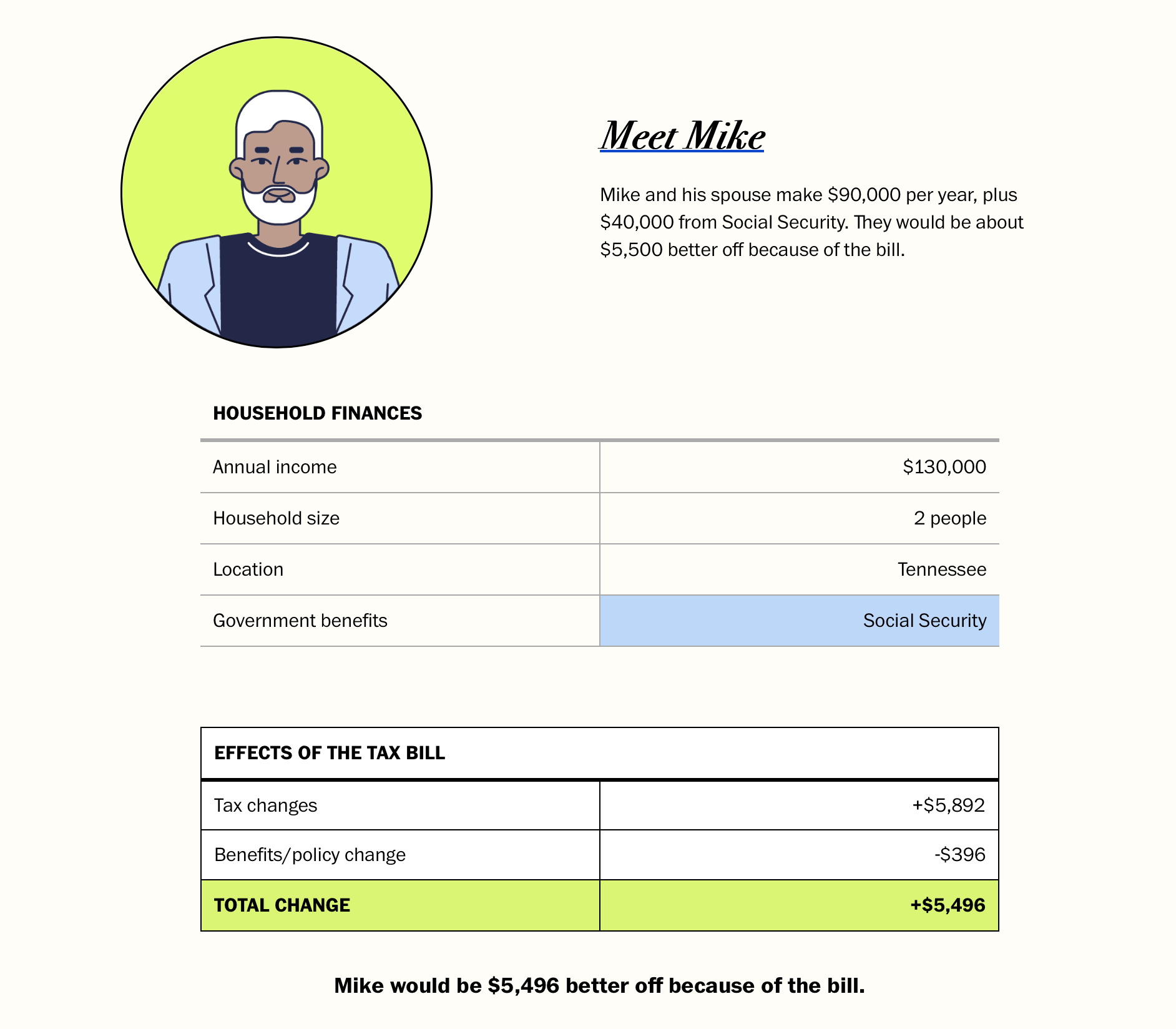

"The tax bill varies in its impact across different income levels and household situations, offering a nuanced view on how each group will feel its effects."

"By providing profiles with specific examples of tax changes, the Washington Post not only highlights the bill's varied effects but also contextualizes these effects so readers can relate."

"The interactive feature that allows users to input personal information offers a practical tool for understanding one's specific situation and navigating the complexities of tax changes."

"The bill's design reflects an effort to cater to diverse financial scenarios, making it essential for taxpayers to be informed and prepared for their individual outcomes."

The upcoming tax bill is set to pass, bringing varied impacts on individuals' tax liabilities depending on income brackets, household structures, and filing statuses. The Washington Post effectively demonstrates these differences through specific profiles, allowing readers to visualize changes relevant to their financial situations. Its interactive tool lets readers personalize information such as income, state, and dependents to ascertain the exact implications of the tax bill, emphasizing the importance of understanding personal tax obligations in light of the new legislation.

Read at FlowingData

Unable to calculate read time

Collection

[

|

...

]