from24/7 Wall St.

1 day agoInvestors Hated CoreWeave's Earnings. It Might Be Even Worse Than They Realize

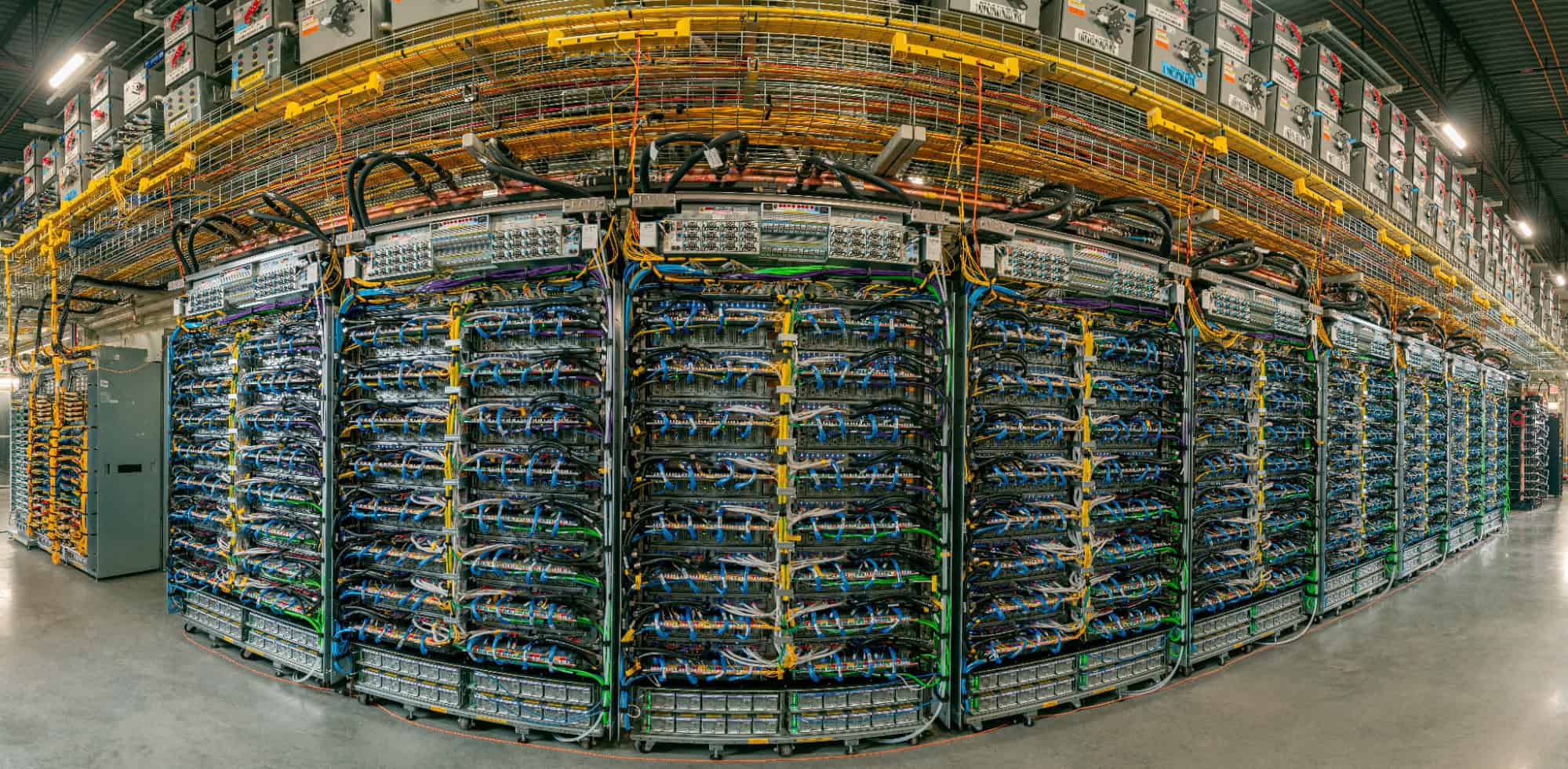

CoreWeave reported quarterly revenue of $1.57 billion, slightly beating estimates, but posted an adjusted loss per share of $0.56, far exceeding the anticipated $0.49 per share deficit. Full-year 2025 revenue hit $5.1 billion, up 168% year-over-year, yet the emphasis on ramping up spending to fuel AI infrastructure growth sparked fears of overspending in a competitive landscape.

Artificial intelligence