"the shortest path to wealth is to avoid debt. And the best way to do that is to either buy a house with cash or go with a 15-year mortgage, which has the overall lowest total cost-and keeps borrowers on track to pay off their house fast."

"The idea is excellent in theory, and it is practical for some people in some areas of the country. But it's not practical for the average person, and waiting your whole life to buy a house with a 15-year mortgage means you'll miss out on building equity and security."

"Many experts agree that Ramsey's rule is good on paper. The interest savings are enormous, and the discipline of a larger, mandatory payment keeps many people from letting extra cash slip into lifestyle creep."

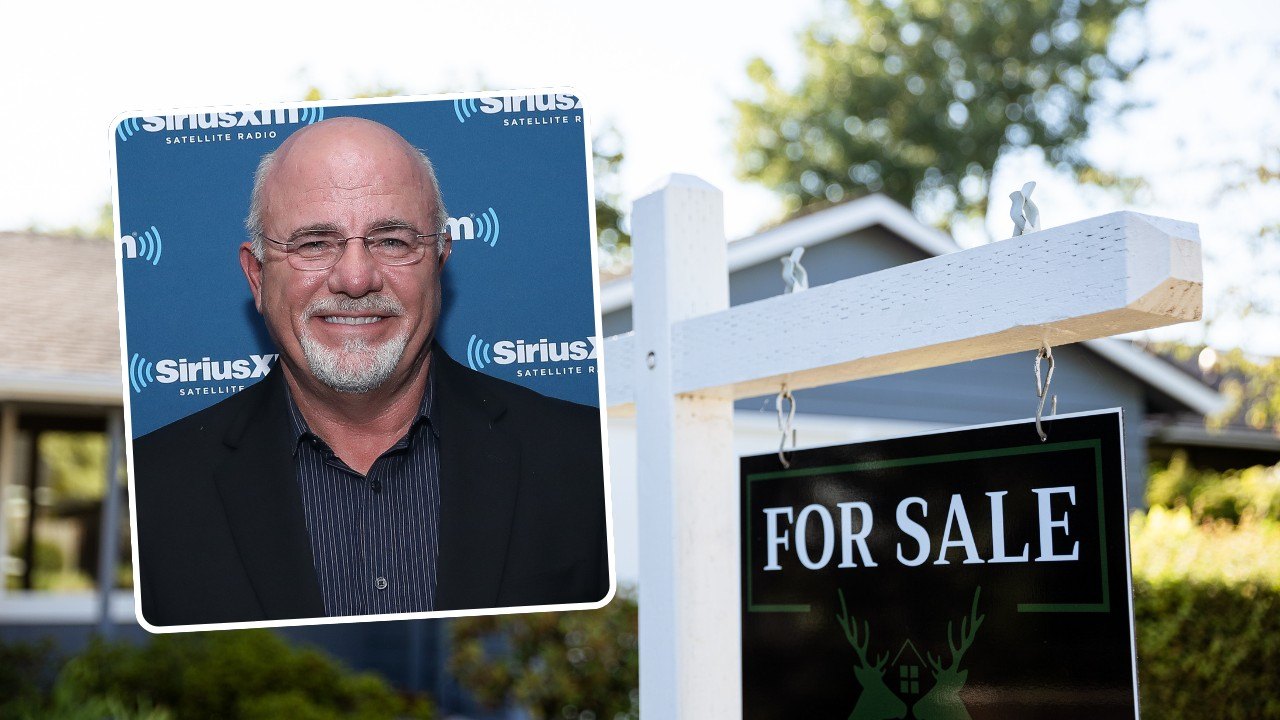

Dave Ramsey encourages homeowners to choose 15-year mortgages as they help eliminate debt quickly and save on interest costs. Critics argue that in today's economic climate, such advice may exclude potential buyers from desirable areas due to high prices and wages that have not kept pace. While Ramsey’s principles emphasize debt avoidance and rapid home equity accumulation, some experts believe they are impractical for the average consumer and could hinder homeownership opportunities.

Read at SFGATE

Unable to calculate read time

Collection

[

|

...

]