#housing-costs

#housing-costs

[ follow ]

fromBusiness Insider

1 week agoThree generations live next door - and it's helping this family afford both housing and elder care

Lauren McCadney had always wanted to live next door to friends or family. In her late 50s, she finally made that happen, though not the way she'd planned. In 2020, Lauren's mother, who had been living with her brother and his family in Frederick, Maryland, died. Lauren, who was going through a difficult divorce and doesn't have children, decided she wanted to be closer to her family and help her brother care for their dad, who was dealing with his own health challenges.

Relationships

fromIndependent

3 weeks ago'If you buy an old boat for 40,000 and think that you're going to get a permanent home... that's just not possible' - How much does it really cost to live on a houseboat in Ireland?

While houseboat dwellers spend significantly less on monthly bills, upfront costs and regular maintenance have to be factored in

Real estate

fromTravel + Leisure

3 weeks agoAARP Just Named the 25 Best Places to Retire in the U.S.-and This City Just Ranked No. 1 (Again)

And the city that topped the ranking for the sixth year in a row is San Francisco. "[...] even though the area's monthly housing costs are three times higher than the U.S. median ($2,693 compared to $943 nationally)," the report notes, the city "excels in other metrics, especially health, boasting excellent access to health care, universal access to exercise opportunities, and low smoking rates."

US news

US news

fromLondon Business News | Londonlovesbusiness.com

1 month agoUS inflation undershoots at 2.6%, Trump can call off the dogs - London Business News | Londonlovesbusiness.com

US core inflation eased to 2.6% in December, below consensus; housing rose 0.4%, annual inflation steady at 2.7%, easing pressure on policy.

fromBoston.com

1 month agoU-Haul ranks Massachusetts near the bottom for growth - again

"The latest U-Haul Growth Index shows Massachusetts ranked near the bottom of the nation in inbound moves - a clear sign we are losing competitive ground compared with states like Texas, Florida and others attracting more residents," said Christopher R. Anderson, MOA co-organizer and president of the Massachusetts High Technology Council, in a statement.

US news

fromTravel + Leisure

1 month agoThis Small City Was Just Ranked the Best Place to Live in the U.S.-and It Has a High Quality of Life

Located about 25 miles northeast of Atlanta, this small city of 79,000 is ideal for young professionals and families searching for a place with access to the outdoors, cultural activities, and relatively easy access to Hartsfield-Jackson Atlanta International Airport (ATL). With Johns Creek as your base camp, you can spend your weekends walking the trails at the 46-acre Autrey Mill Nature Preserve and Heritage Center, paddling the Chattahoochee River, attending performances by the Johns Creek Symphony Orchestra, and sampling craft beer at Six Bridges Brewing.

US news

fromwww.housingwire.com

2 months agoTariffs could inflate housing costs, but the full impact remains uncertain

The Center for American Progress, a progressive think tank, released a report on Tuesday that forecasted a $17,500 cost impact per new home as a result of the Trump Administration's tariff policy. The report used an analysis from the nonpartisan Urban-Brookings Tax Policy Center to make the forecast, based on a model that predicts a $27 billion annual construction tariff impact by 2030.

US politics

Real estate

fromMarylandReporter.com

2 months agohttps://marylandreporter.com/2025/10/25/freedom-bank-wins-an-award-in-dubai/ - MarylandReporter.com

People are leaving cities for smaller towns because high costs, congestion, noise, and stress are outweighed by affordability, safety, greenery, community, and remote-work flexibility.

US politics

fromFortune

2 months agoWall Street strategist explains today's political rage with a poverty line that should be $140,000 and the 'Valley of Death' trapping people below it | Fortune

The official U.S. poverty line dramatically underestimates modern living costs; updated spending patterns imply a crisis threshold near $140,000 for functioning households.

fromCurbed

3 months agoWhen a Woodworker Moves Upstairs

Artists making do in their New York apartments is not uncommon, but most do not install a woodworking studio at home. You need a large space with good ventilation - that's rare and usually expensive. Plus, you need neighbors who can tolerate the sound of power tools going for hours at a time. A one-bedroom rental in a townhouse doesn't usually meet these criteria.

Real estate

fromTravel + Leisure

3 months agoThis Town Was Named the Safest and Wealthiest Retirement Spot in the U.S.-and It's Known as the 'Home of American Golf'

While Pinehurst came in second in 2024, it landed at No. 1 this year, thanks to a few hard numbers. According to GoBankingRates.com's findings, as of October 2025, almost 40 percent of the population there is 65 and older; the average retirement income before Social Security is $51,767; 78.5 percent of households pay under a third of their income for monthly costs; and the property crime rate and violent crime rates are 2.78 and 0.59 (per 1,000).

