#property-taxes

#property-taxes

[ follow ]

#housing-market #homeownership #salt-deduction #tax-reform #homeowners #housing-affordability #tax-relief

fromwww.foxnews.com

1 week agoFormer NYPD chief calls police cuts 'recipe for disaster' as Mamdani threatens tax hikes

Former New York City Police Department (NYPD) Chief John Chell blasted New York City Mayor Zohran Mamdani for walking back the planned hiring of 5,000 more police officers amid a city budget shortfall of billions of dollars, calling it a "recipe for disaster." Mamdani's predecessor, Mayor Eric Adams, proposed at the end of his term that the city hire 5,000 more NYPD officers. Upon entering office, Mamdani moved to cancel all orders signed by Adams after his Sept. 26, 2024, indictment,

US politics

fromReason.com

1 week agoMamdani to increase NYC property taxes by 9.5 percent to balance budget if income taxes are not raised

New York City is already one of the most expensive places to live in the United States, but residents should brace themselves to pay even more for housing if the city's budget deficit persists. To further reduce the deficit, Mamdani wants more state tax revenue to go to the city. At a late January ." The irony here, press conference , Mamdani how "New Yorkers contribute 54.5 percent of state revenue and receive only 40.5 percent back ,

New York City

fromThe Mercury News

1 month agoLetters: Cash-strapped seniors deserve property tax break

It's very nice for Larry Stone if he's paying only $3,000 a year in property taxes on a $3.8 million home. I'm guessing he has a very nice pension, too. However, property taxes are a significant burden on other seniors like me, who pay more than five times as much on a much cheaper house, and with a limited fixed income. In fact, my Social Security income isn't even sufficient to cover my property taxes.

California

fromThe Mercury News

1 month agoLetters: Critical column sells Rishi Kumar's tax plan short

Seniors main source of income is their Social Security. The five largest worries for seniors are housing, transportation, food, health care and taxes. Living in high-cost areas where school and infrastructure bonds are an open checkbook makes it impossible for seniors to keep their homes, let alone sell their homes in an unstable housing market. If families cannot afford housing, how can seniors with fixed incomes afford to thrive? They cannot.

US politics

California

fromwww.mercurynews.com

1 month agoTaves: Failed Silicon Valley politician plans to inject California's Prop. 13 with steroids

Rishi Kumar falsely promised tax exemptions for seniors despite assessors lacking authority and now pursues a statewide initiative that would hugely favor property‑owning seniors.

fromwww.housingwire.com

1 month agoOhio lawmakers push for senior foreclosure protection

I am not aware of any other states that have this kind of legislation, and this puts Ohio at the top for safeguarding our senior homeowners from foreclosures. While foreclosure on seniors is extremely rare, concerns raised by Ohioans illustrate the need for a clear standard, bill proponents added. House Bill 443 ensures seniors who meet the qualifications will not lose their homes due to tax foreclosure, while still preserving all existing tax collection and treasurer processes.

Real estate

fromRedfin | Real Estate Tips for Home Buying, Selling & More

3 months agoWhat Are Non-Disclosure States in Real Estate?

Non-disclosure states limit public access to real estate sales data. Home prices in these states are not publicly recorded, meaning buyers, sellers, and appraisers must rely on private data sources. The policy protects privacy, influences property taxes , and reflects state-level traditions and policy preferences. Home value estimates are still available through real estate professionals and platforms like Redfin, which use verified data sources.

Real estate

fromwww.theguardian.com

3 months agoHave Reeves and Starmer missed the chance to ditch stealth taxes? | Phillip Inman

Stamp duty is a way to siphon off some of the gains when a property transaction goes through. Capital gains tax allows the state to take a slice of wealth after a sale. Never mind that both taxes deter people from buying and selling. It allows everyone to avoid the clearer, fairer annual tax on wealth that many economists support.

