Business intelligence

Business intelligence

[ follow ]

#data-governance #enterprise-ai #meta-platforms #leadership #ai #snowflake #nvidia #debt-to-equity #market-flag

fromBusiness Insider

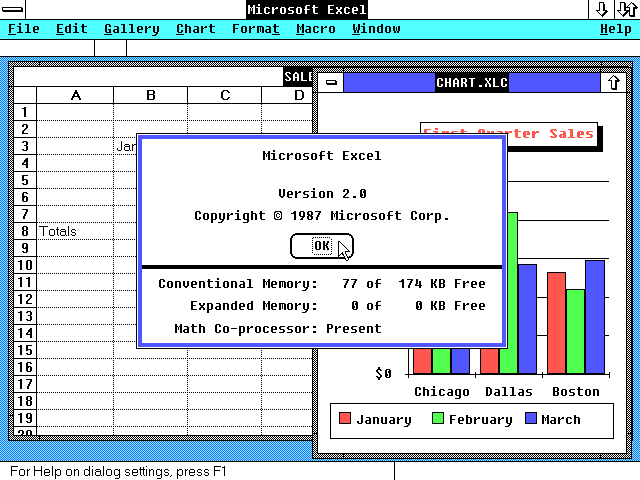

3 days agoI am training AI to do my investment analyst job. It's a bet on job security.

I began AI training in 2023, while I was looking for a job that involved some form of equity valuation work. I had a lot of interviews, but no offers. A recruiter had reached out to me on LinkedIn to saying she was looking for experts in finance and economics to teach AI models. I was skeptical at first, but decided to give it a shot.

Business intelligence

fromLondon Business News | Londonlovesbusiness.com

2 days agoLackluster UK footfall on Super Saturday dipped -6.9% year-on-year - London Business News | Londonlovesbusiness.com

Footfall on Super Saturday (20 Dec 2025) failed to deliver the expected flurry of festive footfall, as consumer hesitancy delays spending with shoppers holding out for last-minute deals, according to data from Sensormatic Solutions, the leading global retail solutions portfolio of Johnson Controls. Its ShopperTrak Analytics data, which captures 40 billion store visits globally each year, showed that store visits yesterday (20 Dec 2025) dipped -6.9% year-on-year.

Business intelligence

fromLondon Business News | Londonlovesbusiness.com

1 week agoFive VAT bookkeeping issues that could cost your business money - London Business News | Londonlovesbusiness.com

Many don't realise how quickly small bookkeeping gaps can turn into bigger financial problems, especially when deadlines and reporting rules come into play. VAT is one area where mistakes tend to build quietly in the background, often unnoticed until a bill, penalty, or cash flow issue appears. With costs rising and margins under more pressure, keeping your VAT records in good shape has never mattered more. Spotting the early signs of trouble can help you stay organised and avoid avoidable stress later.

Business intelligence

Business intelligence

from24/7 Wall St.

1 week agoThe AI Application Giant Prints Cash at 51% Margins While the Data Warehouse Burns Through Hundreds of Millions

Palantir delivers high-growth, high-margin cash flow from AI applications while Snowflake invests in data infrastructure growth and remains operationally unprofitable.

Business intelligence

fromFortune

1 week agoMeetings are not work, says Southwest Airlines CEO-and he's taking action, by blocking his calendar every afternoon from Wednesday to Friday | Fortune

Excessive meetings replace focused leadership work; leaders must protect uninterrupted time to perform high-value tasks.

from24/7 Wall St.

1 week ago5 Dividend ETFs Paying Over 5%

Generating a steady and hefty stream of income is a key factor in any investing strategy. And to reach this goal, many turn to dividend paying stocks. A dividend is a regular payment a company makes to shareholders out of its profits. But it can be difficult and time consuming to analyze and handpick individual dividend paying stocks. That's why many investors seek out dividend paying exchange-traded funds (ETFs).

Business intelligence

from24/7 Wall St.

2 weeks agoXRP Whales Accumulate 340M Tokens While Retail Panic Sells: Is $5 Next?

