Artificial intelligence

from24/7 Wall St.

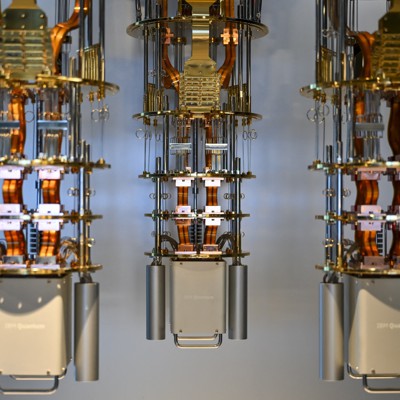

7 hours agoIonQ Is Growing Like a Weed but Bleeding Cash

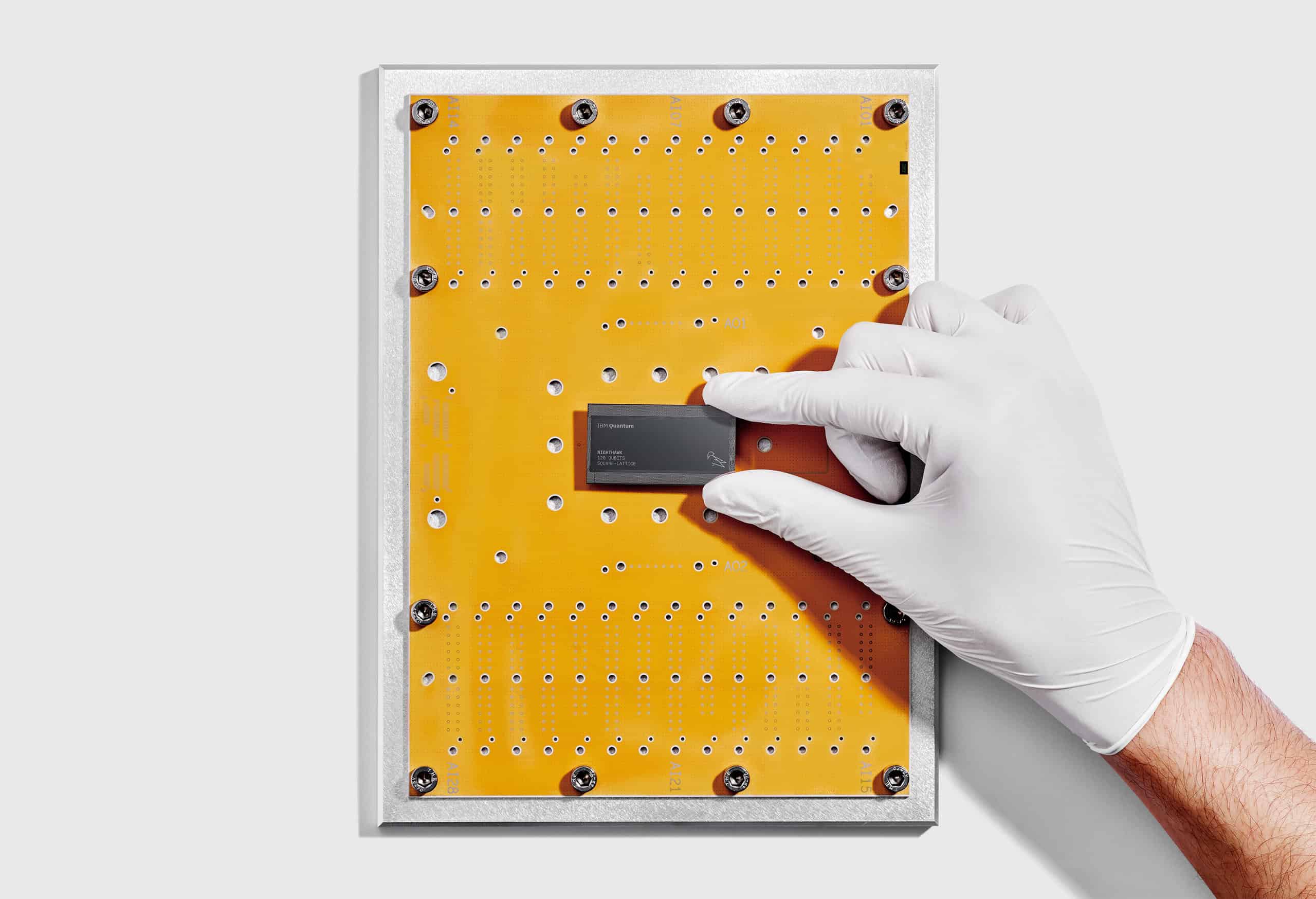

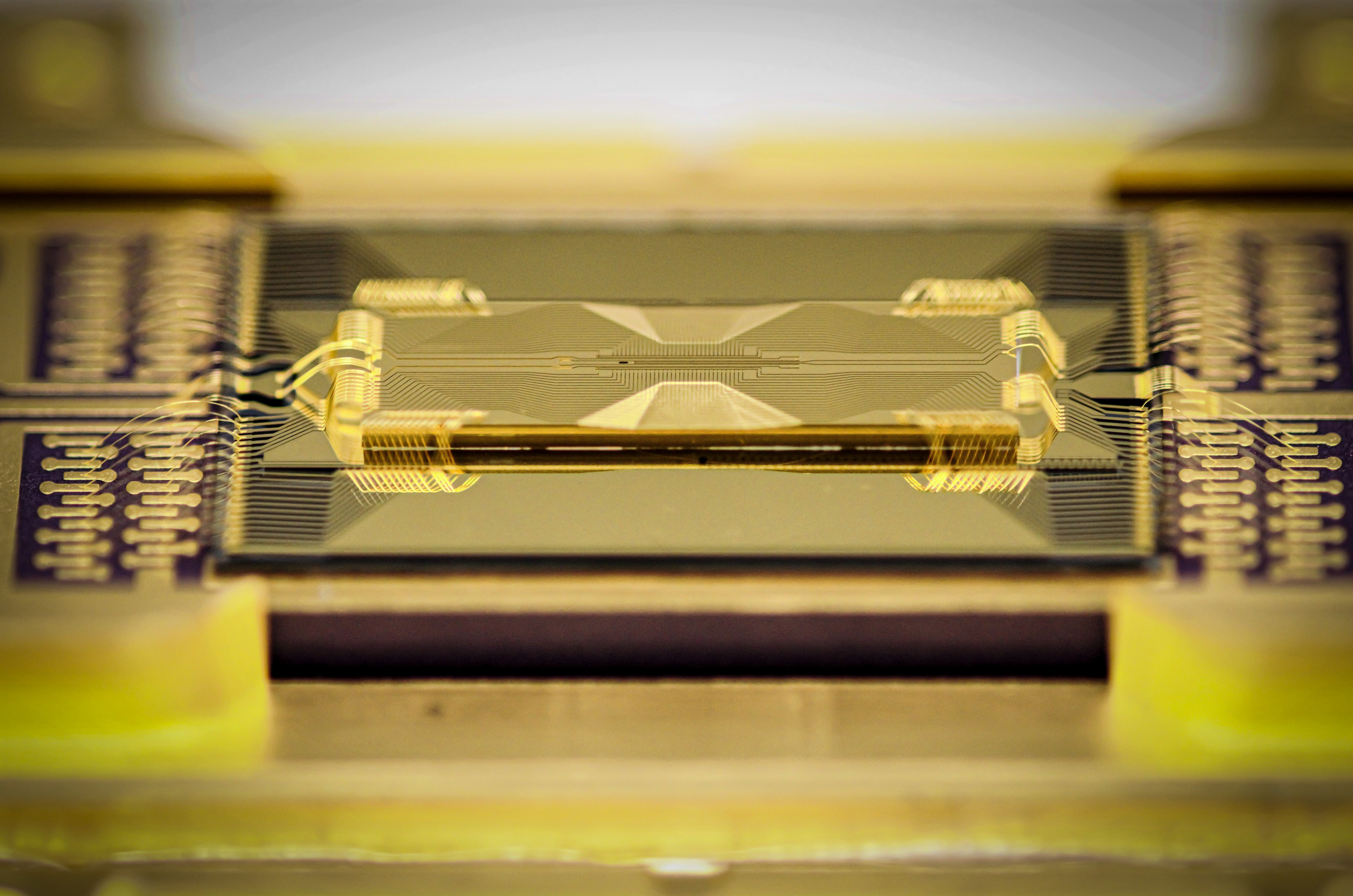

IonQ reported 429% Q4 revenue growth to $61.9 million and full-year 2025 revenue of $130 million, beating expectations, though the stock declined 25.1% year-to-date due to significant operating losses and an earnings miss on profitability metrics.