#us-housing-market

#us-housing-market

[ follow ]

fromBoston Condos For Sale Ford Realty

3 weeks agoUS Housing Market The Year Of Normalization 2025 Boston Condos For Sale Ford Realty

The year 2025 is widely considered by real estate experts to be a year of normalization for the U.S. housing market, moving away from the extremes of the pandemic era. This shift is characterized by a more balanced market with increased inventory and a slower pace of price growth, though it is not expected to be a dramatic price correction or a buyer's market nationally.

Real estate

fromFast Company

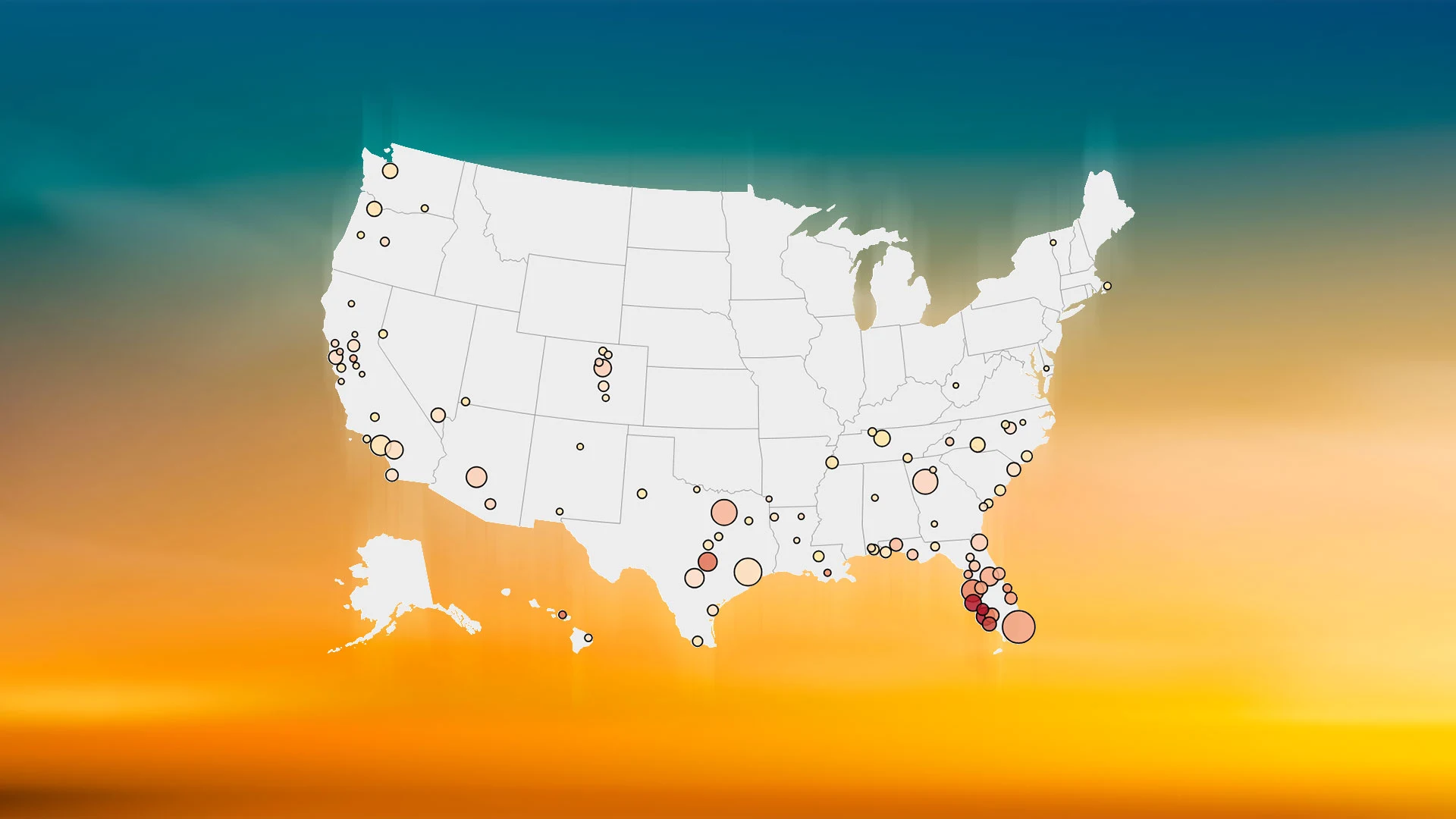

1 month agoHome prices are falling in these 105 major housing markets

Want more housing market stories from Lance Lambert's ResiClub in your inbox? Subscribe to the ResiClub newsletter. National home prices rose +0.1% year-over-year between October 2024 and October 2025, according to the Zillow Home Value Index reading published last week-a decelerated rate from the +2.4% year-over-year rate between October 2023 and October 2024. In the first half of 2025, the number of major metro area housing markets seeing year-over-year declines climbed. That count has since stopped ticking up.

Real estate

fromBoston Condos For Sale Ford Realty

2 months agoHome Prices Rose In 77% Of Metro Areas In Q3 Boston Condos For Sale Ford Realty

Home prices rose in 77% of metro areas in Q3 Furthermore, 4% of metro areas saw double-digit quarterly price gains, although that was down from 5% in the second quarter. Nationwide, the median price for a single-family home increased 1.7% year over year to $426,800. Prices increased by the same annual rate during the second quarter.

Real estate

fromwww.housingwire.com

3 months agoHome price growth drops to lowest level in two years

U.S. home values have essentially stagnated after inflation, marking the third straight month of real housing wealth decline for homeowners. This reversal is striking: during the pandemic boom, home prices were climbing far faster than inflation, rapidly boosting homeowners' real equity. Now, the situation has flipped over the last year, owning a home yielded a modest nominal gain, but an inflation-adjusted loss.

Real estate

fromFortune

4 months agoHome sales are headed for their worst year since 1995 as 'economic jitters' spread from buyers to sellers, Redfin says | Fortune

The housing market is stuck in an unending circle of gridlock: Buyers aren't inclined to purchase a home because mortgage rates and home prices are too high (they're up 1.7% year over year at $440,004, according to Redfin). And homeowners don't want to sell their homes to trade for a higher mortgage rate and out of fear they won't get what they think their home is worth.

Real estate

fromSFGATE

4 months agoUS Housing Market in Challenging Summer-5 Key Takeaways

As Labor Day approaches, the U.S. housing market has faced a challenging summer, with frustrated expectations for buyers, sellers, and builders. The market is deadlocked, with increasing inventory, low sales, and hesitant movements from all parties involved. Despite some silver linings on the horizon, the housing market remains in a state of stagnation, according to the July housing market trends report from Realtor.com®.

Real estate

fromSFGATE

7 months agoThe Most Popular Home Styles Across the U.S. That Command Top Dollar Right Now

Just like their individual barbecue preferences, architectural tastes among Americans vary dramatically across regions. Some areas favor ranch-style homes, while others lean toward charming English-inspired abodes or stately Colonial dwellings.

Boston real estate

[ Load more ]