#berkshire-hathaway

#berkshire-hathaway

[ follow ]

#warren-buffett #greg-abel #leadership-transition #value-investing #succession #portfolio-concentration

#warren-buffett

Business

fromFortune

1 day agoWarren Buffett once admitted that selling McDonald's shares was 'a very big mistake.' Today, they'd be worth over $10 billion | Fortune

Warren Buffett sold his McDonald's stake in 1998 for $1.4 billion, a decision he later acknowledged as a major mistake that cost Berkshire Hathaway approximately $8.9 billion in unrealized gains.

Business

fromBusiness Insider

1 day agoWarren Buffett's most iconic stock picks are up 10 to 50 times since he bought them

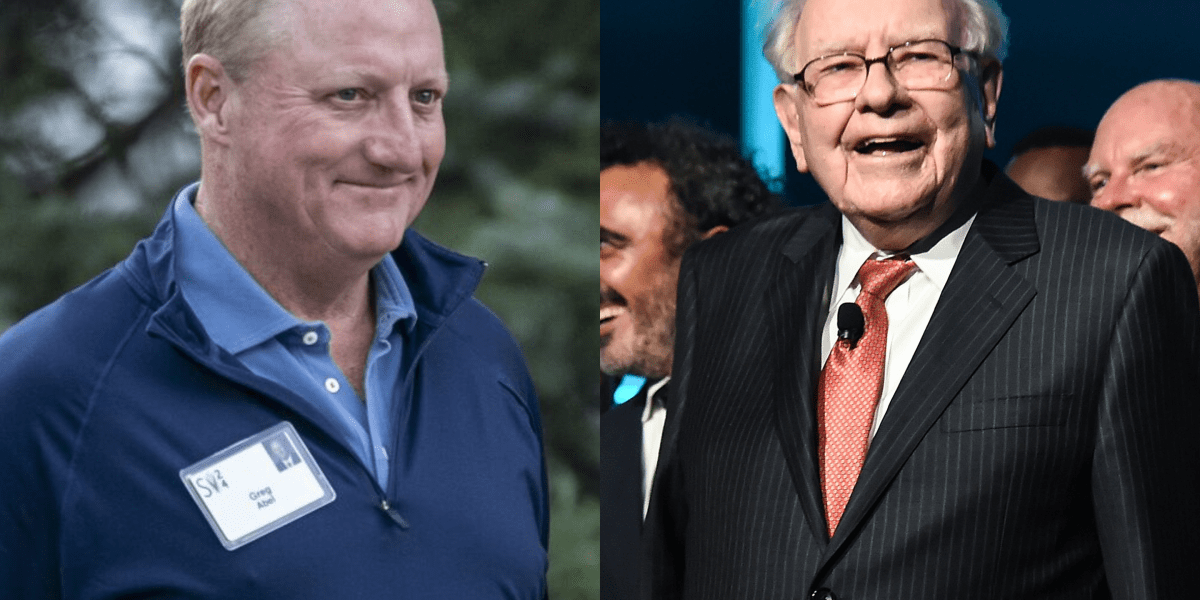

Greg Abel highlighted four of Warren Buffett's most successful stock picks—Apple, American Express, Coca-Cola, and Moody's—in his first shareholder letter, with positions worth 10 to 50 times their original cost.

Business

fromBusiness Insider

3 days agoWarren Buffett sold stocks, built up cash in final weeks as Berkshire Hathaway CEO

Warren Buffett accumulated a record $373 billion in cash at Berkshire Hathaway by selling stocks and avoiding buybacks, signaling difficulty finding attractive investment opportunities despite his stated willingness to deploy capital.

#leadership-transition

Business

fromFortune

3 days agoBerkshire Hathaway shareholders just woke up to a letter by someone other than Warren Buffett | Fortune

