fromEntrepreneur

1 day agoMortgage Rates Hit Their Lowest Level Since 2022. Here's What That Means for Home Buyers and Sellers.

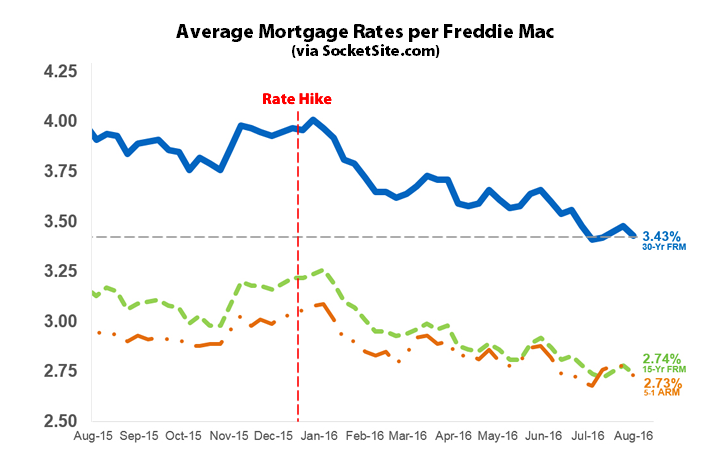

The average 30-year fixed mortgage rate is around 5.98% to 5.99% this week, Freddie Mac said Thursday. The percentage is down sharply from 6.8% to 6.9% a year ago and from peaks near 8% in late 2023, per The Wall Street Journal. On a typical loan, that rate drop can cut monthly payments by hundreds of dollars for home buyers.

Real estate