fromFortune

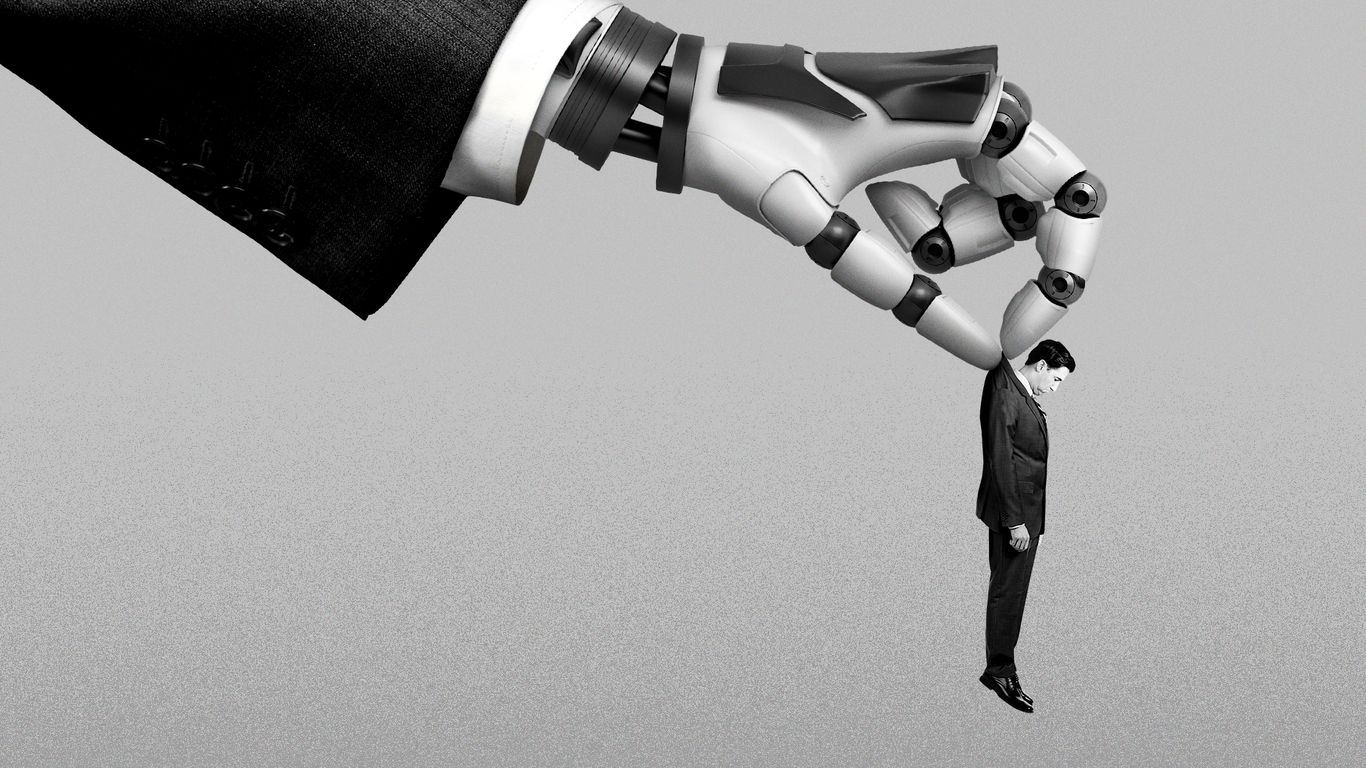

17 hours agoOpenAI investor Vinod Khosla predicts today's five year olds won't ever need to get jobs thanks to AI | Fortune

It's pretty unlikely a five year old today will be looking for a job. The need to work will go away. People will still work on the things they want to work on, not because they need to work.

Venture