Mental health

fromwww.theguardian.com

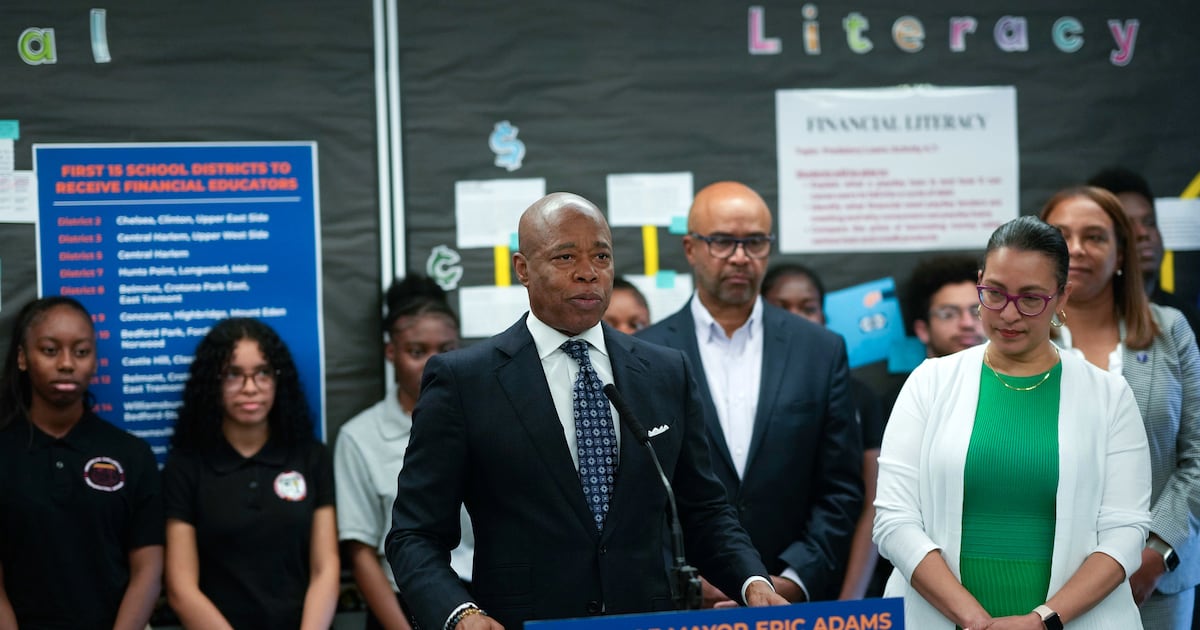

1 day agoOverdrawn, underpaid and over it: how four people conquered their debt mountains

Debt affects 84% of UK adults, with rising borrowing rates driven by cost-of-living pressures, while shame prevents many from seeking help until reaching crisis point.