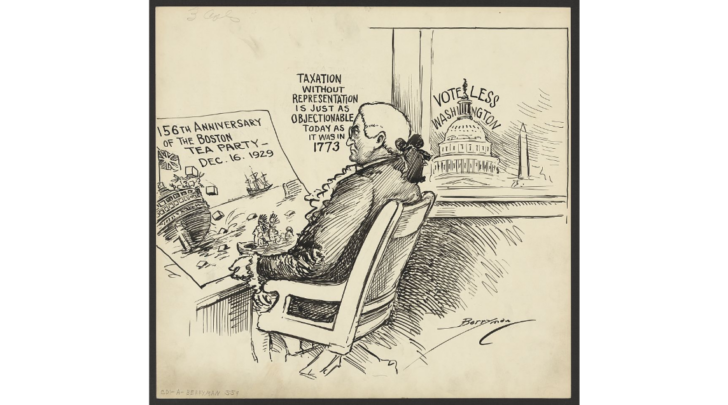

"The Boston Tea Party wasn't sparked by increased taxes, but rather by a decrease that threatened the livelihood of smugglers circumventing high British tea taxes."

"In 1862, President Lincoln signed the first federal income tax law, creating the Bureau of Internal Revenue, generating $1.1 billion for the Union."

"After the war, the emergency tax was eliminated in 1872, reverting the government to a system where nearly 90% of revenue came from sin taxes."

"The tax burden during the Gilded Age fell primarily on the poor through regressive excise taxes, highlighting the inequality in tax practices."

The American tax system has evolved significantly since its inception, marked by historical events like the Boston Tea Party and the Civil War. Early taxes were mainly excise taxes and tariffs until the first federal income tax was established in 1862 to fund the Civil War. Following the war, this tax was abolished, leading to a reliance on regressive 'sin taxes'. The Gilded Age revealed disparities in tax burdens, primarily affecting the poor, which foreshadowed ongoing complexities in taxation and wealth inequality in America.

Read at 99% Invisible

Unable to calculate read time

Collection

[

|

...

]