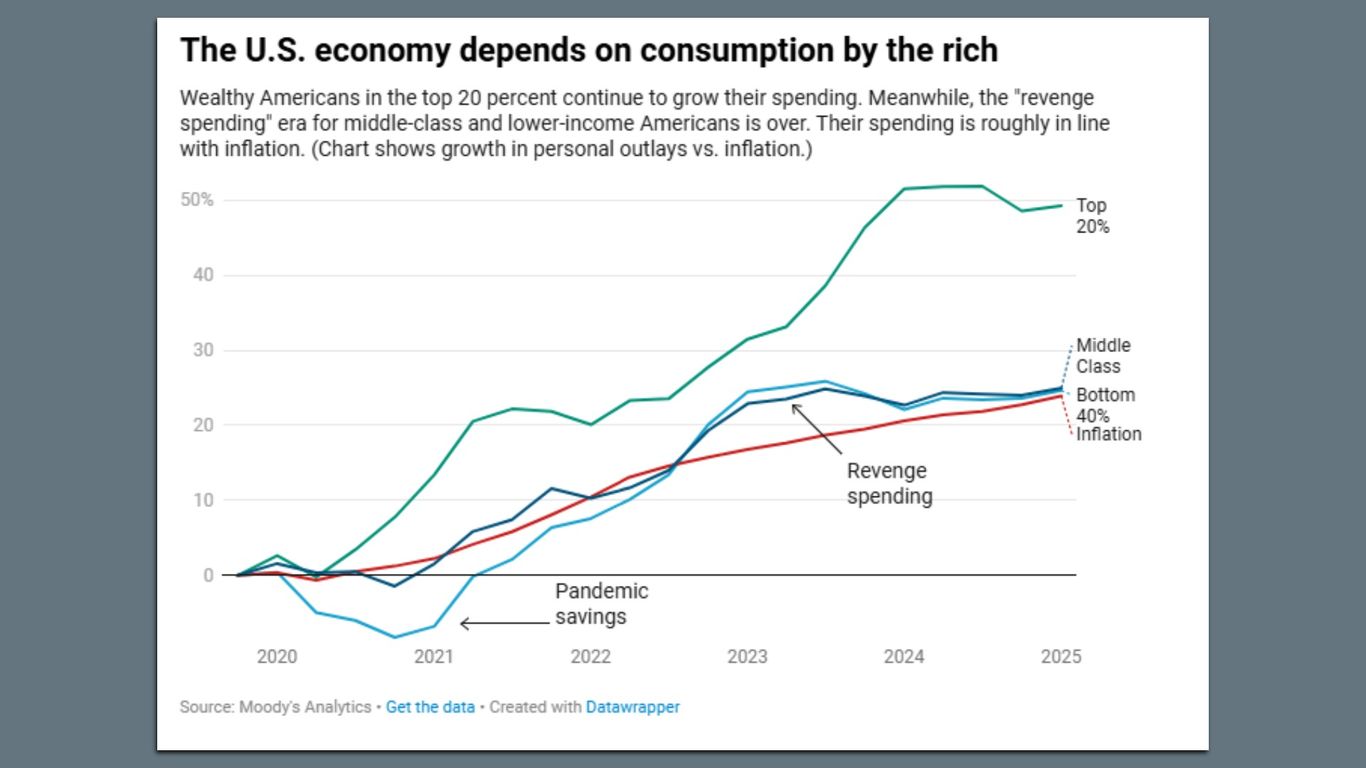

"The top 20% of earners now make up over half of consumer spending, while spending from middle and lower income consumers has flatlined, aligning with inflation."

"Consumer spending constitutes two-thirds of GDP, indicating the significant role it plays in determining economic growth or decline."

"Lower-income households face struggles, impacting companies that service these segments as they lack pricing power, leading to corporate challenges."

"Americans with less money are not benefiting from the wealth effect, which means affluent consumers drive consumption despite potential economic vulnerabilities."

The top 20% of earners account for over half of consumer spending, while spending from middle and lower income households has stagnated. This pattern aligns with inflation, emphasizing the crucial role of consumer expenditure in GDP. Consequently, the affluent seem to sustain consumption levels, masking underlying economic weakness. Lower-income families are struggling, affecting businesses that cater to them. Meanwhile, the wealth effect benefits the rich, but poses risks to spending if stock prices drop. Overall, a small subset of wealthy individuals and large corporations keeps the economy afloat amid challenges for the majority.

Read at Axios

Unable to calculate read time

Collection

[

|

...

]