Business

from24/7 Wall St.

13 hours agoRetirees Chasing Income Are Overlooking This 4.49% Emerging Market Fund That's Crushing the S&P 500

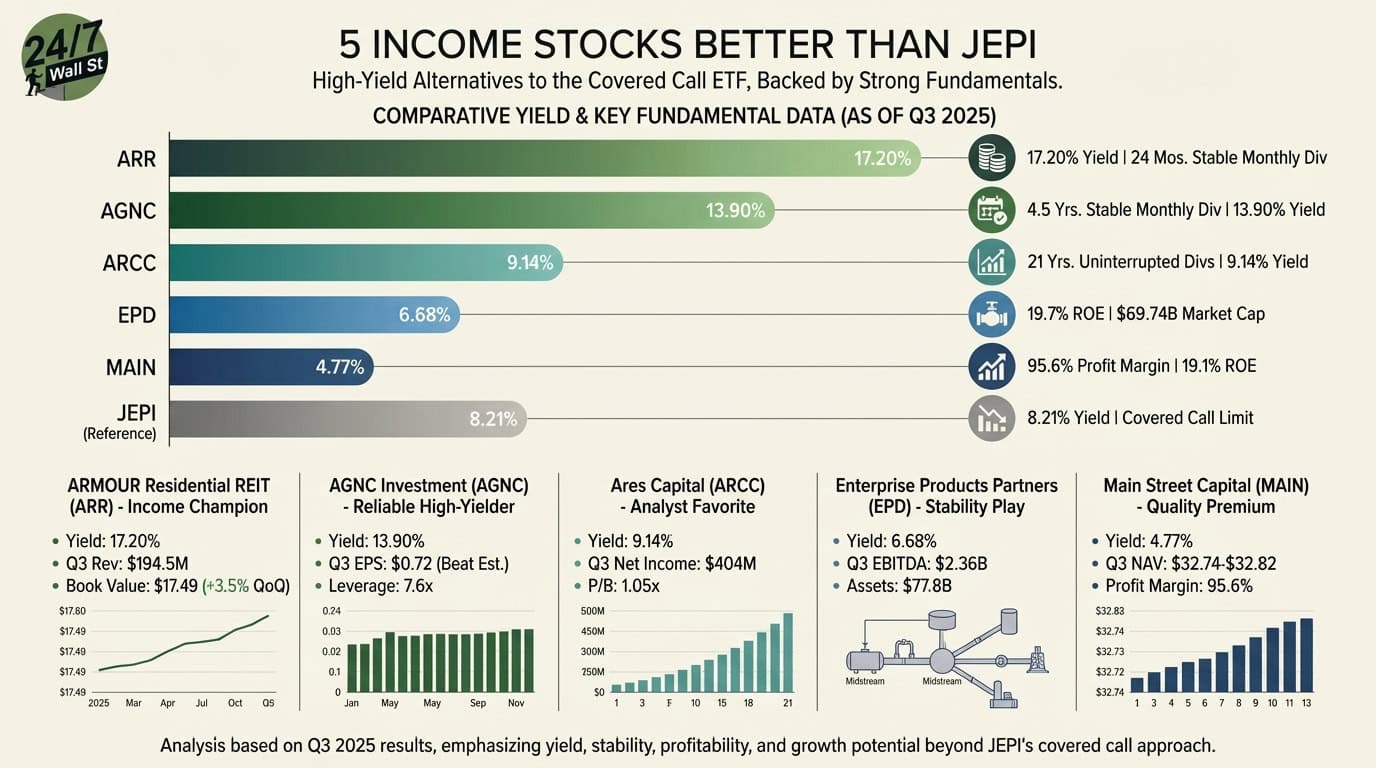

DEM yields 4.49% from emerging market dividends but carries currency, geopolitical, and income variability risks that offset the higher yield advantage over VYM.