Retail panic has gripped XRP over the past few months, driven by sharp price drops, aggressive liquidations, and a complete breakdown in market sentiment. The shift from confidence to fear happened quickly, and once it started, it formed a chain of reactions-each new wave of selling triggered the next. The mood flipped after XRP failed to hold its July high near $3.67. Every pullback triggered stop-losses and margin liquidations, dragging the price from $3.05 to $2.52 and eventually toward $2.20 in November.

Business intelligence

Business intelligence

fromAdExchanger

2 weeks agoWPP Raises Its Ad Growth Forecast Thanks To The AI Boom - But That Doesn't Mean It Will Last | AdExchanger

WPP increased its 2025 global ad-spend forecast to 8.8% growth, driven by easing tariffs and AI-fueled growth in its intelligence (search) segment.

fromBusiness Matters

3 weeks agoVault Wealth Management io Shares Live Market Updates for Informed Decision Making

Vault Wealth Management.io is a financial service firm. It focuses on clear and accessible information delivery for people who wish to understand ongoing movements in the wider financial space. The firm has introduced a steady flow of live market updates designed to support informed decision making. This development reflects a continued effort to offer timely guidance for users who depend on accurate figures and steady reporting.

Business intelligence

from24/7 Wall St.

2 weeks agoMonthly Dividend ETFs Investors Should Load Up On

The JPMorgan Equity Premium Income ETF is managed by the highly experienced and professional managers at JPMorgan. It is one of the many monthly dividend ETFs with a juicy yield of 8.25%. It is an actively managed fund that employs a two-step strategy. It invests in stocks using a bottom-up fundamental research process and ranks stocks based on volatility, risk/return profile, and value. The fund manager identifies the top stocks and invests in them. For the second part of the strategy, it uses an options overlay to sell out-of-money call options on the S&P 500 index. The premium generated through the call options allows JEPI to maintain a high yield.

Business intelligence

fromBusiness Insider

2 weeks agoCiti names 276 new MDs in its smallest class since 2020 - see the list

Citi has a new group of senior leaders joining its highest ranks. On Wednesday, the bank announced 276 managing directors, elevating the class of leaders to its highest rank below the C-suite. This year's class includes 55 promotions in markets, 45 in banking, 40 in wealth, and 33 in services, the bank's unit that helps clients manage and move money globally.

Business intelligence

Business intelligence

fromFortune

3 weeks agoThere's a 'once-in-a-generation opportunity' in these stocks right now, no matter how the AI boom ends, market veteran says | Fortune

Quality stocks with high returns on equity, stable earnings growth, and low debt are deeply undervalued globally, creating a rare buying opportunity with strong return potential.

fromBusiness Insider

3 weeks agoMrBeast promises to join the hardcore worker moment in 2026

In a post on X on Wednesday, the 27-year-old creator, whose real name is Jimmy Donaldson, told his 33.4 million followers that he hasn't been fully satisfied with the quality of his latest videos. "After some reflection, I just want to say I think some of our newer youtube videos haven't been as good as I wanted. I apologize," MrBeast wrote. "Ya boy is going to go into ultra grind mode and make the greatest content of my life in 2026. Promise," he added.

Business intelligence

from24/7 Wall St.

1 month agoMSTR Investors: Mark Your Calendars for Jan. 15 -- Billions Could Be Wiped Off in 1 Day

( Strategy ( NASDAQ:MSTR ), the former business-intelligence software maker turned BitcoinCRYPTO:BTC) holding company, now owns 649,870 bitcoin worth roughly $56 billion at today's price around $86,700. That's around 3% of all Bitcoin ever mined and far exceeds the company's $500 million annual software revenue. Since 2020, executive chairman Michael Saylor has treated Bitcoin as the company's primary treasury asset, raising billions in convertible debt and equity to keep buying on every dip.

Business intelligence

fromZDNET

1 month ago'Sales heroics' won't save you: How to build scalable, repeatable systems instead

One of the top problems affecting sales reps today isn't a lack of speed; it's the fragmentation of their tools and information. Groeschel noted that the intense pressure for deep personalization and value-add engagement forces reps to consult numerous systems for a single customer view, often navigating ten or more different platforms.

Business intelligence

from24/7 Wall St.

