""Because I chose not to sell Fannie Mae and Freddie Mac in my first term, a truly great decision and against the advice of the "experts," it is now worth many times that amount-an absolute fortune-and has $200 billion in cash. Because of this, I am instructing my representatives to buy $200 billion in mortgage bonds. This will drive mortgage rates down, monthly payments down, and make the cost of owning a home more affordable.""

"Conversely, during quantitative tightening since 2022, the Fed has been letting MBS assets roll off its balance sheet without replacing them-effectively removing a major MBS buyer from the market-which can put additional upward pressure on 30-year fixed mortgage rates. Effectively, Trump is proposing to use Fannie Mae and Freddie Mac-both in government conservatorship-to absorb a larger share of mortgage bonds, increasing relative market demand for MBS. That could put some short-term upward pressure on MBS prices and"

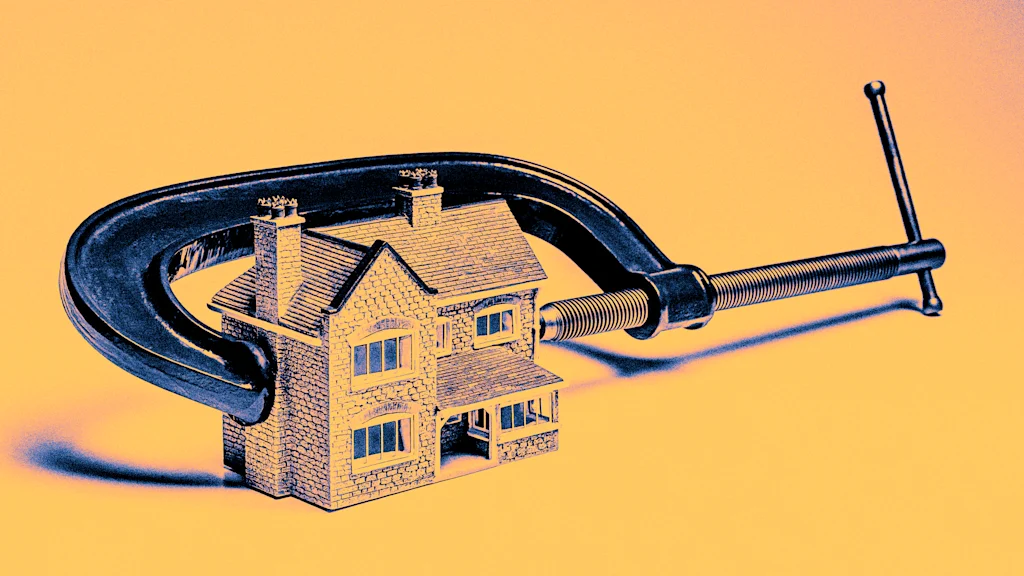

President Donald Trump announced that Fannie Mae and Freddie Mac will buy an additional $200 billion in mortgage bonds using $200 billion in cash on their balance sheets. The purchases aim to increase demand for mortgage-backed securities (MBS), which would raise MBS prices and lower long-term yields, including 30-year mortgage rates, thereby reducing monthly payments and housing costs. Long-term yields move inversely to bond prices, and past Federal Reserve quantitative easing lowered mortgage rates by buying Treasuries and MBS. Quantitative tightening has removed a major MBS buyer since 2022, putting upward pressure on rates.

#fannie-mae--freddie-mac #mortgage-backed-securities-mbs #mortgage-rates #federal-reserve-policy #quantitative-tightening

Read at Fast Company

Unable to calculate read time

Collection

[

|

...

]