"The turmoil briefly subsided after Bessent pledged a financial lifeline. Amid the calm in the market, Argentina suspended export taxes on soybeans, which prompted China to swoop in and buy Argentine soybeans in the kinds of volumes it would typically buy from U.S. farmers. American farm groups and lawmakers from farming states have voiced their frustrations over the turn of events. And the peso remained under pressure. Argentina has spent billions of dollars in an effort to defend the value of its currency."

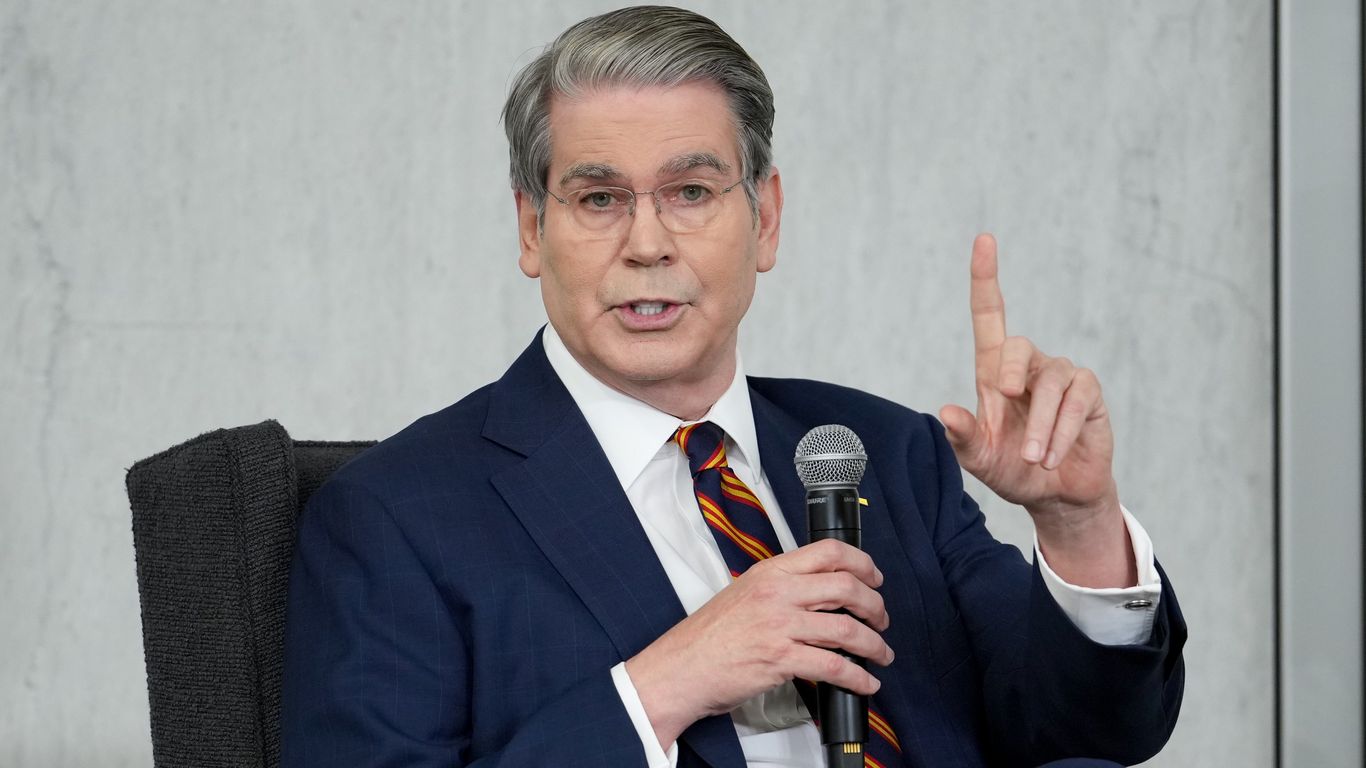

"Driving the news: On Thursday, Bessent said on X that Treasury had agreed on a $20 billion currency swap framework with Argentina's central bank. He also said that Treasury directly purchased pesos, a step the department rarely takes. What they're saying: "As Argentina lifts the dead weight of the state and stops spending into inflation, great things are possible," Bessent wrote. "The success of Argentina's reform agenda is of systemic importance.""

Argentina's peso plunged after President Milei's party lost local elections, triggering doubts about his economic program. The turmoil eased when U.S. official Bessent pledged a financial lifeline and announced a $20 billion currency swap framework between the U.S. Treasury and Argentina's central bank, and Treasury directly purchased pesos. Argentina suspended export taxes on soybeans, prompting China to buy Argentine soybeans in volumes similar to typical U.S. purchases. American farm groups and lawmakers from farming states expressed frustration. Argentina has spent billions defending the peso. President Trump plans to meet President Milei, and legislative elections are scheduled for Oct. 26 as markets remain watchful.

Read at Axios

Unable to calculate read time

Collection

[

|

...

]