UK politics

Real estate

fromLondon Business News | Londonlovesbusiness.com

4 months agoMore than dirt: Understanding your options for inherited land - London Business News | Londonlovesbusiness.com

Inherited land carries emotional ties but often imposes recurring financial, legal, and maintenance burdens requiring a clear decision to sell, develop, or retain creatively.

fromSFGATE

4 months agoYou'll Struggle To Live Well in New Hampshire on Just Your Social Security, Even If Your Mortgage Is Paid Off

The analysis underscores that "housing costs are what really separate the states where Social Security is enough from those where it falls short". New Hampshire retirees spend nearly $1,000 per month on housing-related expenses-more than double the costs in surplus states such as Alabama ($419) or West Virginia ($398). At 43% of the typical Social Security check, New Hampshire's housing burden far exceeds the 30% affordability guideline established by the Department of Housing and Urban Development. This imbalance leaves retirees unable to cover other basic needs without additional income.

Real estate

fromAustin Monitor

5 months agoTravis County signs off on Central Health's new budget - with a tax rate increase - Austin Monitor

Around 5% of a Travis County homeowner's property tax bill goes to Central Health. Those taxes must support health care for low-income and indigent residents. Central Health's new annual tax rate is 11.8 cents per $100 of valuation - an effective increase of more than 9% from last year. That means the average homeowner will pay around $64 more to Central Health on their next bill.

Public health

fromRedfin | Real Estate Tips for Home Buying, Selling & More

6 months agoWhy Does My Mortgage Keep Going Up?

Once you buy a home, you expect your mortgage payment to stay steady, especially if you have a fixed-rate loan. But for many homeowners, the amount due each month can creep up over time, leaving you asking: "Why did my mortgage payment go up?" Whether you're paying off a home in Denver, CO or managing your home in Orlando, FL , this Redfin article explains the most common reasons mortgage payments rise, plus steps you can take to lower them.

Real estate

fromSFGATE

6 months agoPalm Beach Homeowners Facing Rising Tax Bills: 5 Key Takeaways

In Palm Beach, FL, property owners are facing substantial tax bills, with some exceeding $1 million, as the taxable values continue to increase in this affluent enclave. Despite a cooling real estate market, taxable values are rising, albeit at a slower pace compared with previous years. Homeowners receive TRIM notices annually, providing a preview of their upcoming property tax bills and allowing them to understand the proposed tax rates and changes in assessed values.

