fromBusiness Insider

5 days agoThe line between TV ads and YouTube ads is getting very blurry

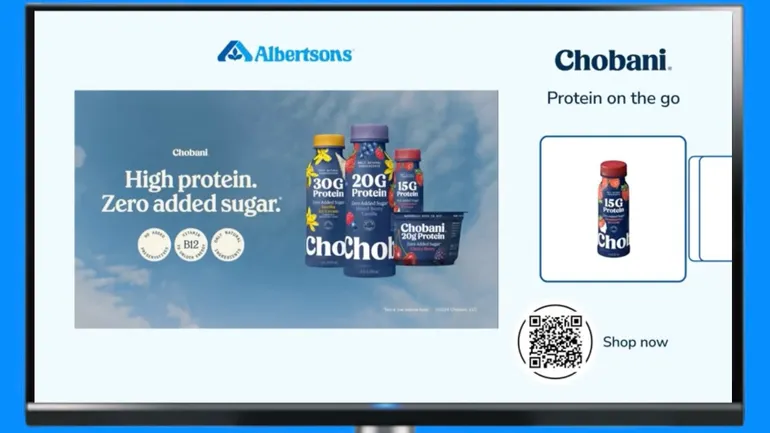

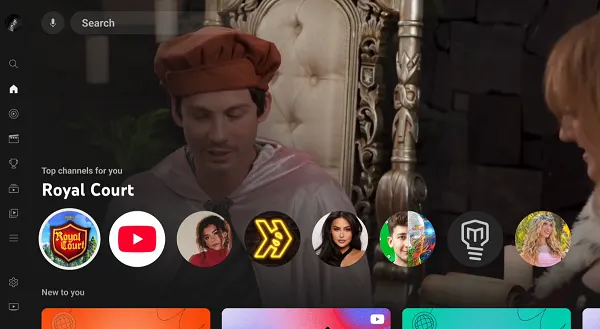

Google has been coveting lucrative TV ad budgets for more than a decade. But despite stats showing that an increasing amount of YouTube viewing takes place on TV sets in the living room, its ad sellers faced a hurdle. Many advertisers and agencies classified YouTube as "online video" or "social media," treating it as a separate part of the media plan from TV.

Marketing