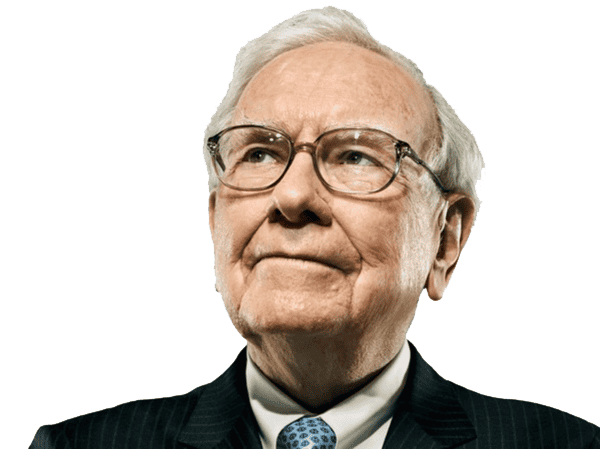

Greg Abel assumes CEO role at Berkshire Hathaway while maintaining Warren Buffett's established operational culture and investment philosophy with minimal structural changes.

fromFortune

1 week agoWarren Buffett's company takes a $350 million stake in The New York Times, 6 years after bailing on newspapers | Fortune

Six years after Warren Buffett sold off all of Berkshire Hathaway's newspapers and predicted unending declines for most of the industry, Berkshire disclosed a new $350 million investment in The New York Times on Tuesday. The somewhat surprising move highlighted the quarterly update Berkshire filed with the Securities and Exchange Commission about the company's stock holdings in Buffett's last quarter as CEO.

Business

fromThe Motley Fool

1 week agoWarren Buffett's Berkshire Hathaway Bought Shares of The New York Times. Should You? | The Motley Fool

While the position is small for Berkshire, accounting for only about 0.1% of its overall portfolio, it's meaningful for The New York Times. After buying nearly 5.1 million shares of The New York Times Co. during the quarter, the stake is now valued at more than $350 million, representing approximately a 3% stake in the company, which commands a market capitalization of more than $12 billion.

Business

fromFortune

3 weeks agoWarren Buffett's big bet on Japan earned Berkshire Hathaway $24 billion in just 6 years | Fortune

In 2020, Buffett's investing vehicle announced it had acquired positions in five major Japanese trading companies. The stakes were worth slightly more than 5% in each firm, around $6.25 billion in total. At the time, Berkshire Hathaway signaled it was part of a long-term strategy, and the company was open to increasing its stakes under the right circumstances. Fast-forward five years, and the Omaha-based giant did increase its holdings-

Business

fromBusiness Insider

2 months agoWarren Buffett's departure is putting a 'succession discount' on Berkshire Hathaway stock, a strategist says

Barbara Goodstein, a managing partner at R360, an invitation-only investment and networking group for ultra-high-net-worth individuals, told CNBC on Monday that longtime Berkshire CEO Warren Buffett's impending departure offered a "lot of opportunity" for investors. Buffett, 95, is set to step down as the CEO of Berkshire at the end of 2025 after nearly 60 years in the role. He will be replaced by Greg Abel, who heads the firm's non-insurance businesses and will stay on as its chairman.

Business

Real estate

fromFast Company

2 months agoThis housing market cycle is so unique that even Warren Buffett broke his own rules to make money on it

Berkshire Hathaway repeatedly bought and sold major U.S. homebuilder stocks from 2023–2025, ending with substantial Lennar holdings but selling D.R. Horton positions.

from24/7 Wall St.

3 months agoWarren Buffett's 52% Portfolio Rests on These Three Dividend Giants

Based on the recent 13F filing, we've noticed Berkshire Hathaway Inc. ( NYSE: BRK-B) make significant moves in the third quarter. While the investor owns several artificial intelligence (AI) stocks, he also focuses on dividend-paying stocks. Apple ( NASDAQ:AAPL), American Express ( NYSE:AXP), and Bank of America ( NYSE: BAC) form 52% of his portfolio, and here's why I think they're an excellent buy.

Business

Business

from24/7 Wall St.

3 months agoTime to Shore Up Your Personal Portfolio With These 3 Bullet-Proof Blue-Chip Stocks

Despite recent outsized equity gains, cautious investors can find lower-risk exposure in blue-chip defensive stocks like Berkshire Hathaway, built on cash-flowing, value-oriented businesses.

fromFortune

3 months agoThe Warren Buffett era is ending. Here are five investing lessons from the GOAT | Fortune

If you had put $1,000 into the S&P 500 index at the beginning of those 60 years, you'd now have $441,196-a tremendous reward for doing nothing. But if you had put your $1,000 into Berkshire stock, you would now have a truly incredible $59,681,063. Another way to think of it: If you had invested $20,000 back then, you would today be a billionaire. Without doing a thing.

Business

[ Load more ]