"Beijing insists Washington is responsible for the 'serious shocks and violent turbulence' that has hit global stock markets hard, wiping out trillions."

"The US's imposition of abnormally high tariffs on China violates international trade rules and is completely a unilateral bullying and coercion."

"President Trump has announced a 90 day pause on additional tariffs, but for China he raised this even further to 145%."

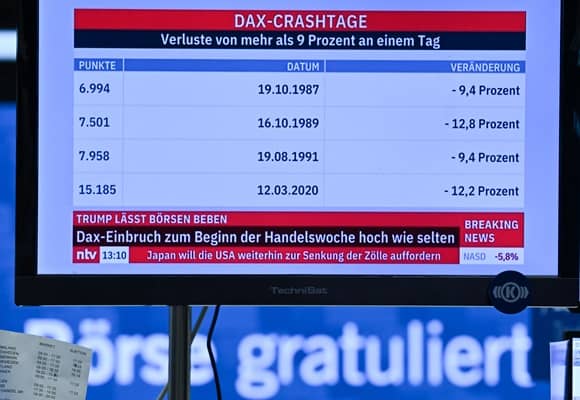

"European stock markets have gone red over China's tariffs countermeasures, with significant drops in indices such as the FTSE 100 and Germany's Dax 40."

China plans to raise tariffs on U.S. goods to 125% from 84%, amidst escalating trade tensions. The Chinese Finance Ministry criticized the U.S. for imposing high tariffs, labeling it as unilateral bullying that violates international trade norms. Despite President Trump's attempt to pause new tariffs for 90 days, China's retaliation sees tariffs increasing to 145%. The conflict has also impacted global markets, with European stocks experiencing declines, while the Shanghai index showed a slight rise amid the turmoil.

Read at London Business News | Londonlovesbusiness.com

Unable to calculate read time

Collection

[

|

...

]