Business

from24/7 Wall St.

6 days agoFinancial Stocks Are Way Oversold: 5 Strong Buy High-Yield Dividend Ideas

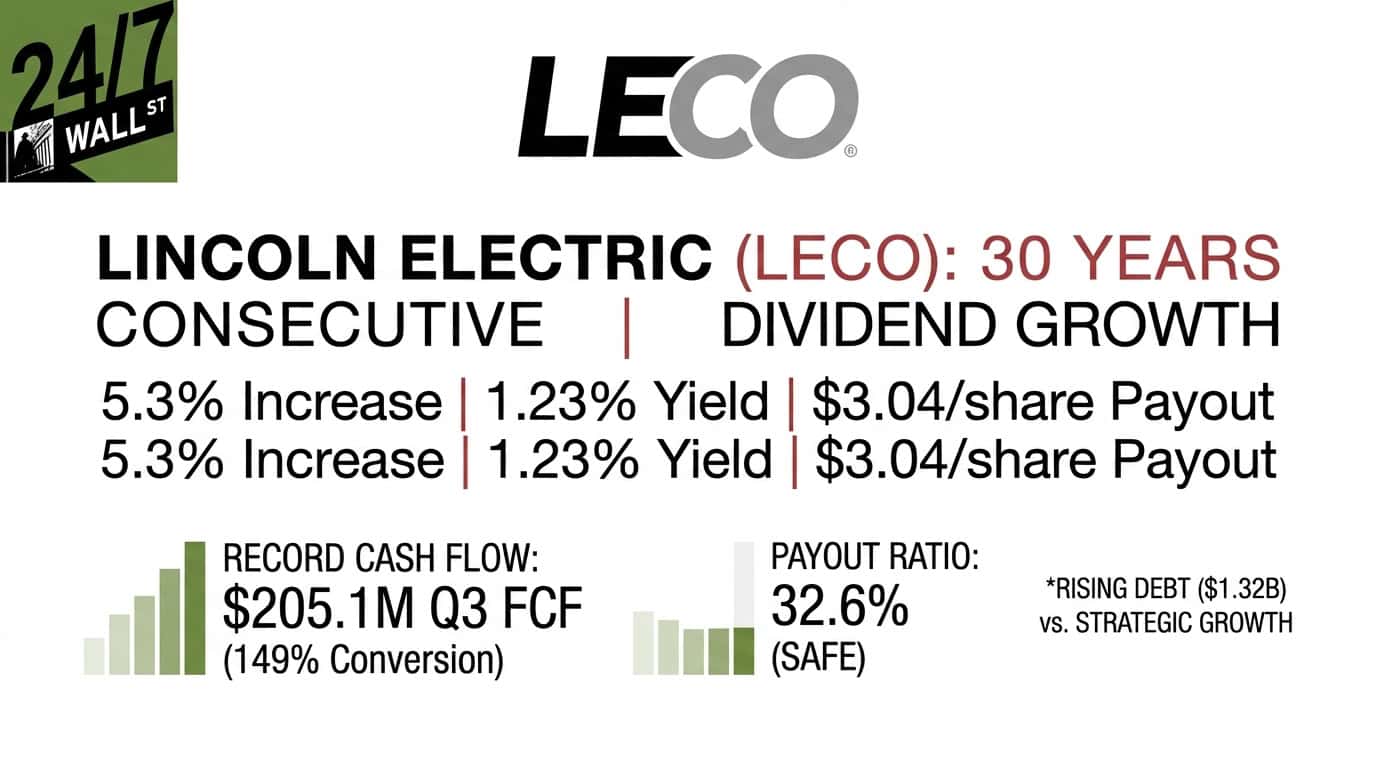

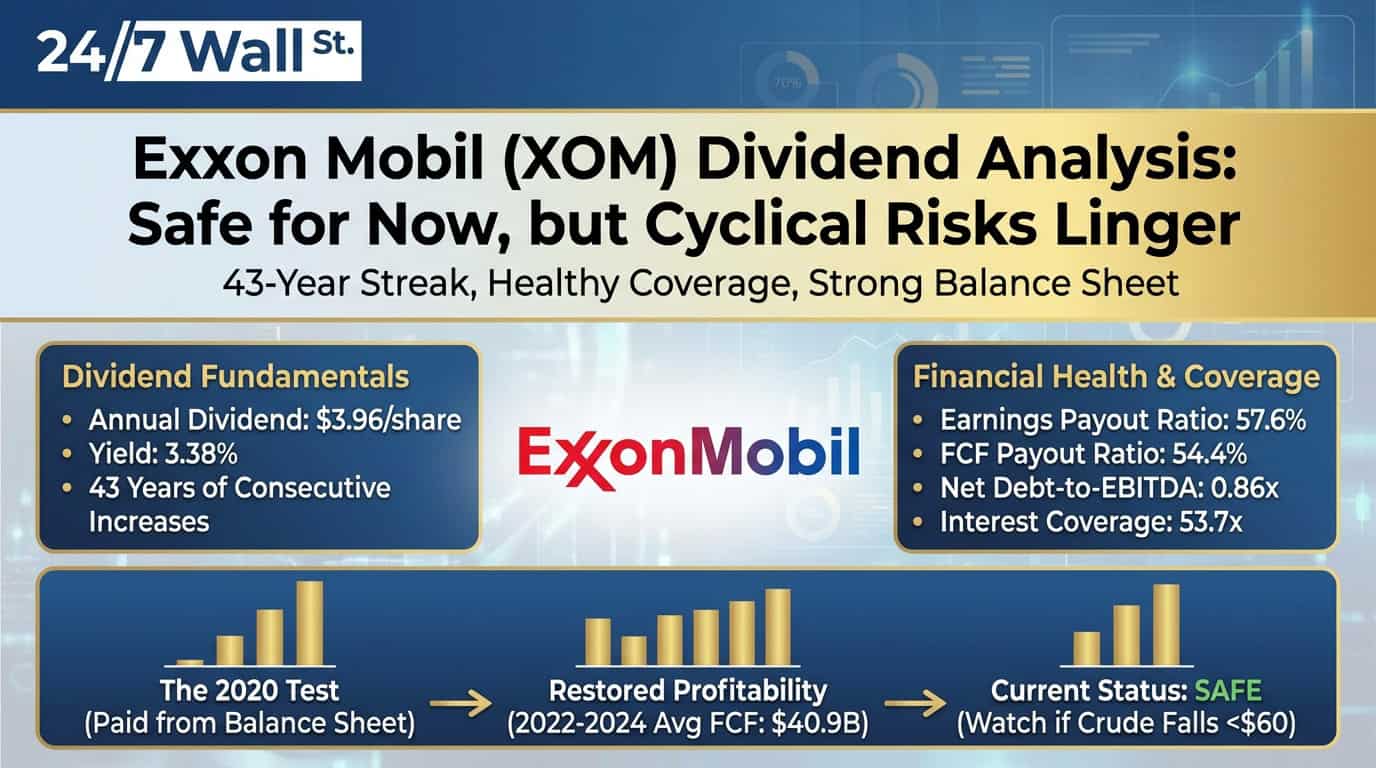

Financial stocks are deeply oversold, trading below historical valuations despite solid balance sheets and capital ratios, creating potential buying opportunities for dividend-focused investors.