#economic-outlook

#economic-outlook

[ follow ]

#federal-reserve #interest-rates #inflation #tariffs #housing-market #stock-market #mortgage-rates #unemployment

fromwww.housingwire.com

1 week agoWary optimism sparks new-home outlook but grind may linger

While homebuilder sentiment remains subdued after a 12-month grind that hasn't quite let up, Robert Dietz, Chief Economist for the National Association of Home Builders, offered guarded optimism in his take on housing economics' complex set of market drivers. In other words, the worst of the worst may be over, but don't expect a switch to flip. Not yet, anyway.

Real estate

Business

fromFortune

2 weeks agoWhy you shouldn't worry about AI eating the stock market, top analyst says. The U.S. economy is 'about to take off' | Fortune

Software-sector AI breakthroughs caused major market selloffs, but committed data-center spending and other tailwinds should support a U.S. economic boom.

fromBusiness Matters

1 month agoUK economy returns to growth with 0.3% expansion in November

The UK economy returned to growth in November, expanding by 0.3 per cent after contracting in the month leading up to the autumn budget, according to figures from the Office for National Statistics. The increase in GDP exceeded economists' expectations of a modest 0.1 per cent rise and suggests that economic activity proved more resilient than many sentiment surveys had indicated in the run-up to the budget on 26 November.

UK news

fromFortune

2 months agoCFO confidence rebounds, but delivering AI's value is the next test in 2026 | Fortune

Deloitte's Q4 2025 CFO Signals report, released this morning, finds the CFO Confidence Score at 6.6, higher than the Q3 reading of 5.7, and the highest score since late 2021. The score, the highest 10, measures CFO confidence in economic conditions and sentiment about the capital markets. CFOs raised their assessment of the North American economy this quarter, with 36% rating the current environment as very good or good, and 56% saying they expect it to be much better or better in 12 months.

Business

Business

fromFortune

4 months agoJPMorgan beats expectations in strong earnings as Jamie Dimon says the U.S. economy 'generally remained resilient' | Fortune

JPMorgan posted stronger-than-expected Q3 results with double-digit net income growth, record trading revenue, and rising investment banking fees amid economic resilience and uncertainty.

fromwww.theguardian.com

4 months agoRachel Reeves confirms she no longer stands by pledge not to raise taxes

Well, look, I think everyone can see in the last year that the world has changed, and we're not immune to that change. Whether it is wars in Europe and the Middle East, whether it is increased barriers to trade because of tariffs coming from the United States, whether it is the global cost of borrowing, we're not immune to any of those things.

UK politics

UK news

fromLondon Business News | Londonlovesbusiness.com

5 months agoMuted hiring appetite feeds further loosening of the labour market - London Business News | Londonlovesbusiness.com

UK unemployment rose to 4.7% while payrolled employment fell by 51,000, indicating a softening labour market and forecasted rise to 4.8% by year-end.

fromLondon Business News | Londonlovesbusiness.com

6 months agoGold retreats on improved risk appetite, Trump-Putin meeting in focus - London Business News | Londonlovesbusiness.com

Gold prices have been trading sideways for almost three months, with slight declines as risk appetite improved, suggesting potential changes in investor sentiment.

Miscellaneous

E-Commerce

fromBusiness Insider

6 months agoThere's a spending split between Americans, and it's popping up from McDonald's to Uber

US consumer spending shows a split between wealthier and low-income groups, with affluent consumers increasing spending.

Retail earnings reflect a growing economic divide among different income levels functioning in the consumer market.

US politics

fromLondon Business News | Londonlovesbusiness.com

7 months agoS&P 500 continues to set new highs ahead of earnings season and mixed economic data - London Business News | Londonlovesbusiness.com

S&P 500 gains 0.07%, reaches record high, supported by investor optimism despite mixed economic signals.

fromFortune

7 months agoHalliburton: Oil markets are "softer" and will remain weak for all of 2025

To put it plainly, what I see tells me the oilfield services market will be softer than I previously expected over the short to medium term. Oil producers and countries are cutting back spending more dramatically than current oil prices would normally necessitate.

E-Commerce

fromFortune

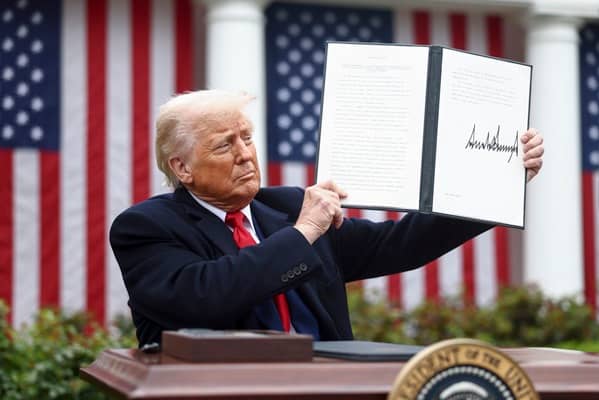

7 months agoDow futures sink as Trump keeps pushing tariffs while White House suggests Powell's job could be at risk

U.S. stock futures dropped as Trump's threats of 30% tariffs on the EU and Mexico prompted investors to reconsider trade war risks, with markets poised for declines.

