"The presented research explores the efficacy of feature selection and similarity methods on financial datasets, highlighting their adaptability across varying sample sizes in predicting stock prices."

"Using historical finance data from the 100 largest companies, this methodology emphasizes a systematic reduction of features to enhance linear regression forecasting accuracy."

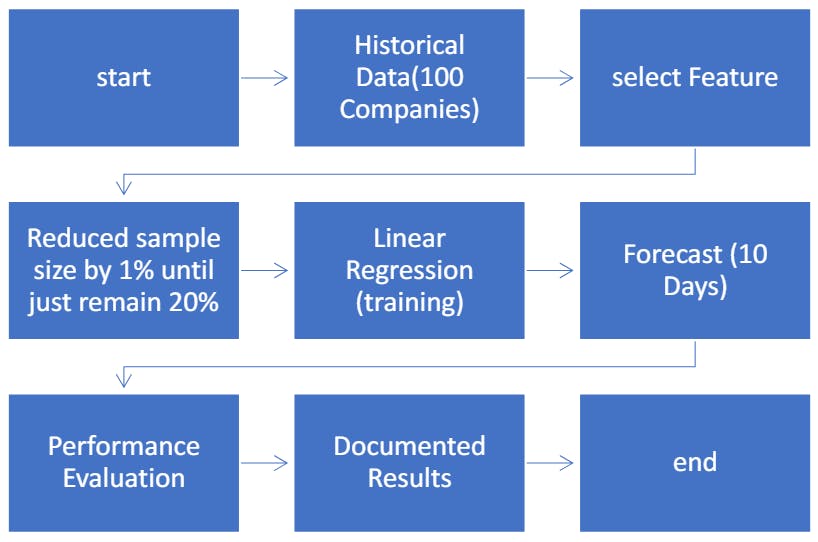

This article details a research study focused on the effectiveness of feature selection and similarity methods in financial data analysis. By collecting historical datasets from the 100 largest companies, the methodology involves systematic feature reduction over 80 steps to analyze performance across different sample sizes. Specifically, the objective was to forecast Apple's closing stock price, employing linear regression with the carefully chosen features. Performance was measured using cross-validation techniques, ultimately determining the best model among datasets of varying sizes, thus contributing to the understanding of data sensitivity in predictive modeling.

#feature-selection #similarity-methods #stock-price-prediction #linear-regression #financial-analysis

Read at Hackernoon

Unable to calculate read time

Collection

[

|

...

]