#first-time-buyers

#first-time-buyers

[ follow ]

#housing-market #housing-affordability #real-estate #homeownership #mortgage-rates #affordability #home-buying

fromwww.housingwire.com

1 month agoWhat will bring first-time buyers into the 2026 housing market?

They have strong demand for the American dream of homeownership, but they're really just feeling left behind right now, Jessica Lautz, the deputy chief economist at NAR, said of first-time buyers. Homeownership is a way that many Americans build wealth and unfortunately they're just being pushed to the sidelines for a longer period of time and losing out on those wealth gains. They're also thinking about unique ways to enter into homeownership.

Real estate

Real estate

fromBoston Condos For Sale Ford Realty

2 months agoThese Were Residential Real Estate's Top Stories Of 2025 Boston Condos For Sale Ford Realty

2025 real estate saw major brokerage consolidations, heated portal competition, stricter MLS listing rules, record-low first-time buyers, and rising cash purchases and regional shifts.

fromLos Angeles Times

2 months agoHousing Tracker: Southern California home values drop in November

Until the recent declines, July 2023 was the last time that year-over-year prices had fallen. Back then rising mortgage rates were knocking many buyers out of the market. Values started increasing again when the number of homes for sale plunged as sellers backed away, unwilling to give up mortgages they took out earlier in the pandemic with rates of 3% and lower.

Real estate

fromwww.housingwire.com

3 months agoCulture is not a perk. It is the new engine of mortgage growth

Trust is the only thing that can cut through fear, complexity, and industry jargon. And as the market evolves, trust is increasingly the first thing first-time buyers are looking for. Today's borrower, especially the emerging homebuyer, is walking into the market with real concerns. Rising costs, confusing guidelines, cultural barriers, past financial trauma, and years of hearing that homeownership is not for them.

Real estate

fromwww.independent.co.uk

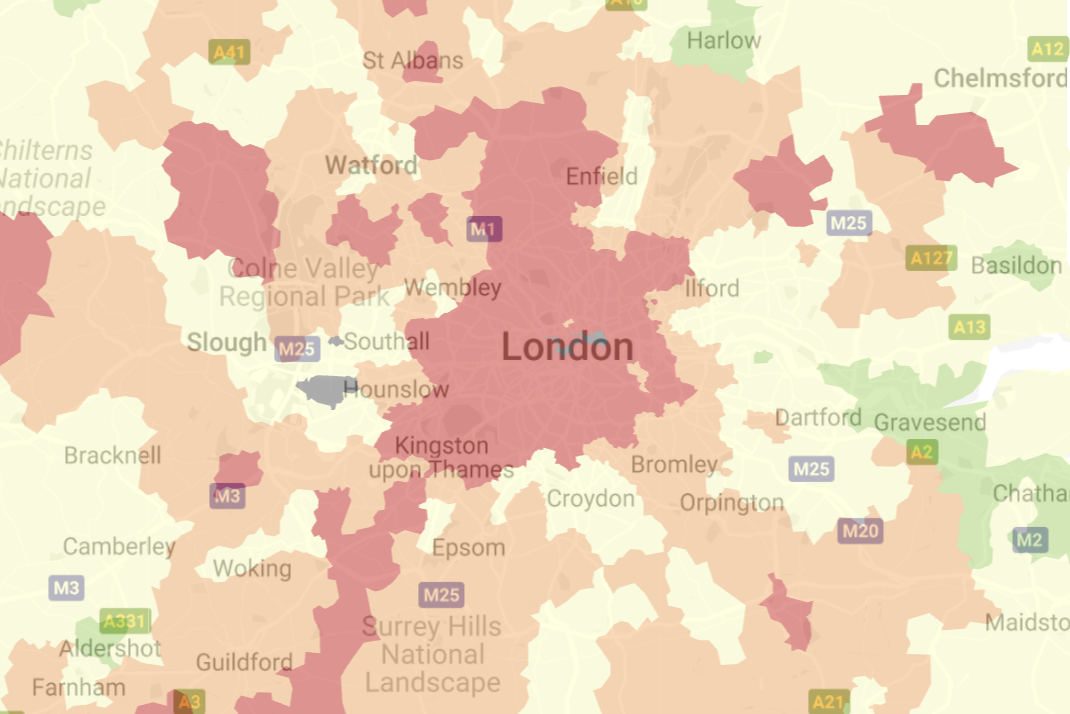

4 months agoLabour will struggle to hit 1.5m homes target, house builders warn OBR

The government will fail to meet its target of building 1.5m homes by the end of the decade, house builders have warned in a letter to the budget watchdog - a fresh blow to Rachel Reeves ahead of what is expected to be a difficult budget in November. In a letter to the Office for Budget Responsibility (OBR), the Home Builders Federation (HBF) - the representative body

UK politics

fromIrish Independent

4 months agoFirst-time buyers account for 27,000 mortgage drawdowns in past year

More than 27,000 new-buyer mortgages were drawn down in the year to end of September. This is the highest annualised number since 2007, according to the Banking and Payments Federation of Ireland (BPFI). First-time buyers continue to be the most active segment in the market, ­accounting for six out of 10 mortgage drawdowns in that period, during which close to 46,000 mortgages were drawn down.