US politics

fromLondon Business News | Londonlovesbusiness.com

8 months agoUS dollar subdued as ceasefire tempers risk aversion - London Business News | Londonlovesbusiness.com

The US Dollar index remained near multi-year lows as geopolitical tensions eased and investor sentiment improved, indicating a shift in safe-haven demand.

US news

fromWIRED

8 months agoCompanies Warn SEC That Mass Deportations Pose Serious Business Risk

The holding companies for banks such as Bridgewater Bancshares and Heartland Bank and Trust Company mentioned deportations may affect their 'forward looking statements' but weren't clear on the outcomes.

European startups

fromLondon Business News | Londonlovesbusiness.com

8 months agoNigerian stock market volatile near high, oil price gains support - London Business News | Londonlovesbusiness.com

The recovery of the NGX All Share Index amidst geopolitical tensions suggests potential for Nigeria's export receipts, but concerns about sustainability linger.

UK news

UK politics

fromLondon Business News | Londonlovesbusiness.com

8 months agoPublic opinion of Rachel Reeves plummets - London Business News | Londonlovesbusiness.com

Labour's Spending Review did not significantly boost public trust in the party.

Public sentiment reflects economic pessimism, with many doubting Labour's priorities.

A preference exists among voters for targeting child poverty over pensioner support.

fromAxios

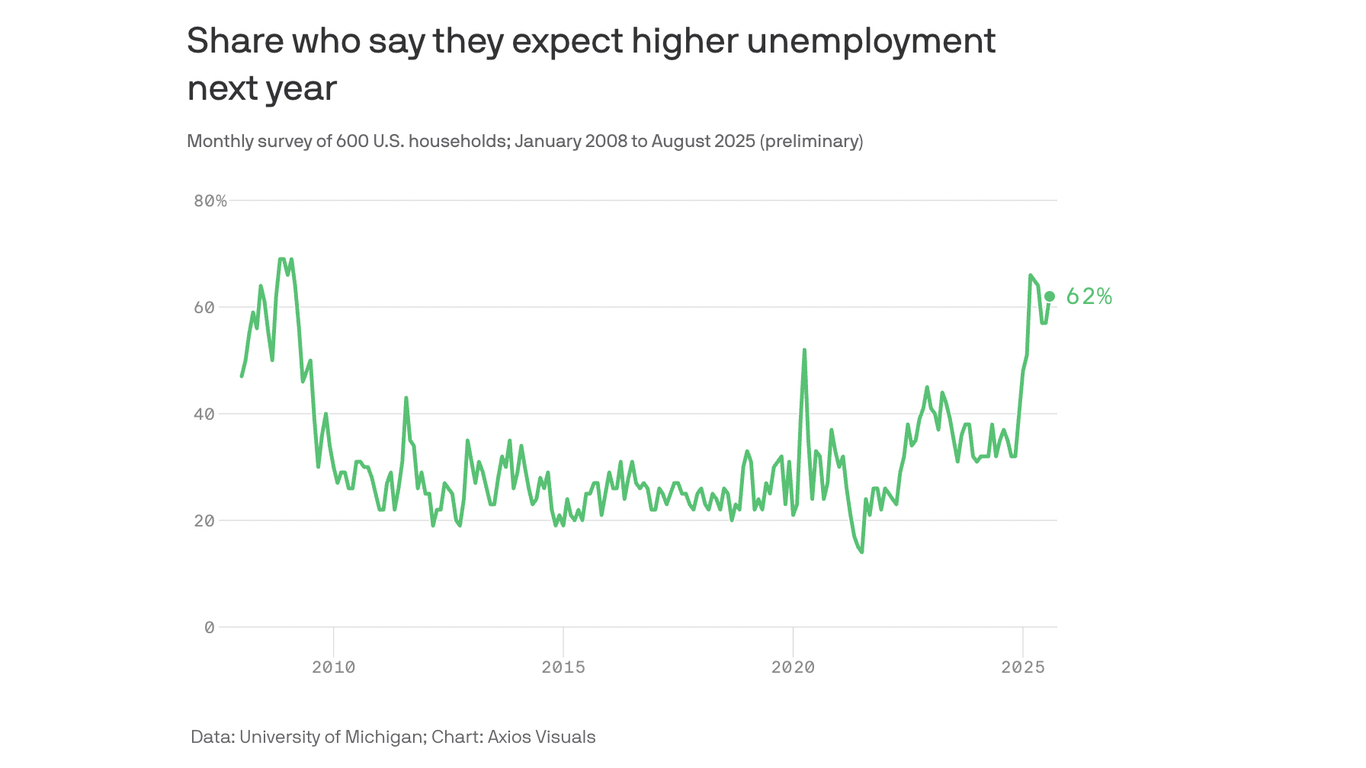

8 months agoJobs report shows some worrying signs

"There are now clear trends in the data, not just vague signs, that even if the train is chugging forward, more and more people are getting left behind at the station," Cory Stahle, an economist at job search site Indeed, wrote in a note.

US politics

Marketing tech

from24/7 Wall St.

8 months agoLive Nasdaq Composite: Markets Lack Conviction Amid Trade Deal Uncertainty

Meta Platforms' nuclear power deal marks a milestone for Big Tech in energy sourcing to meet AI demands.

Market uncertainty persists as trade progress is awaited, with a dimmed economic outlook from the OECD.

[ Load more ]