1 month agoADP Slips 4% After Reporting Q1 Earnings

ADP hit the right marks on the headline numbers. Adjusted EPS came in at $2.49 versus $2.44 expected, while revenue reached $5.20 billion against a $5.13 billion estimate. The 7.6% year-over-year revenue growth reflects solid momentum across the business, and net income climbed 6% to $1.01 billion.

Business intelligence

from24/7 Wall St.

2 months ago4 Midstream Energy MLPs Offer Reliable Yields as High as 10%

Midstream energy stocks are the companies involved in the processing, transportation, and storage of crude oil, natural gas, and natural gas liquids. These companies operate in the "midstream" sector, which falls between the upstream (exploration and production) and downstream (refining and marketing) sectors of the energy industry. They are far less susceptible to spot benchmark pricing moves, as most sector leaders have locked in contracts for their services, some of which run for years.

Business intelligence

Business intelligence

fromComputerWeekly.com

2 months agoRender Networks unveils next-generation business intelligence platform | Computer Weekly

ClearSight uses Databricks-powered AI to provide continuous visibility, predictive insights and performance accountability across broadband infrastructure deployment, improving decision-making, field execution, and financial accuracy.

Business intelligence

fromLondon Business News | Londonlovesbusiness.com

2 months agoBusiness intelligence for executives: Turning data into strategic decisions - London Business News | Londonlovesbusiness.com

Treat BI as the company operating system to convert signals into decisions with decision rights, guardrails, feedback loops, and measurable action.

fromLondon Business News | Londonlovesbusiness.com

2 months agoiMAD Research Inc. decodes smart meter adoption barriers across emerging markets - London Business News | Londonlovesbusiness.com

iMAD Research Inc. (https://imad.com), a global market intelligence firm, recently concluded a multi-country study aimed at understanding adoption challenges for smart meter technology in semi-urban and urban business environments. The research revealed critical behavioural insights related to consumer hesitancy, billing trust gaps, and digital readiness among small and medium enterprises (SMEs). Founded in 2017 by Kartik Khanna and Abhishek Soni, iMAD Research Inc. operates across the United States, United Kingdom, and India, with over 2.5 million verified respondents globally.

Business intelligence

Business intelligence

fromInfoWorld

2 months agoOracle debuts Iceberg-compatible Autonomous AI Lakehouse to boost enterprise analytics

Autonomous AI Lakehouse enables multi-cloud, vendor-neutral data lakehouse deployments with Apache Iceberg, unified metadata, and plug-and-play SQL for AI and analytics workloads.

from24/7 Wall St.

2 months agoThis is Warren Buffet's Last Rodeo

Warren Buffett has made what may be his final major acquisition, with Berkshire Hathaway purchasing the petrochemical division of Occidental Petroleum. Buffett already owns a large portion of Occidental - between 27% and 35% of its common stock - as well as a significant amount of preferred shares from an earlier deal. This new transaction provides Occidental with about $10 billion, which will help the company reduce its debt and improve its balance sheet.

Business intelligence

fromwww.independent.co.uk

2 months agoBusiness news live - Thames Water creditors submit rescue plan

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging. At such a critical moment in US history, we need reporters on the ground.

Business intelligence

from24/7 Wall St.

2 months ago20 Years On Wall Street Taught Me: Buy and Hold High-Yield Dividend Giants

By analyzing cash flow generation, capital allocation strategies, and management quality, I can identify companies with durable competitive advantages and the financial discipline to maintain and grow their dividends through economic cycles. Early in my career, I realized that dividend investing is not merely an income strategy, but also a comprehensive framework for building wealth through companies that consistently return capital to shareholders while maintaining financial stability.

Business intelligence

Business intelligence

fromBusiness Insider

2 months agoNearly 90% of BCG employees are using AI - and it's reshaping how they're evaluated

Boston Consulting Group embeds AI use into performance benchmarks, requiring broad adoption and using AI tools to boost problem solving, reviews, efficiency, and client services.

[ Load more ]

/PayPal%20Holdings%20Inc%20sign%20on%20building-%20by%20Sundry%20Photography%20via%20Shutterstock.jpg)