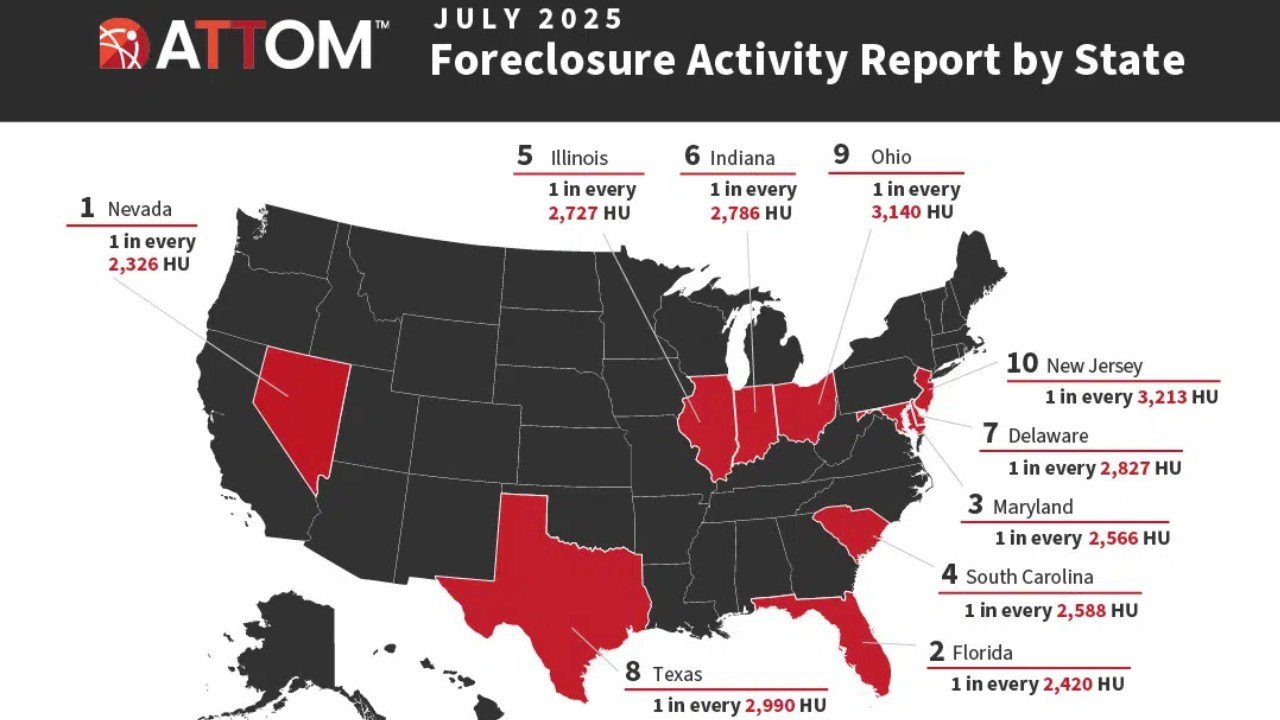

"The rise in foreclosure rates across the United States, particularly in states like Nevada and Florida, is a concerning trend driven by economic challenges, including the impact of the tourism industry and stagnant wages. While some areas have seen a slight decrease in foreclosure completions, the overall numbers are still on the rise, according to a new report by ATTOM."

"Foreclosure rates in the U.S. are increasing, with July experiencing a 13% rise in properties facing foreclosure compared to the previous year. Nevada and Florida are among the states with the highest foreclosure rates, linked to their reliance on the tourism industry, which has been adversely affected by economic slowdowns. Las Vegas, a key city in Nevada, has seen a surge in foreclosure rates, with a growing invent"

Foreclosure rates have increased across the United States, with a 13% year-over-year rise in properties entering foreclosure in July. States with heavy reliance on tourism, notably Nevada and Florida, show some of the highest foreclosure activity due to weakened tourism revenue and stagnant wages. Some areas saw slight declines in foreclosure completions, but overall counts of distressed properties continue to rise. Nevada exhibits mixed signals with rising sales and stable prices in certain markets even as Las Vegas reports accelerating foreclosures. Identifying root causes and local economic vulnerabilities remains essential for effective policy responses and homeowner risk mitigation.

Read at SFGATE

Unable to calculate read time

Collection

[

|

...

]