Real estate

#home-renovation

Real estate

fromSFGATE

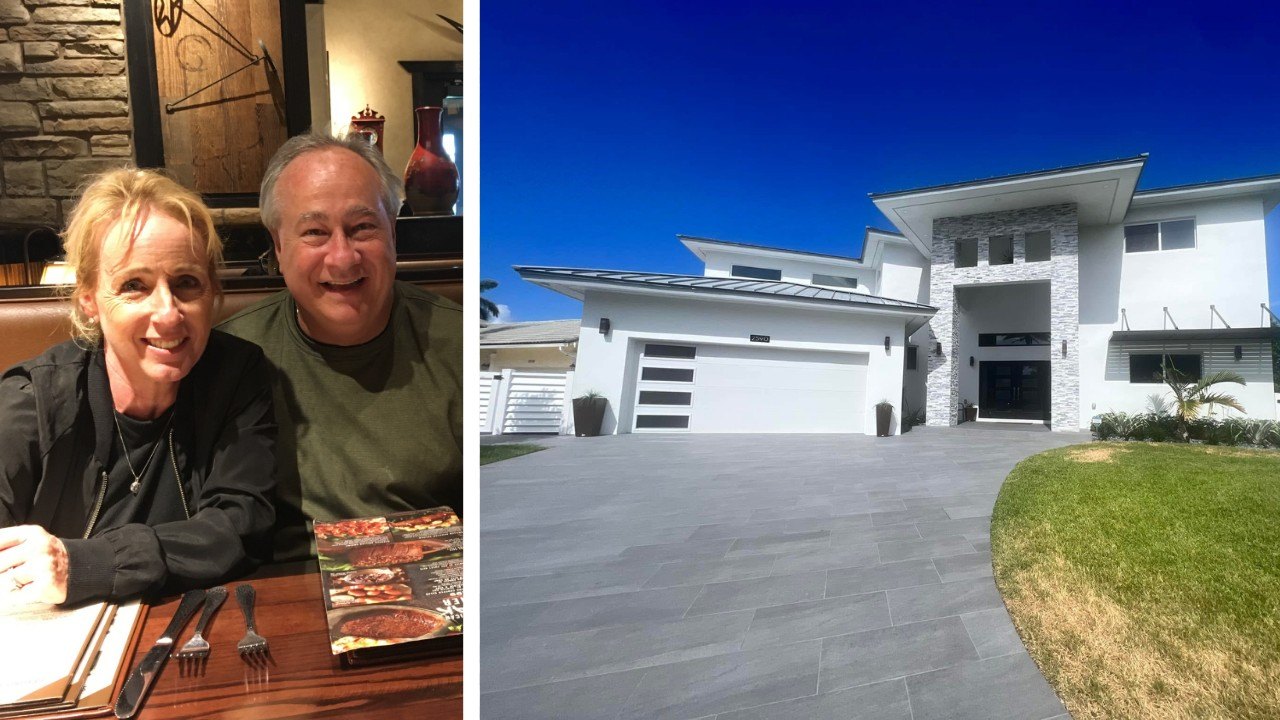

9 months ago'My Property Tax Went From $15K to a Life-Altering $91K a Year'

Rising property taxes challenge longtime homeowners, as renovations can trigger vast reassessments.

The Priebes' experience highlights the urgency for protective legislation against skyrocketing property taxes.

fromSFGATE

6 months agoThe Property Tax System Is Breaking-and Ohio Might Be Ground Zero

In Mahoning County, the tax delinquency rate has hit 18%, with more than $70 million in unpaid property taxes. Some neighborhoods in Youngstown are even seeing rates as high as 1 in 3 homeowners behind.

Real estate

fromSFGATE

7 months agoMiami Homeowners Will Benefit The Most From The New SALT Deduction Changes In Florida

"Residents of high-tax states suffered the most with the previous cap on state and local taxes, because their taxes far exceeded the cap, they were not able to deduct the full amount like residents in low-tax states."

Real estate

fromSFGATE

7 months agoHome Values Are Up-but Montana's New Tax System Is About To Be Put to the Test

Residents in Great Falls, MT expressed intense frustration over skyrocketing property tax bills due to assessed values reflecting soaring home prices, demanding explanations from local officials.

