""...the longer you stay and the more your home appreciates, the more likely the IRS will claim a cut when you finally sell.""

""This home equity tax has big consequences. It erodes family wealth right when people need it most.""

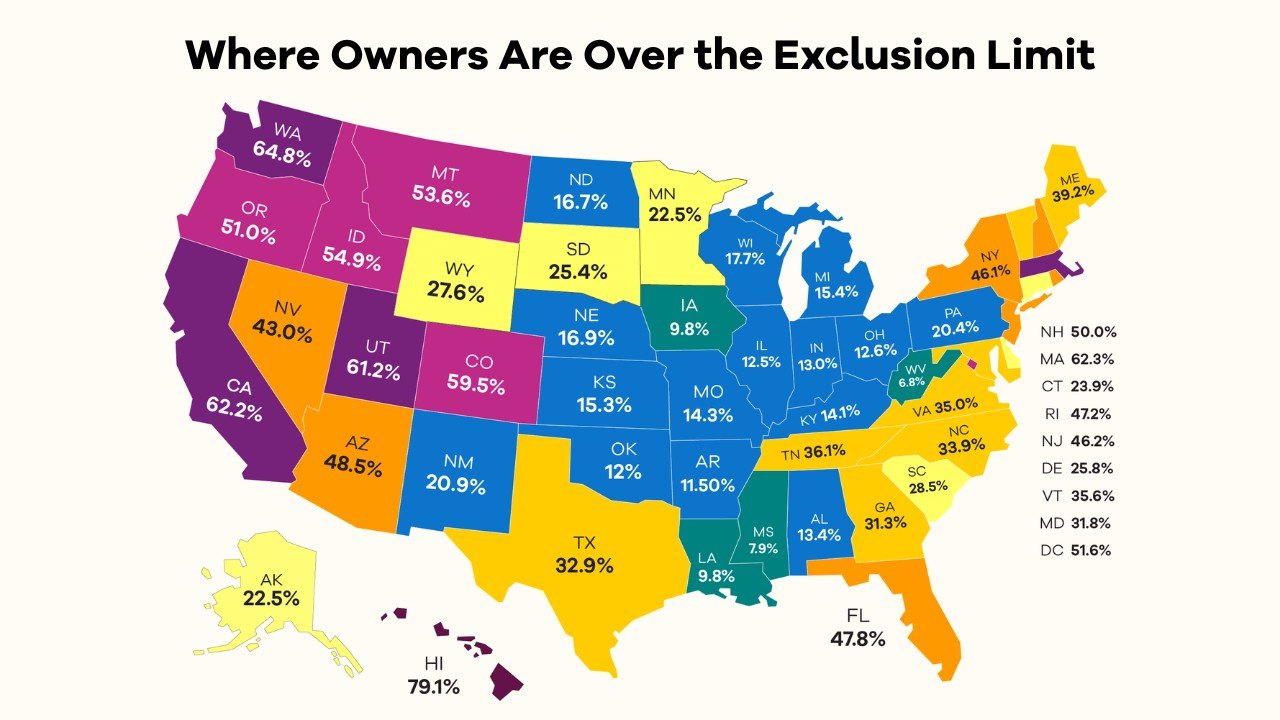

Many American homeowners are unknowingly facing a hidden tax burden related to capital gains tax on home equity. Approximately one-third of homeowners hold more equity than the current federal tax exclusion for home sales, a figure expected to rise to 56% by 2030. The outdated rule, unchanged since 1997, means homeowners could owe taxes on their home profit upon selling, impacting their wealth and discouraging downsizing, which exacerbates the housing supply shortage. This creates a significant barrier for families during financial transitions.

Read at SFGATE

Unable to calculate read time

Collection

[

|

...

]