#microstrategy

#microstrategy

[ follow ]

#bitcoin #bitcoin-holdings #michael-saylor #investing #market-volatility #institutional-accumulation #msty

fromBitcoin Magazine

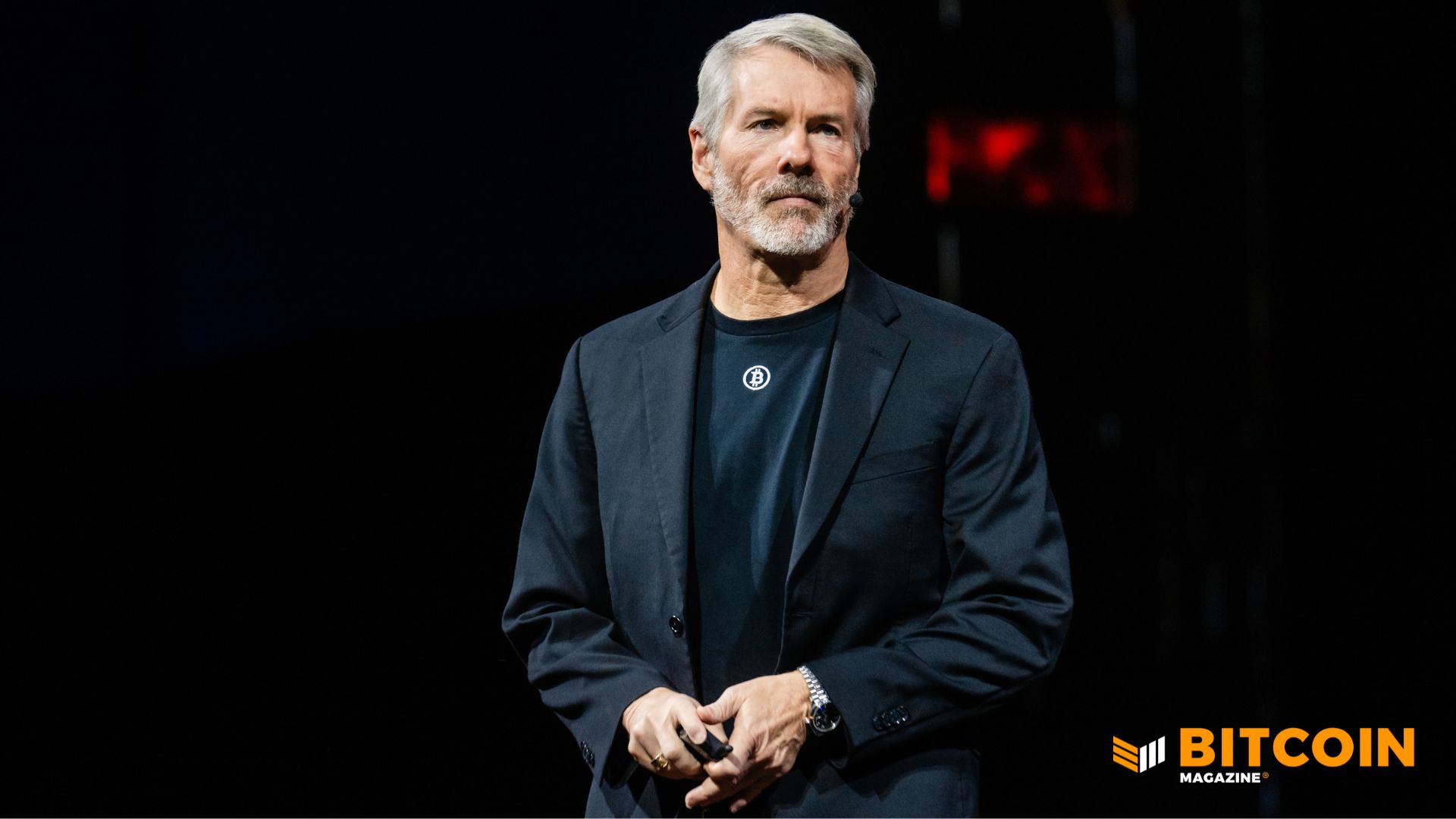

2 weeks agoStrategy ($MSTR) To Lead Bitcoin Quantum Defense, Says Saylor

Strategy's ($MSTR) Executive Chairman Michael Saylor said on the company's fourth-quarter 2025 earnings call that Strategy will initiate a Bitcoin Security Program. The effort is meant to coordinate with the global cyber, crypto, and Bitcoin security community. In the call, Saylor framed quantum computing as a long-term engineering challenge rather than an immediate danger. He said the technology is likely more than a decade away from posing a serious risk to Bitcoin's cryptography.

Information security

fromBitcoin Magazine

3 months agoStrategy Could See $2.8B In Outflows If Indices Exclude MSTR

Strategy - the original "bitcoin-on-NASDAQ" proxy - is now facing its most consequential structural risk since Michael Saylor began converting the firm into a leveraged BTC holding vehicle five years ago. A new JPMorgan research note warns that Strategy is "at risk of exclusion from major equity indices" as MSCI approaches a key January 15 decision on whether companies with large digital-asset treasuries belong in traditional stock benchmarks.

Cryptocurrency

fromBitcoin Magazine

4 months agoBitcoin Price Rebounds To $111,000 As Strategy Adds 168 More BTC

Strategy (NASDAQ: MSTR), the world's largest corporate holder of bitcoin, expanded its treasury once again last week, purchasing 168 BTC for $18.8 million at an average price of $112,051 per coin, according to a new U.S. Securities and Exchange Commission filing. Following the purchase, Strategy now holds 640,418 BTC, acquired at a total cost of roughly $47.40 billion, reflecting an average purchase price of $74,010 per bitcoin.

Cryptocurrency

fromBitcoin Magazine

5 months agoHow MSTR Could Have Gained 50K Extra Bitcoin With MVRV BTC Strategy

Bitcoin treasury companies have become one of the most important demand drivers in this cycle. Collectively, 86 publicly traded firms now hold more than 1 million BTC on their balance sheets. What began with MSTR (Strategy) in 2020 has since spread across the corporate landscape, with new entrants joining seemingly every week. But a closer look at their purchase history reveals a surprising insight that many of these companies could be holding considerably more Bitcoin today if they had followed a simple, rules-based strategy for accumulation.

Cryptocurrency

[ Load more ]