"If the Federal Reserve starts cutting rates in 2026, a specific category of stocks could see their valuations expand like a compressed spring finally released. Lower borrowing costs don't just make debt cheaper; they make future cash flows more valuable, dividend yields more attractive relative to bonds, and growth stories more credible. Here's how two rate-sensitive stocks might respond based on their financial structures and what analysts expect to see if rates drop this year."

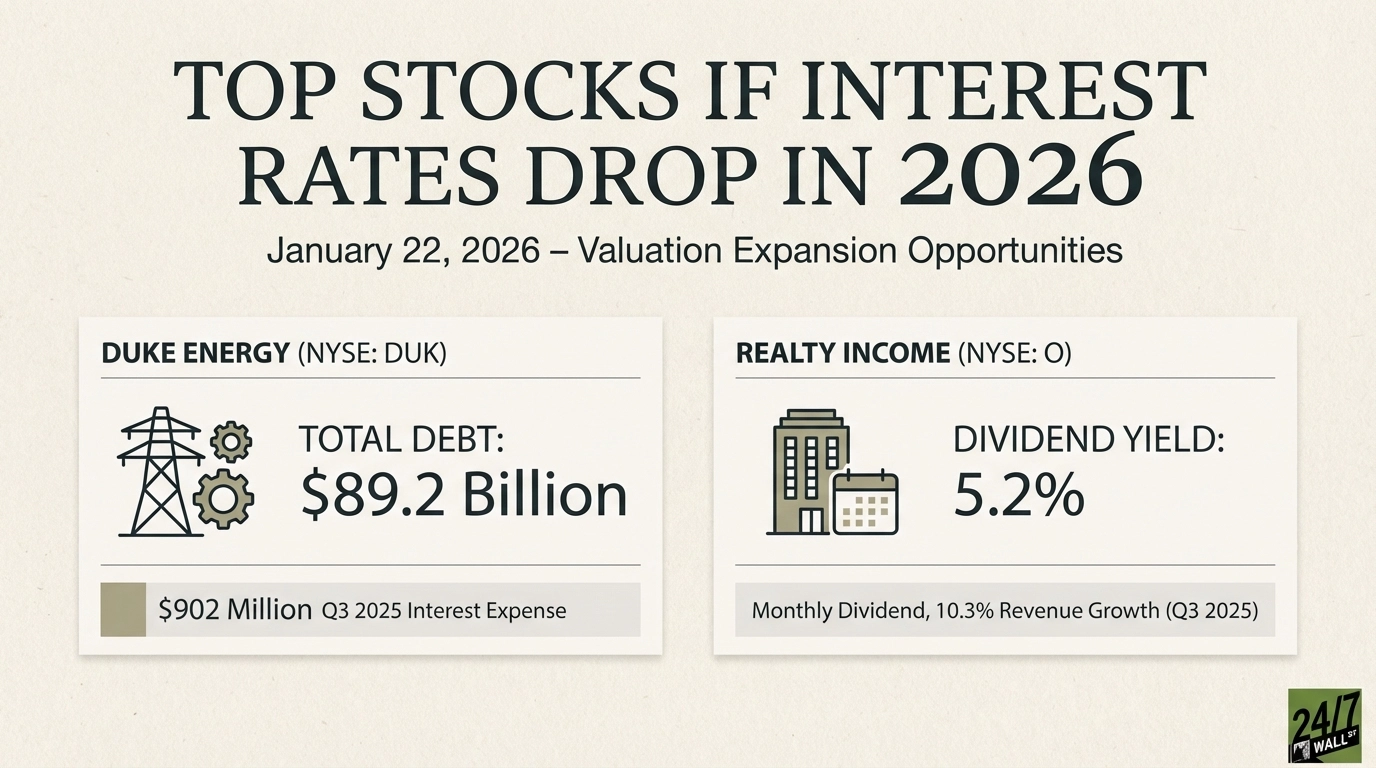

"Duke Energy (NYSE:DUK) carries $89.2 billion in total debt against just $688 million in cash. That's not a typo. The company's interest expense hit $902 million in Q3 2025 alone. When you're servicing nearly $1 billion in interest payments every quarter, even a 50 basis point rate cut translates to tens of millions in savings annually as debt rolls over. The company generated $15.95 billion in EBITDA over the trailing twelve months with a 27% operating margin."

"The Federal Reserve will announce its next interest rate decision tomorrow, January 28th. The overwhelming consensus is that rates will remain unchanged. That is likely to be the case at the Federal Reserve's next meeting in March as well. Predicting markets currently place 84% odds that the Federal Reserve will leave rates unchanged in its March 16th meeting. However, Federal Reserve Chair Jerome Powell's term ends on May 15th, 2026. It's expected that his replacement will be far more dovish and support rate cuts."

Markets expect rates to remain unchanged through January and likely March 2026, with 84% odds priced for no March move. Jerome Powell's term ends May 15, 2026, and his expected replacement is anticipated to be more dovish, increasing the likelihood of cuts later in the year. Heavily indebted utilities stand to benefit from lower refinancing costs. Duke Energy carries $89.2 billion of debt against $688 million cash and reported $902 million of interest expense in Q3 2025, so modest rate cuts could yield tens of millions in annual savings as debt rolls over. Duke generated $15.95 billion in trailing EBITDA with a 27% operating margin and serves 7.7 million customers across six states under a regulated model, producing a 3.51% dividend yield slightly below current 10-year Treasury rates.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]