SF real estate

fromNew York Post

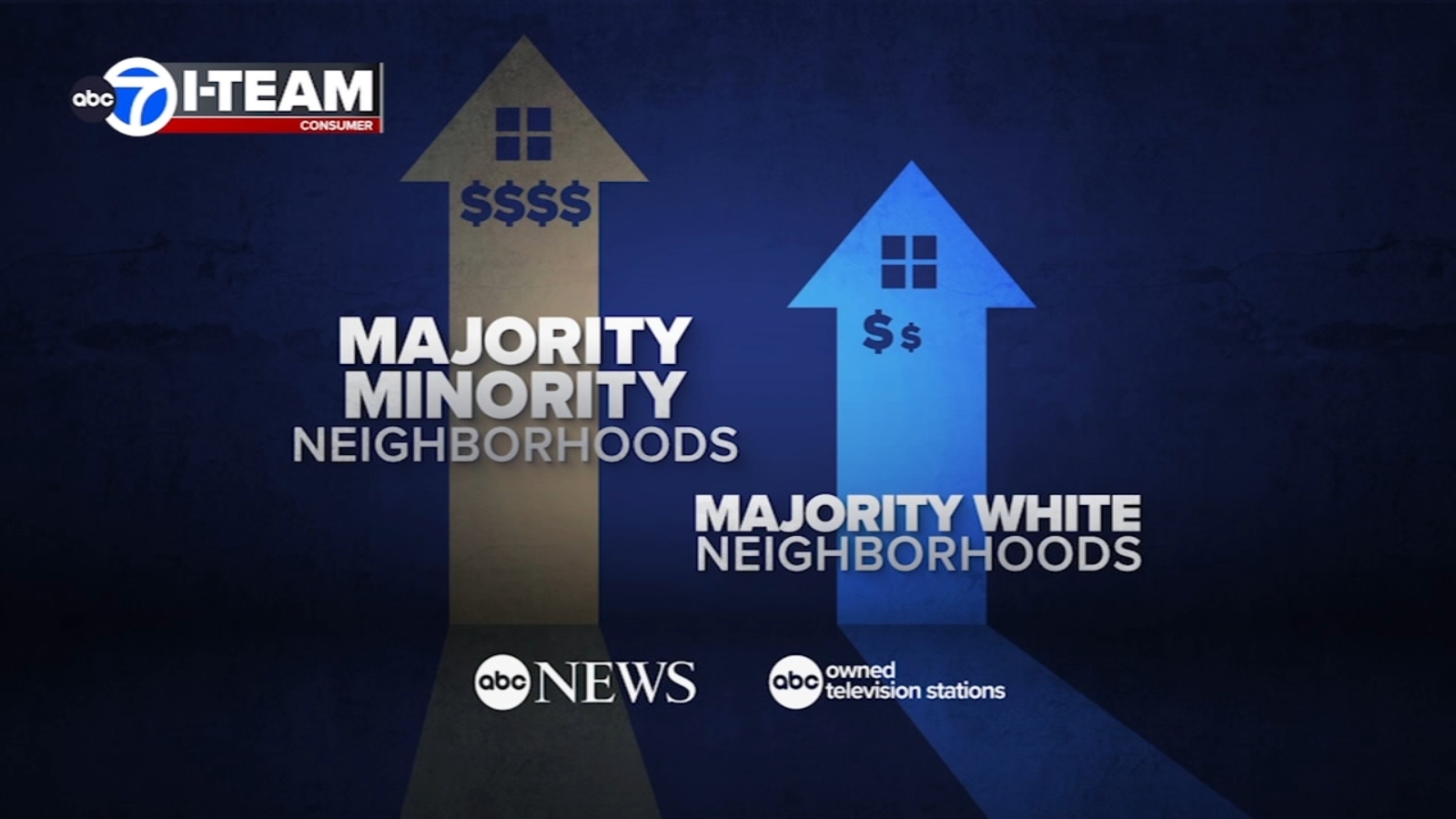

8 months agoZohran Mamdani doubles down on plan to target 'whiter neighborhoods' with higher taxes - and says billionaires shouldn't exist

Mamdani claimed that his soak-the-rich proposal was not driven by race, despite targeting white homeowners, emphasizing an assessment of under-taxed versus over-taxed neighborhoods.

NYC politics

fromSFGATE

9 months agoOhio Homeowner 'Hit the Floor' After Seeing Her Home Value Skyrocket-Now She's Fighting To Abolish Property Tax in the State

"When I got my property tax reevaluation last year, I opened the envelope up and hit the floor," says Beth Blackmarr, a resident of Lakewood and spokesperson of a group organizing to abolish property taxes in Ohio. "Panic."

SF politics

NYC politics

fromSFGATE

9 months agoIf You Live in One of These 16 High-Tax Counties, Here's How To Appeal Your Property Taxes

Property taxes are increasing nationally, impacting homeowners with rising bills and highlighting the complexity of the appeals process.

Nearly half of homeowners may be overpaying their property taxes, emphasizing the need for awareness and local knowledge when appealing.

[ Load more ]