from24/7 Wall St.

9 hours agoPassive Income Investors: 3 Actively-Managed ETFs to Provide Sleep-At-Night Gains Long-Term

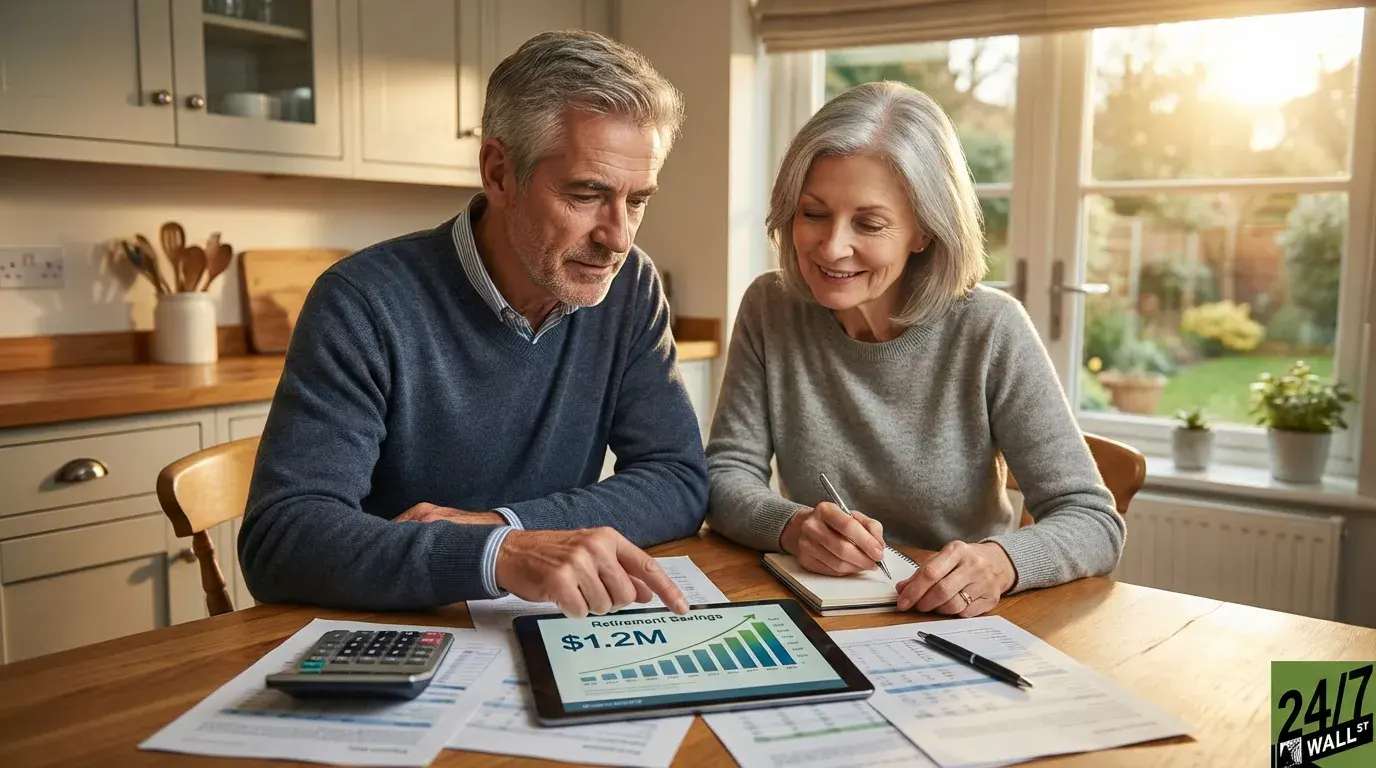

Time in the market beats timing the market every single day of the week. Decades of data prove staying invested through thick and thin lets compounding do its magic, turning modest gains into serious wealth. For long-term investors craving those sleep-at-night returns, actively managed ETFs can be a great solution.

Miscellaneous