US news

fromwww.standard.co.uk

4 months agoLondon 'will avoid worst of Angela Rayner's council funding raid' after fears of huge tax rises and service cuts

It has always been shocking that the cost of housing in London was left out of the Government's fair funding formula. If the rumours are true and ministers are listening, then I hope that means a brighter financial forecast. Reflecting the true cost of housing and the impact of daytime visitors in the capital would be a good start, but for now this is rumour.

London politics

fromwww.housingwire.com

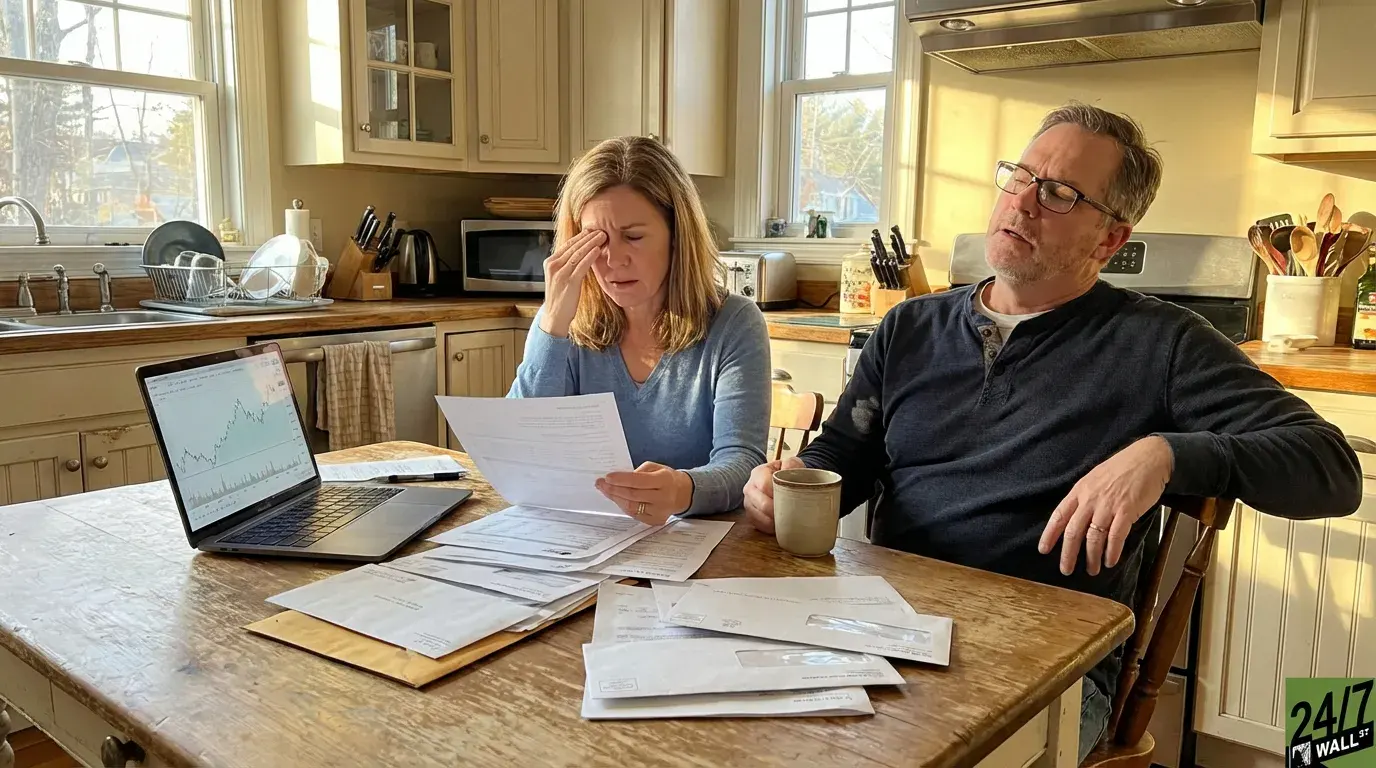

4 months agoHomeownership dreams clash with retirement goals for Millennial investors

Once considered a cornerstone of wealth-building, homeownership is now viewed as a barrier to retirement readiness. About 35% of respondents cited rising housing costs including rent, mortgage payments, property taxes and other expenses as the biggest obstacle to preparing for retirement. That figure surpassed concerns over market volatility and economic uncertainty (29%), insufficient retirement income (28%), and financial support for children or aging parents (27%).

Real estate

fromThe Mercury News

4 months agoCalifornians spend $8,640 more than other Americans. Where did it go?

To gain insight into California costs, my trusty spreadsheet reviewed detailed consumer spending statistics from the Bureau of Economic Analysis. These numbers allow us to track key components of household expenses in 2024 for the 50 states and the District of Columbia. It's calculated per resident, so much like an average, the biggest and smallest spenders can influence the results.

