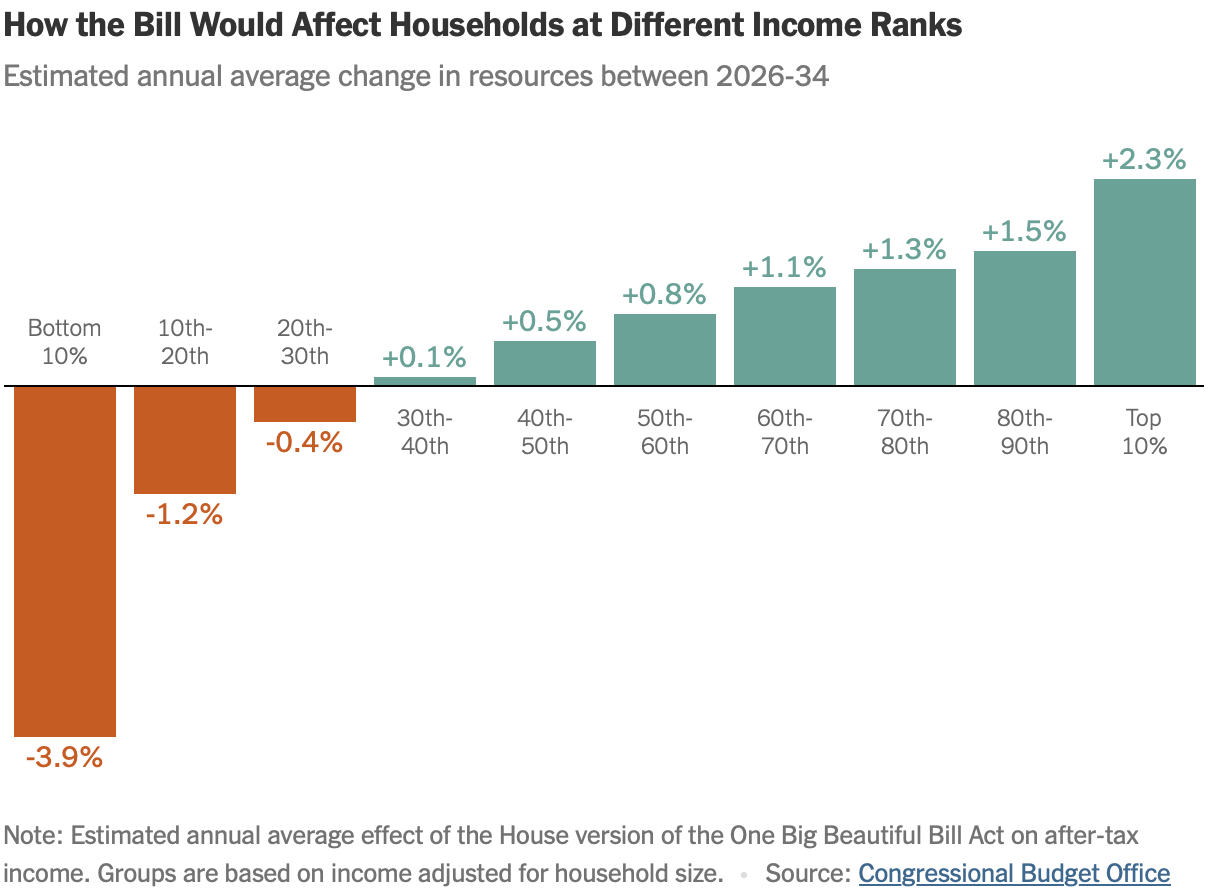

"The bill proposed by the current administration raises after-tax incomes for the highest-earning 10% while lowering them for the poorest, creating an unprecedented distribution."

"According to new estimates by the Congressional Budget Office, this bill would raise incomes for the top earners by 2.3% while reducing those for the lowest earners by 3.9%."

The current administration's bill presents an unusual impact on income distribution, raising after-tax incomes for the wealthiest while significantly affecting the poorest negatively. According to the Congressional Budget Office, the income of the highest-earning 10 percent could rise by 2.3 percent over the next decade, contrasted by a 3.9 percent decrease for the lowest tenth. This reversal of traditional tax cut dynamics marks a significant departure from past legislation, demonstrating a unique approach by congressional Republicans in the context of fiscal policy since the 1990s.

Read at FlowingData

Unable to calculate read time

Collection

[

|

...

]