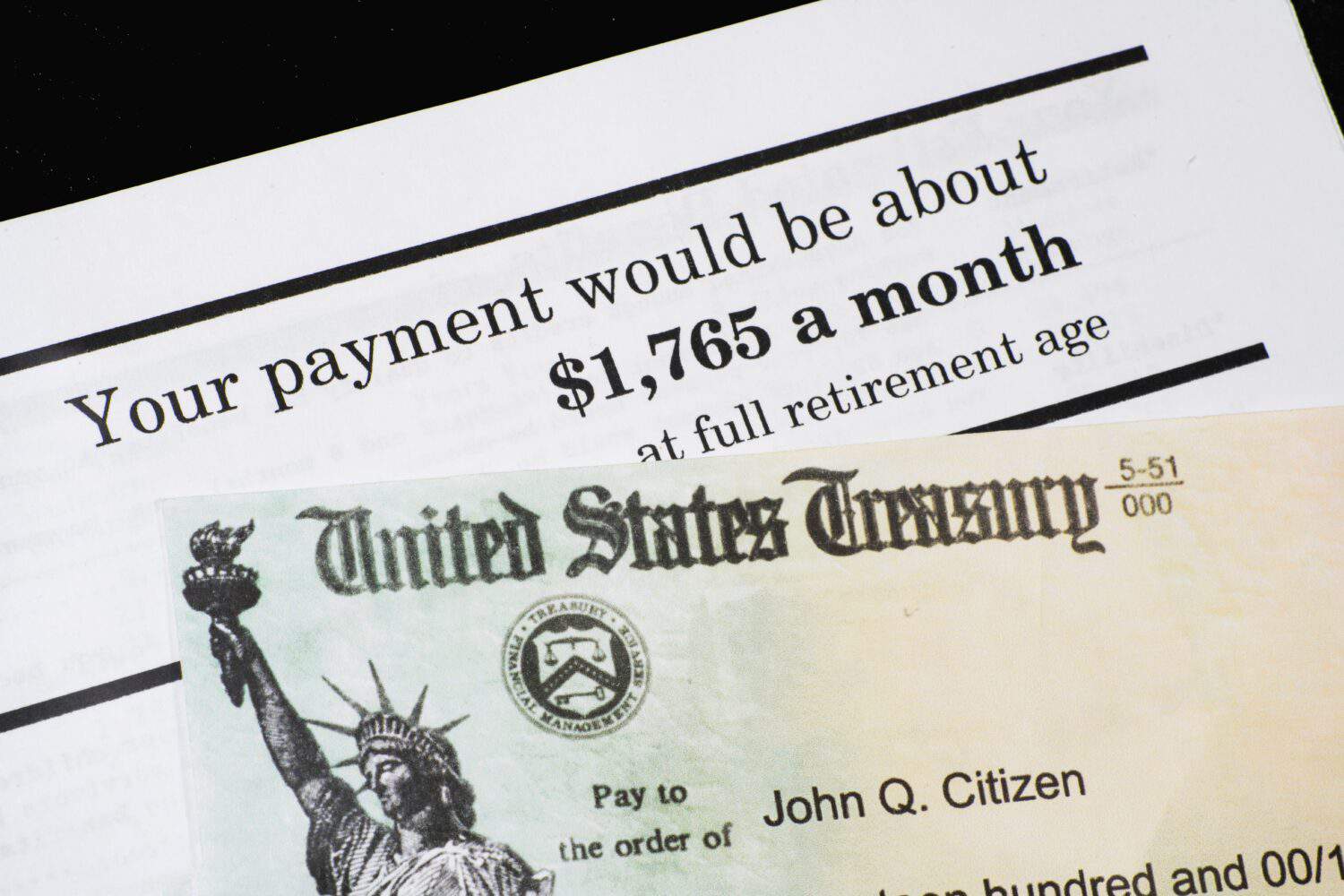

"Some big changes are coming to Social Security in 2026 that you need to know about if you are nearing retirement. One of those key changes has to do with the full retirement age for Social Security. Understanding how FRA is changing can shape when you should claim benefits and can affect the income that you will receive for the rest of your life. Here's what you need to know about the change and how it can impact you."

"Full retirement age is the age when you are entitled to your standard Social Security benefit if you request that the Social Security Administration start your checks at that time. You must claim your benefits exactly at your full retirement age if you want your standard benefit. If you claim even a single month before, then the benefit is reduced. If you wait even a single month beyond your FRA, then your benefit starts increasing."

Full retirement age (FRA) determines the standard Social Security benefit when benefits are claimed at that exact age. Claiming even one month before FRA reduces benefits, while waiting past FRA increases benefits. FRA has been gradually rising since 1980s reforms that shifted the entitlement age later to address Social Security finances. The increase continues in 2026 and represents the final scheduled shift later. For people who turned 66 in 2025, FRA was 66 and 10 months. Understanding the changing FRA is essential for timing benefit claims and lifetime retirement income.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]