California

fromSFGATE

4 months agoYou'll Struggle To Live Well in Alaska on Just Your Social Security, Even If Your Mortgage Is Paid Off

Retirees in Alaska face one of the harshest financial gaps in the nation when attempting to live on Social Security alone. According to a Realtor.com® analysis of median Social Security benefits by state and the Elder Economic Security Standard Index, the average retiree in Alaska experiences an annual shortfall of $4,152, or about $346 per month, even with their mortgage fully paid. While that might not seem like a lot to some, it could mean all the difference to someone on a fixed income.

Public health

fromSFGATE

4 months agoMost Americans Say Housing Costs Are Too High-But They're Divided on the Reasons Why

the majority of Americans find housing costs in the U.S. unreasonably high, according to a recent survey conducted by Tavern Research for the Searchlight Institute. While housing economists attribute the crisis to a chronic shortage of housing, the survey shows a variety of opinions on the causes, including blaming investors, building material costs, landlords, and elected officials. The survey also highlights that a majority of Americans welcome more home construction in their communities, recognizing the benefits of increased housing availability.

Real estate

fromSFGATE

4 months agoYou'll Struggle To Live Well in Massachusetts on Just Your Social Security, Even If Your Mortgage Is Paid Off

The typical retiree in Massachusetts faces an annual shortfall of $7,345, or about $612 per month, even with their mortgage fully paid. Additionally, retirees here face average monthly living expenses of $2,634, while the median Social Security benefit is just $2,022 per month. With housing costs averaging $1,007 per month, retirees' budgets simply cannot keep pace. With housing consuming nearly half of the average Social Security check, seniors are forced into deficit territory before accounting for food, transportation, or healthcare.

US news

Real estate

fromSFGATE

4 months agoYou'll Struggle To Live Well in Vermont on Just Your Social Security, Even If Your Mortgage Is Paid Off

Retirees in Vermont relying solely on Social Security face an average annual shortfall of $8,088, driven largely by high housing-related costs consuming nearly 43% of benefits.

fromSFGATE

4 months agoYou Can Live Well in Alabama on Just Your Social Security, If You've Paid Off Your Mortgage

According to a Realtor.com® analysis of median Social Security benefits by state and the Elder Economic Security Standard Index,, the average retiree in Alabama ends up with an annual surplus of $576, or about $48 a month, after paying for essential living costs. While it may not seem like a lot, the extra funds are more than homeowners have in most of the country, and can be put to good use in future-proofing a home.

US news

fromHudson Valley Post

4 months agoNew Yorkers Are Fleeing The City-Hudson Valley Braces For Impact

We are absolutely seeing a correlation between Zohran Mamdani's surprise win in the Democratic primary and an uptick in real estate interest in Westchester," Zach and Heather Harrison told Realtor.com.

Real estate

fromFortune

5 months ago1 in 3 Americans have no emergency savings-while boomers' $2,000 cushion dwarfs Gen Z's $400, survey finds | Fortune

For one in three Americans, a single surprise bill could spell financial crisis. That's according to a new survey by Empower, a retirement and financial services company, which found 32% of Americans have no emergency savings set aside. But not everyone is equally short on cash: Gen Zers have a median of $400 in their crisis funds, while boomers have saved up to five times as much.

US news

fromThe Mercury News

5 months agoFor 27% of California tenants, rent is more than half their income

My trusty spreadsheet identified this affordability challenge by analyzing 2024 Census Bureau housing data for the 50 states and the District of Columbia. These latest figures detail swings in who's renting, how much they pay, and how many tenant households are financially swamped by rental expenses - that's rent plus utilities exceeding 50% of incomes. Remember, California is the nation's largest rental market with 6.1 million tenant households.

Real estate

fromThe Oaklandside

5 months agoRenting vs. owning a home - which is best for you right now?

Renting is a short-term commitment. You can sign a lease and have the flexibility to move somewhere else after the lease is over Maintenance and repairs are typically handled by the landlord, saving you time and money. Additionally, taxes and other local expenses are also usually covered by the landlord If you live in a city with high property taxes, renting may be more affordable, helping to reduce your monthly payments

East Bay (California)

Canada news

fromwww.cbc.ca

6 months agoMove-in day marks the start of a new chapter for hundreds of 1st year TMU students | CBC News

Over 1,100 first-year students moved into Toronto Metropolitan University residences amid high housing costs and limited on-campus bed availability, despite available financial support.

UK news

fromLondon Business News | Londonlovesbusiness.com

6 months agoGovernment policies continue to pull inflation higher - London Business News | Londonlovesbusiness.com

UK inflation at 3.8% in July erodes real incomes, keeps bond yields and borrowing costs high, but is expected to return to 2% by 2026.

fromwww.cbc.ca

7 months agoIs it cheaper to live in Halifax or Toronto? This data says costs are comparable | CBC News

"A lot of people have this kind of misconception that homes are cheap," said Melnyk. Over the last few years, he's regularly received inquiries from people outside Nova Scotia who are interested in moving to the province.

Toronto

[ Load more ]