"The original premise of diversity initiatives grew out of mid-20th century civil rights legislation and affirmative action policy. At its core, the idea was straightforward: widen the aperture to access the largest possible talent pool and incorporate broader perspectives into consequential decisions. In theory, bringing together individuals with different lived experiences and viewpoints should strengthen oversight of strategy, growth, risk management, and market positioning."

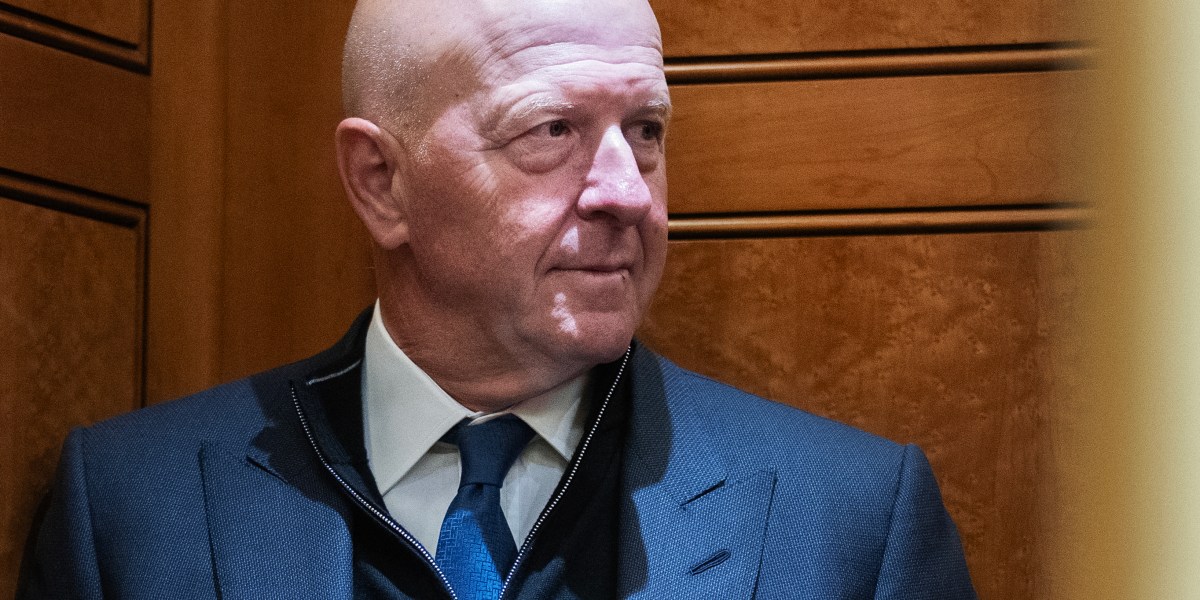

"The board of Goldman Sachs recently updated its governance policy, removing formal DEI criteria from director selection. Other major banks, including JPMorgan Chase, Wells Fargo, and Morgan Stanley, have made similar adjustments. The headlines frame this as a retreat from diversity. A more important question is whether it creates space for a broader and more practical conversation about what kind of diversity boards actually need."

Goldman Sachs and several other major banks removed formal DEI criteria from director selection, prompting reevaluation of boardroom diversity priorities. The original aim of diversity initiatives was to widen the talent pool and bring varied perspectives into consequential decisions to improve strategy, growth, risk management, and market positioning. The core objective of including diverse experiences remains sound, but many boards retain similar educational, career, age, and socioeconomic profiles, creating shared blind spots and governance risk. Approximately 70% of American workers are frontline or essential workers while boards remain dominated by former executives and financial professionals, underrepresenting frontline and blue-collar perspectives.

Read at Fortune

Unable to calculate read time

Collection

[

|

...

]