Real estate

fromIrish Independent

4 months agoYour Questions: 'We're moving to Dubai. Will Revenue claw back our Help to Buy money?'

To qualify for the tax rebate available under the HTB scheme, you must adhere to certain conditions, including that you live in the property as your main home for five years after purchasing or building the property. If you cease to occupy the property as your main residence before those five years are up, the HTB payment must be repaid to Revenue in whole or in part.

Real estate

fromTESLARATI

4 months agoHow Tesla's Standard models will help deliveries despite price disappointment

There's no arguing it: $36,990 and $39,990 for the Model 3 Standard and Model Y Standard were not what consumers had in mind. But, despite Tesla getting its new offerings to a price that is not necessarily as low as many expected, the two cars still have a chance to assist with quarterly deliveries. Here's how: First-time Tesla buyers will lean toward Standard models

Cars

Real estate

fromLondon Business News | Londonlovesbusiness.com

5 months agoMaking homeownership simple: How the mortgage pod supports first-time buyers - London Business News | Londonlovesbusiness.com

The Mortgage Pod provides personalised mortgage guidance that reduces stress, matches first-time buyers to suitable products, and improves long-term homeownership outcomes.

fromIrish Independent

5 months agoMortgage approvals drop as first-time buyers and movers struggle to find homes

The drop in would-be movers, who own a home but are looking to either move to somewhere bigger or downsize, fell more sharply, down 16.8pc year-on-year in August. Those movers who did get a loan are looking to borrow more, an average of €384,887, compared with the €325,934 average for first-time buyers. The slowdown among movers combined with the lack of new housing completions points to a further strain on supply for first-time buyers.

Real estate

Business

fromLondon Business News | Londonlovesbusiness.com

5 months agoDemand for silver doubles year-on-year - London Business News | Londonlovesbusiness.com

Silver purchases more than doubled year-on-year at Gold Bank London, driven largely by first-time buyers and rising demand for silver coins such as Queen's Beasts.

fromFortune

5 months ago'Oracle of Wall Street' says boomers control the housing market, and their enormous equity will keep them in place - 'There will be no quick fixes' | Fortune

The CEO of Meredith Whitney Advisory Group, whose prediction of the Great Financial Crisis earned her the moniker "Oracle of Wall Street," pointed out in a Financial Times op-ed that more than 54% of homes are owned by seniors, up from 44% in 2008. She added that 79% of seniors own their homes, and three-fourths of them don't have a mortgage, meaning they have an enormous amount of equity that can help cover rising homeownership costs, such as insurance.

Real estate

fromwww.independent.co.uk

6 months agoLenders urged to make mortgage rule changes to help first-time buyers

A carefully measured relaxation of mortgage lending criteria could open the door for more first-time buyers without triggering a significant rise in loan defaults, a leading banking and finance body has suggested. UK Finance's analysis indicates that a modest increase in lending, facilitated by reduced stress rates, could enhance mortgage accessibility, particularly for those entering the property market for the first time, without substantially increasing arrears.

Real estate

Real estate

fromwww.housingwire.com

6 months agoTexans Credit Union announces 105% LTV financing option

First-time buyers face affordability and availability challenges; Texans Credit Union offers supportive lending solutions and guidance to help members pursue homeownership amid declining national rates.

fromSFGATE

8 months agoCape Coral's Top Home Style Offers Simplicity With a Florida Twist

"Ranch homes are often the preference of first-time buyers and empty nesters due to single-story convenience and ease of maintenance. The style is particularly well-liked in Sun Belt states like Texas and Arizona," said Alexei Morgado, real estate agent and CEO of Lexawise.

Renovation

fromwww.independent.co.uk

8 months agoThe people who could benefit from possible mortgage rule changes

The Financial Conduct Authority (FCA) has released a discussion paper outlining the potential benefits and risks of rule changes, aiming to support wider access to sustainable home ownership.

UK politics

[ Load more ]